For today’s bulletin, we take a look at our latest STRONG BUY and BUY upgrades. We also provide a link to download a FREE STOCK REPORT on Adobe Systems Inc. $ADBE, one of our top upgrades for the day.

VALUATION WATCH: Overvalued stocks now make up 28.79% of our stocks assigned a valuation and 10.37% of those equities are calculated to be overvalued by 20% or more. One sector is calculated to be overvalued (barely).

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Natera Inc. is a STRONG BUY upgrads. The other components of our top-five list are BUY upgrades.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| NTRA | NATERA INC | 14.21 | 14.19% | 43.97% | 1.13% | 13.56% | N/A | Medical |

| GWGH | GWG HOLDINGS | 9.23 | 26.11% | 8.69% | 0.66% | 7.89% | 13.98 | Finance |

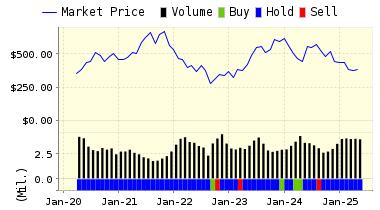

| ADBE | ADOBE SYSTEMS | 242.36 | -5.49% | 25.93% | 0.55% | 6.57% | 43.49 | Computer and Technology |

| OMER | OMEROS CORP | 14 | 1.65% | -22.57% | 0.55% | 6.56% | N/A | Medical |

| HCKT | HACKETT GROUP | 17.78 | -0.38% | 12.53% | 0.51% | 6.14% | 21.42 | Business Services |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

Adobe Systems (ADBE) Incorporated is one of the largest software companies in the world. They offer a line of products and services used by creative professionals, marketers, knowledge workers, application developers, enterprises and consumers for creating, managing, delivering, measuring, optimizing and engaging with compelling content and experiences across personal computers, devices and media. They market and license their products and services directly to enterprise customers through their sales force and to end users through app stores and their own website at www.adobe.com. They offer many of their products via a Software-as-a-Service model or a managed services model as well as through term subscription and pay-per-use models. They also distribute certain products and services through a network of distributors, value-added resellers, systems integrators, independent software vendors, retailers, software developers and original equipment manufacturers.

ValuEngine updated its recommendation from HOLD to BUY for ADOBE SYSTEMS on 2019-01-15. Based on the information we have gathered and our resulting research, we feel that ADOBE SYSTEMS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Sharpe Ratio.

You can download a free copy of detailed report on Adobe Systems Incorporated (ADBE) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 243.69 | 0.55% |

| 3-Month | 242.22 | -0.06% |

| 6-Month | 246.32 | 1.64% |

| 1-Year | 258.28 | 6.57% |

| 2-Year | 228.76 | -5.61% |

| 3-Year | 225.93 | -6.78% |

| Valuation & Rankings | |||

| Valuation | 5.49% undervalued | Valuation Rank(?) | 38 |

| 1-M Forecast Return | 0.55% | 1-M Forecast Return Rank | 86 |

| 12-M Return | 25.93% | Momentum Rank(?) | 93 |

| Sharpe Ratio | 1.31 | Sharpe Ratio Rank(?) | 100 |

| 5-Y Avg Annual Return | 26.59% | 5-Y Avg Annual Rtn Rank | 97 |

| Volatility | 20.30% | Volatility Rank(?) | 69 |

| Expected EPS Growth | 15.61% | EPS Growth Rank(?) | 52 |

| Market Cap (billions) | 121.40 | Size Rank | 100 |

| Trailing P/E Ratio | 43.49 | Trailing P/E Rank(?) | 37 |

| Forward P/E Ratio | 37.61 | Forward P/E Ratio Rank | 9 |

| PEG Ratio | 2.79 | PEG Ratio Rank | 15 |

| Price/Sales | 13.44 | Price/Sales Rank(?) | 9 |

| Market/Book | 12.97 | Market/Book Rank(?) | 11 |

| Beta | 1.13 | Beta Rank | 32 |

| Alpha | 0.33 | Alpha Rank | 93 |

DOWNLOAD A FREE SAMPLE OF OUR ADOBE SYSTEMS INCORPORATED (ADBE) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com