I’m frequently asked for a top ten picks list for the new year. The nature of ValuEngine Ratings is that the ten stocks picked for the highest 1-year price gain among the 6,000 in our universe are better suited for high-risk tolerance traders than mainstream advisors and their retail clients.

Therefore, in compiling this top ten list among stocks ranked as 5 (Strong Buy) or 4 (Buy) by Value Engine to start 2024, I decided to include additional criteria in my selection process. These include market capitalization greater than $10 billion, a market price greater than $10 per share, and more than $1 million daily trading volume.

All 5,000 stocks, 16 sector groups, 140 industries, and 500 ETFs have been updated.

Two-week free trial: www.ValuEngine.com

The following ten stocks were selected. Here is a brief synopsis of the relevant companies:

- Carnival Cruise Lines (CCL) – Carnival Corporation operates as a cruise and vacation company. As a single economic entity, Carnival Corporation & Carnival plc forms the largest cruise operator in the world. Carnival is the world’s leading leisure travel firm and carries nearly half of the global cruise guests. The company was founded in 1972 and is headquartered in Miami, Florida.

- Affirm Holdings (AFRM) – Affirm Holdings is an emerging growth company. They are building the next generation platform for digital and mobile-first commerce. They believe they can reinvent the payment experience. Their platform consists of three core elements: a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. Affirm Holdings, Inc. was founded in 2012 and is headquartered in San Francisco, California.

- Twilio Inc. (TWLO) – Twilio Inc. provides Cloud Communications Platform-as-a-Service. The company enables developers to build, scale and operate real-time communications within software applications. The company’s platform consists of three layers, Engagement Cloud, Programmable Communications Cloud and Super Network. Twilio’s Programmable Communications Cloud software allows developers to embed voice, messaging, video and authentication capabilities. The company was founded in Seattle, Washington in 2008.

- Tesla Inc. (TSLA) – Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. It operates in two segments, Automotive, and Energy Generation and Storage. Tesla, Inc. was incorporated in 2003 and is headquartered in Austin, Texas.

- Roku Inc. (ROKU) – Roku, Inc., together with its subsidiaries, operates a TV streaming platform. The company operates in two segments, Platform and Devices. Its streaming platform allows users to find and access TV shows, movies, news, sports, and others. The company also provides digital advertising and related services, including the demand-side ad platform and content distribution services, such as subscription and transaction revenue shares; media and entertainment promotional spending services; premium subscriptions services; video and display advertising services; and sells branded channel buttons on remote controls of streaming devices. Roku, Inc. was incorporated in 2002 and is headquartered in San Jose, California.

- Spotify Tech SA (SPOT) – Spotify Technology S.A., together with its subsidiaries, provides audio streaming services worldwide. It operates through two segments, Premium and Ad-Supported. The Premium segment offers unlimited online and offline streaming access to its catalog of music and podcasts without commercial breaks to its subscribers. The firm was incorporated in 2006 and is based in Luxembourg,

- DraftKings Inc. (DKNG) – DraftKings Inc. operates as a digital sports entertainment and gaming company in the United States and internationally. It provides online sports betting and casino, daily fantasy sports, media, and other consumer products, as well as retail sportsbooks. The company also engages in the design and development of sports betting and casino gaming software for online and retail sportsbooks, and iGaming operators. DraftKings Inc. was incorporated in 2012 in Boston, Massachusetts..

- Unity Software (U) – Unity Software Inc. operates a platform that provides real-time 3D development tools and services. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company serves enterprises, mid-market companies, and government and non-profit institutions; mid-sized, small, and independent businesses; and individuals across various industries. Unity Software was founded in 2004 and is headquartered in San Francisco, California.

- Okta Inc. (OKTA) – Okta, Inc. provides identity solutions for enterprises, small and medium-sized businesses, universities, non-profits, and government agencies in the United States and internationally. The company offers a suite of products and services that are used to manage and secure identities. These include Universal Directory, a cloud-based system of record to store and secure user, application, and device profiles for an organization; Single Sign-On that enables users to access applications in the cloud or on-premise from various devices; Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, Web applications, and data; Lifecycle Management that enables IT organizations or developers to manage a user’s identity throughout its lifecycle; API Access Management that enables organizations to secure APIs; Access Gateway enables organizations to extend the Workforce Identity Cloud; Advanced Server Access to manage and secure cloud infrastructure; and Okta Identity Governance, an identity access management and identity governance solutions. Okta, Inc. was incorporated in 2009 and is headquartered in San Francisco, California.

- Block, inc. (SQ) – Block, Inc. operates as a technology company with a focus on financial services. It builds tools to help people in accessing the economy. Its products include Square that makes commerce and financial services easy and accessible for sellers with its integrated ecosystem of technology solutions; Cash App to send, spend, or invest money in stocks or bitcoin; Afterpay for connecting consumers and businesses; TIDAL; and TBD that is building an open source platform and developer infrastructure which enables everyone to access and participate in the global economy. The company, formerly known as Square, Inc. was incorporated in 2009 and is based in Oakland, California.

Current ValuEngine reports on these stocks or ETFS can be viewed HERE

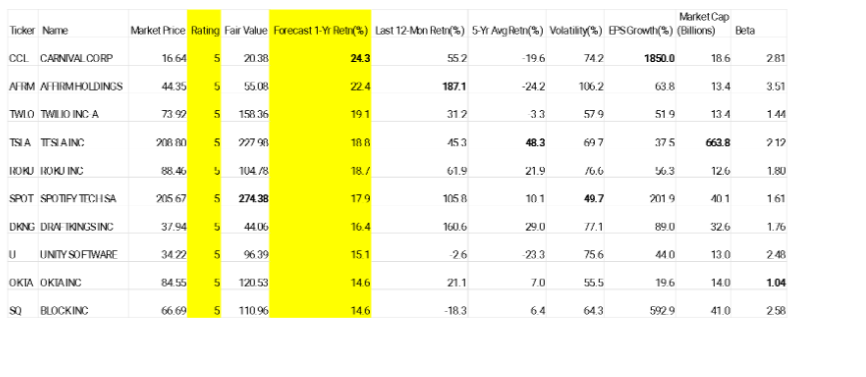

The following table compares the 10 companies on three of ValuEngine’s proprietary measures, Rating, Fair Value and Forecast 1-Yr. Return along with 6 historical measures. Rating and return forecasts (several other time periods are available) are from our predictive model. The Fair Value applies our valuation model to the current price to determine the “fair value” price of the stock.

OBSERVATIONS

- Carnival Corp. (CCL) has our highest forecast one-year return at 24.3% and stratospheric EPS growth from a low base. It performed even better in 2023 with a 55.2% one-year gain. As a Leisure & Recreation company, it tends to perform best when the economy is doing well. After a recession scare, most consumers seem convinced that the economy is doing well enough to be able to spend on themselves. While there is a high potential upside here, CCL is also one of the most volatile stocks in the report and its 5-year annualized return is negative.

- Affirm Holdings (AFRM) has a much different business profile than CCL. It is pioneering technology to try to redefine the mobile payment experience. From a ValuEngine forecast perspective however, the stories are very similar. It has the second highest forecast return and had the highest realized return last year but also has a negative five-year return and its price volatility is even higher. Unlike CCL, AFRM has the potential to be one of the “Magnificent Seven” stocks for the following decade as it has the potential for exponential growth if it can become the preferred mobile and digital platform with its technology. It is definitely a high upside and low-floor stock.

- Cloud Communications specialist Twilio (TWLO), with the third highest forecast return also had terrific 12-month gains, high earning growth and a negative 5-year return. One major difference, its price volatility has been much lower than the first two discussed here.

- Tesla (TSLA) on the other hand, has done just as well on a 5-year annualized basis, 46%, as it did last year, 45%. Even though at 19% it gets our 4th highest projection in this group for price gain, that would be more than a 50% fall from the annual gains that shareholders have been used to. It is also very volatile. The biggest difference is that the other three stocks have a market cap between 13 and 18 billion dollars while Tesla’s is greater than $660 billion.

- The next three stocks in descending order of forecast 1-year return are all entertainment companies: Roku (ROKU), Spotify and DraftKings (DKNG). They have market caps between $13 and $40 billion. All three have positive 5-year annualized returns and performed tremendously in 2023. SPOT has the lowest volatility and Beta in this high-flying top ten but certainly would not be considered a conservative stock.

- In contrast, two of the final three stocks, Unity Software (U) and Block (SQ) are both coming off years where the stock went down. The predictive model is looking for a price rebound precipitated by a strong earnings rebound. They are also high potential rewards at high potential risk stocks.

- OKTA, with the 9th highest projected gain, is an interesting case. It’s been a steady performer in an increasingly important industry, data security. It has, by far, the lowest beta of the group. Its growth has been steadier and appears somewhat more sustainable than some of the other companies reviewed here that have similar market capitalization in the mid-teens. Its current price understates what our valuation model considers it worth by about 50%. For the volatility-conscious, OKTA might be worth investigating as a potential growth play.

Financial Advisory Services based on ValuEngine research available:

www.ValuEngineCapital.com

SUMMARY

The top 10, in the aggregate, is very earnings-growth oriented and for the most part technology-oriented as well. Except for TSLA, DKNG and SPOT, all of the stocks are headquartered on the West Coast of the United States. This is not surprising since a preponderance of US tech stocks are from companies headquartered there.

We will track this top 10 list as an equally weighted portfolio to see how it winds up at the end of the year in comparison with other top 10 lists and with RSP, the Invesco Equal-Weight S&P 500 ETF. Stay tuned.

_______________________________________________________________

By Herbert Blank

Senior Quantitative Analyst, ValuEngine Inc

www.ValuEngine.com

support@ValuEngine.com

All of the approximately 5,000 stocks, 16 sector groups, 140 industries, and 600 ETFs have been updated on www.ValuEngine.com

Financial Advisory Services based on ValuEngine research available through ValuEngine Capital Management, LLC

Free Two Week Trial to all 5,000 plus equities covered by ValuEngine HERE

Subscribers log in HERE