Amidst widespread speculation, The return of President Trump as commander-in-chief could threaten earnings growth in the defense industry in 2025. Analysts seeing it this way point to these items on the perceived Trump agenda:

- Hardball negotiations with defense contractors led by the new Department of Government Efficiency co-heads Elon Musk and Vivek Ramaswamy;

- Trump’s stated belief one major and obvious place that needs attention is the “unbelievable waste and fraud” involved in government defense contracts;

- Supply changes have already suffered disruptions with their global supply chains amidst disruptions caused by political tensions;

- Planned tariffs may exacerbate cost problems in the supply chain;

- Amidst an aging specialized workforce population, cost increases due to wage inflation may be difficult to avoid;

- Trump has stated interest in charging NATO countries for defense support and otherwise abandoning overseas bases and deployment of personnel. This may create an inventory glut in equipment;

- If Trump is successful in ending the war in Ukraine quickly, this could exacerbate a defense equipment inventory glut, cutting into demand for replacements.

All 5,200+ stocks US and Canadian stocks, 16 sector groups, 200+ industries, and 600+ ETFs have been updated:

Two-week free trial: www.ValuEngine.com

Other analysts note the emphasis and need for new technology and see a simple shift in demand from traditional military equipment to more high-tech needs in aerospace and homeland security. They claim the American job market for sophisticated tech engineers is considerably younger and more well-stocked. Some have even postulated a boon for aerospace and defense companies under the new Trump regime.

Since the ValuEngine models focus solely on data, the only potential effect of such speculation on our predictive ratings are on analysts’ earnings revisions and already-adjusting stock prices. Let’s take a look at what our data-based models say about the short- and medium-term outlooks for the Aerospace/Defense Industry.

Current ValuEngine reports on all covered stocks and ETFS can be viewed HERE

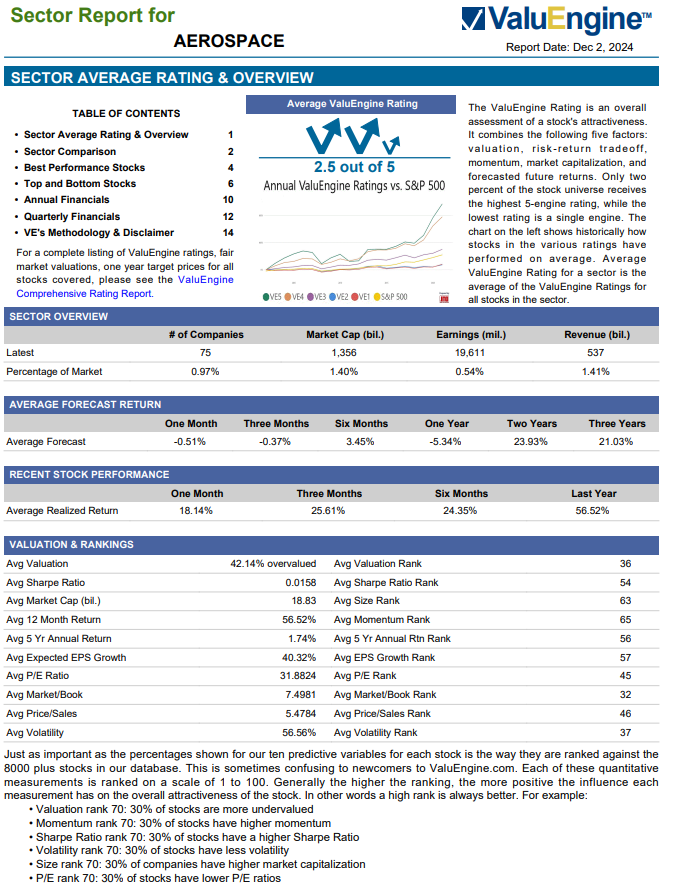

The sector is currently rated 2.5 by our predictive price change model, which is below average. Since a 3 rating indicates Hold and a 2 rating is considered a Sell candidate, Aerospace/Defense would be characterized as Hold/Sell. In this regard, it ranks 14th highest of our 15 sectors. The only lower-ranked sector is Energy/Oils. Let’s look at the statistical overview of the sector.

Current ValuEngine reports on all covered stocks, Sectors and ETFS can be viewed HERE

One fact made clear through comparing the second and third lines is that our model is predicting more difficult times ahead for the sector. In the past 12-months, the average Aerospace/Defense stock price rose nearly 49%. In the next 12 months, the ValuEngine predictive model projects a return of -2.85%. Thud! In terms of its rank relative to other ValuEngine sectors, the sector continues to rank above average in growth categories, but below average in all valuation and volatility categories.

Three of the top five ranked stocks, all ranked 4 (Buy) from our predictive model in our sector report include:

Spirit AeroSystems Holdings, Inc. (SPR), a $4 billion company located in Wichita KS. It engages in the design, engineering, manufacture, and marketing of commercial aerostructures worldwide.

Wheels Up (UP) – a $1.5 billion company, located in Chamblee, GA. It provides private aviation services in the United States and internationally.

Triumph Group, Inc. (TGI), a $1.5 billion company based in Radnor PA. TGI designs, engineers, manufactures, repairs, overhauls, and distributes aircraft, aircraft components, accessories, subassemblies, and systems worldwide.

Since all of these are small cap stocks, how do the industry’s three largest stocks, as ranked by market cap, stack up for projected performance?

RTX Corp. (RTX), formerly Raytheon Corp., a $150+ Billion company based in Arlington, VA, is an aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally. It is rated 3 (Hold).

Lockheed Martin Corp.(LMT) is a $125 Billion company based in Dayton, OH. It is the largest defense contractor in the world, serving in defense, space, intelligence, homeland security and information technology including cyber security to the U.S. Government, international customers and U.S. commercial & other customers. It is rated 3 (Hold).

Boeing Corp. (BA) is a $95 Billion company based in Chicago IL. Unlike RTX and BA, the price of Boeing had taken a major beating during the past five years and has lost more than 30% during the past 12 months. Our predictive model is not looking for a short-term rebound. Its rating is 2 (Sell).

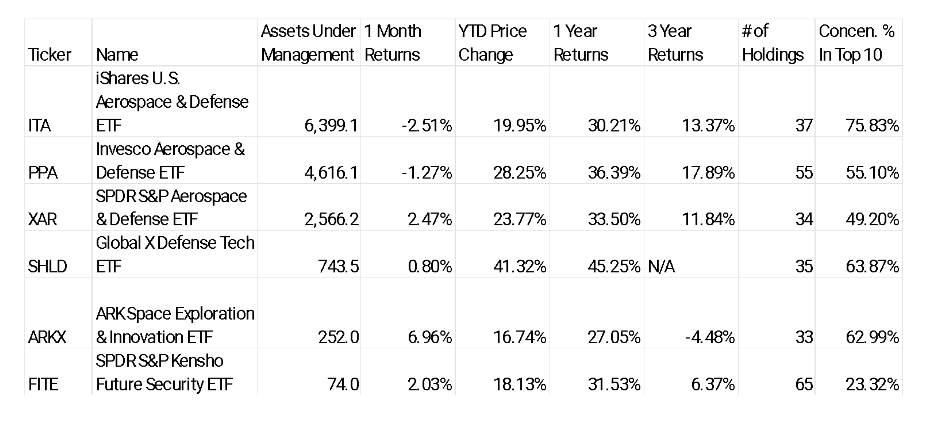

The next logical step is to investigate which ETFs serve the sector. There are six. Precisely half of these are by the three major index ETF providers trying to capture the sector. The other three all center on companies producing technology within the sector. As you might expect given the poor overall outlook ValuEngine’s predictive model has for the sector, all three broad-based ETFs are rated poorly. In fact, all three (ITA, PPA & XAR, names in table below) get our worst rating of 1 (Strong Sell). SHLD and ARKX contain several non-US companies, have a shorter history, and are not currently listed by ValuEngine. SPDR Kensho Future Security ETF (FITE) which uses a fundamental screen to select companies and weights has a somewhat less dismal rating of 2 (Sell).

This table displays some additional fast facts about these ETFs: Although iShares Aerospace & Defense ETF (ITA) has the most assets and the longest history, Invesco’s PPA ETF is broader and has better price returns in all four periods. When the sector rebounds, PPA may deserve the longer look of the two.

Current ValuEngine reports on all covered stocks, Sectors and ETFS can be viewed HERE

In conclusion, the article’s title sums it up nicely. Given lower-than-average projected price returns, higher-than-average overvaluation, and potential political maelstroms of uncertainty in navigating the global geopolitics that lie ahead, I would consider being very cautious and even defensive about existing holdings in the Aerospace & Defense sector. Based on ValuEngine data and analysis, I would not be looking to add to such positions on a relative basis.

________________________________________________________________________________________________

By Herbert Blank

Senior Quantitative Analyst, ValuEngine Inc

www.ValuEngine.com

support@ValuEngine.com

All of the over 4,200 stocks, 16 sector groups, over 250 industries, and 600 ETFs have been updated on www.ValuEngine.com

Financial Advisory Services based on ValuEngine research available through ValuEngine Capital Management, LLC

Free Two-Week Trial to all 5,000 plus equities covered by ValuEngine HERE

Subscribers log in HERE