For today’s bulletin, we take a look at our latest STRONG BUY and BUY upgrades and focus on our top upgrade for the day, Amtech Systems $ASYS. We also provide a link to download a FREE STOCK REPORT on the company

VALUATION WATCH: Overvalued stocks now make up 58.65% of our stocks assigned a valuation and 24.08% of those equities are calculated to be overvalued by 20% or more. Thirteen sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Amtech Systems Inc. is the only STRONG BUY upgrade for today. The other companies are ranked BUY. We did not have five upgrades today with full data, so we included Seven Stars and Tejin as a courtesy.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| ASYS | AMTEC SYSTEMS | 13.23 | 31.55% | 173.91% | 1.03% | 12.40% | 19.17 | Computer and Technology |

| AVID | AVID TECH INC | 6.59 | 13.02% | 46.77% | 0.52% | 6.27% | 20.81 | Computer and Technology |

| MMSI | MERIT MEDICAL | 43.55 | 42.26% | 81.84% | 0.51% | 6.12% | 34.20 | Medical |

| SSC | SEVEN STARS CLD | 2.48 | N/A | 89.31% | 0.53% | 6.33% | N/A | Computer and Technology |

| TINLY | TEIJIN | 21.64 | N/A | 15.05% | 0.52% | 6.19% | 14.05 | Consumer Discretionary |

For today’s bulletin, we take a look at our top STRONG BUY upgrade for the day, Amtech Systems (ASYS). Amtech Systems Inc. manufactures capital equipment, including silicon wafer handling automation, thermal processing, PSG and PECVD (plasma-enhanced chemical vapor deposition) equipment and related consumables used in fabricating solar cells and semiconductor devices. Amtech is a leading supplier of horizontal diffusion furnace systems, related automation and polishing supplies that enable key steps of the front end manufacturing process for both solar cells and semiconductor chips.diffusion furnace systems, related automation and polishing supplies that enable key steps of the front end manufacturing process for both solar cells and semiconductor chips.

Amtech’s products are recognized under the leading brand names Tempress Systems™, Bruce Technologies™, BTU™, P.R. Hoffman™, SoLayTec™ and R2D automation™ and are sold to a large and diverse worldwide customer base that consists primarily of manufacturers of solar cells, integrated circuits, electronics assemblies and silicon wafers. Amtech is leveraging its proven technology, established brands and strong industry presence to further expand its penetration into the large and growing solar cell market as a technology turnkey product supplier to the diffusion, PSG and PECVD solar markets.

The company reported results earlier this week for Q4 2017. Net revenue for the fourth quarter of fiscal 2017 was $54.7 million compared to $47.8 million in the preceding quarter and $42.4 million in the fourth quarter of fiscal 2016. The sequential increase was due primarily to increased shipments of semiconductor equipment. The increase from the prior year quarter was due primarily to shipments relating to the large solar turnkey order, as well as increased shipments of semiconductor equipment.

Mr. Fokko Pentinga, Chief Executive Officer of Amtech, had this to say about the results:

We are pleased to report that shipment of Phase I of the turnkey order and strong shipments of semiconductor products led to strong financial results in the fourth quarter and fiscal year 2017. All three of our businesses delivered very positive earnings in the fourth quarter. Both our solar and semiconductor business units performed well with sequential quarter-to-quarter and year-over year improvements in both revenue and operating profit. The polishing segment also produced higher quarterly profits sequentially and year-over-year. In August, we successfully completed a round of equity financing, which enhanced our financial position as we continue to develop next-generation products and solutions, focus on operational excellence, and the long-term profitable growth of the company.

The company expects revenues for the quarter ending December 31, 2017 to be in the range of $60 to $70 million. Gross margin for the quarter ending December 31, 2017 is expected to be in the mid 20 percent range, with operating margin percentage in the mid-single digits, both influenced by product mix.

In the wake of the latest results, many analysts reiterated their BUY ratings for the stock.

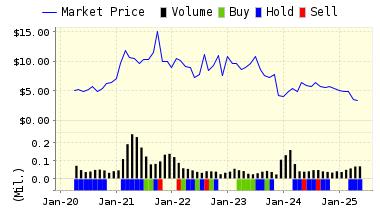

Below is our latest data for Amtech Systems (ASYS):

ValuEngine updated its recommendation from BUY to STRONG BUY for Amtech Systems on 2017-11-21. Based on the information we have gathered and our resulting research, we feel that Amtech Systems has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Sharpe Ratio.

You can download a free copy of detailed report on Amtech Systems (ASYS) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 13.37 | 1.03% |

| 3-Month | 13.47 | 1.85% |

| 6-Month | 13.98 | 5.69% |

| 1-Year | 14.87 | 12.40% |

| 2-Year | 15.66 | 18.39% |

| 3-Year | 15.66 | 18.39% |

| Valuation & Rankings | |||

| Valuation | 31.55% overvalued | Valuation Rank(?) | 14 |

| 1-M Forecast Return | 1.03% | 1-M Forecast Return Rank | 98 |

| 12-M Return | 173.91% | Momentum Rank(?) | 98 |

| Sharpe Ratio | 0.51 | Sharpe Ratio Rank(?) | 74 |

| 5-Y Avg Annual Return | 30.30% | 5-Y Avg Annual Rtn Rank | 94 |

| Volatility | 59.15% | Volatility Rank(?) | 28 |

| Expected EPS Growth | -28.02% | EPS Growth Rank(?) | 7 |

| Market Cap (billions) | 0.13 | Size Rank | 36 |

| Trailing P/E Ratio | 19.17 | Trailing P/E Rank(?) | 67 |

| Forward P/E Ratio | 26.64 | Forward P/E Ratio Rank | 20 |

| PEG Ratio | n/a | PEG Ratio Rank | n/a |

| Price/Sales | 0.86 | Price/Sales Rank(?) | 74 |

| Market/Book | 2.45 | Market/Book Rank(?) | 47 |

| Beta | 2.18 | Beta Rank | 10 |

| Alpha | 0.75 | Alpha Rank | 97 |

DOWNLOAD A FREE SAMPLE OF OUR AMTECH SYSTEMS (ASYS) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information