For today’s bulletin, we take a look at our latest BUY and STRONG BUY upgrades and focus on our top upgrade for the day, MasTec Inc $MTZ. We also provide a link to download a FREE STOCK REPORT on the company

VALUATION: Overvalued stocks now make up 57.43% of our stocks assigned a valuation and 20.17% of those equities are calculated to be overvalued by 20% or more. Twelve sectors are calculated to be overvalued.

To subscribe to our bulletins and receive content whenever it is published, subscribe at our blog HERE

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Mastec Inc (MTZ) is our top-rated upgrade this week and it is a STRONG BUY. Applied Optoelectronics (AAOI) is also also a STRONG BUY stocks. The other picks this week–TransAct Technologies (TACT), Protein Design Labs Biopharma (PDLI), and Greenlight Capital (GLRE) are BUY-rated stocks.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| MTZ | MASTEC INC | 42.85 | -10.94% | 75.83% | 1.11% | 13.29% | 14.38 | Construction |

| AAOI | APPLIED OPTOELE | 64.6 | -19.78% | 403.90% | 1.06% | 12.77% | 16.58 | Computer and Technology |

| TACT | TRANSACT TECH | 9.2 | -5.90% | 21.53% | 0.60% | 7.24% | 16.53 | Computer and Technology |

| PDLI | PDL BIOPHARMA | 2.39 | -10.18% | -32.49% | 0.58% | 6.99% | 5.56 | Medical |

| GLRE | GREENLIGHT CAP | 22.75 | -9.69% | 14.21% | 0.51% | 6.16% | 16.21 | Finance |

For today’s bulletin, we take a look at our top-ranked STRONG BUY upgrade, MasTec Inc (MTZ). MasTec Inc is one of the largest providers of construction services to the telecommunications industry in the United States. The Company’s principal business consists of the installation and maintenance of aerial, underground and buried copper and fiber optic cable, underground conduit, manhole systems and relatessed construction for local telephone companies, including Regional Bell Operating Companies such as BellSouth Telecommunications, Inc., U.S. West, Inc. and SBC Communications, Inc., and non-Bell local telephone companies such as Sprint Corp., and GTE Corp.

MasTec reported Q2 2017 earnigns last week and the results were impressive. The company reported revenue of $1.89 billion, a 53% increase in revenue compared with $1.23 billion for the same period last year, exceeding the Company’s previously announced second quarter 2017 expectation by $390 million. COmpany CFO George Pita said that MasTec “significantly exceeded our second quarter expectations in our Oil & Gas segment, including acceleration of some second half 2017 project activity, and are pleased to be in the position of increasing our 2017 guidance to new record levels.”

Jose Mas, MasTec’s Chief Executive Officer, noted that the

second quarter performance significantly exceeded our expectations primarily due to record levels of Oil & Gas project activity, with segment revenues at $1.1 billion, a 168% increase over last year’s second quarter level. Our current performance, coupled with significant opportunities for future growth across all of our segments, position us well for continued long-term growth.

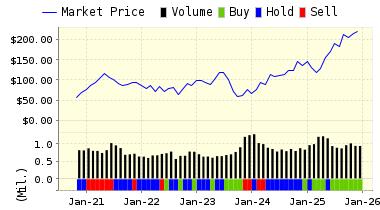

Below is our latest data for MasTec Inc (MTZ):

ValuEngine updated its recommendation from BUY to STRONG BUY for MasTec Inc on 2017-08-04. Based on the information we have gathered and our resulting research, we feel that MasTec Inc INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and P/E Ratio.

You can download a free copy of detailed report on Mastec Inc (MTZ) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 43.32 | 1.11% |

| 3-Month | 41.92 | -2.16% |

| 6-Month | 42.27 | -1.35% |

| 1-Year | 48.55 | 13.29% |

| 2-Year | 40.29 | -5.97% |

| 3-Year | 37.52 | -12.43% |

| Valuation & Rankings | |||

| Valuation | 10.94% undervalued | Valuation Rank(?) | 74 |

| 1-M Forecast Return | 1.11% | 1-M Forecast Return Rank | 99 |

| 12-M Return | 75.83% | Momentum Rank(?) | 93 |

| Sharpe Ratio | 0.59 | Sharpe Ratio Rank(?) | 78 |

| 5-Y Avg Annual Return | 21.26% | 5-Y Avg Annual Rtn Rank | 88 |

| Volatility | 35.74% | Volatility Rank(?) | 45 |

| Expected EPS Growth | -29.75% | EPS Growth Rank(?) | 7 |

| Market Cap (billions) | 3.51 | Size Rank | 78 |

| Trailing P/E Ratio | 14.38 | Trailing P/E Rank(?) | 81 |

| Forward P/E Ratio | 20.47 | Forward P/E Ratio Rank | 33 |

| PEG Ratio | n/a | PEG Ratio Rank | n/a |

| Price/Sales | 0.66 | Price/Sales Rank(?) | 79 |

| Market/Book | 3.05 | Market/Book Rank(?) | 40 |

| Beta | 1.41 | Beta Rank | 22 |

| Alpha | 0.46 | Alpha Rank | 93 |

DOWNLOAD A FREE SAMPLE OF OUR MASTEC INC (MTZ) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information