For today’s bulletin, we take a look at our latest BUY and STRONG BUY upgrades. We also provide a link to download a FREE STOCK REPORT on our top upgrade for the day, Netflix $NFLX.

VALUATION WATCH: Overvalued stocks now make up 52.99% of our stocks assigned a valuation and 21.15% of those equities are calculated to be overvalued by 20% or more. Eleven sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Netflix is rated STRONG BUY. The rest of our upgrades for today are rated BUY.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| NFLX | NETFLIX INC | 404.98 | 24.97% | 164.00% | 1.09% | 13.05% | 210.56 | Retail-Wholesale |

| VCYT | VERACYTE INC | 9.26 | 24.75% | 17.81% | 0.66% | 7.93% | N/A | Medical |

| FANG | DIAMONDBACK EGY | 127.58 | 4.67% | 48.54% | 0.56% | 6.70% | 21.16 | Oils-Energy |

| OMCL | OMNICELL INC | 52.6 | 12.51% | 22.90% | 0.54% | 6.53% | 68.02 | Medical |

| FBNK | FIRST CT BANCRP | 31.15 | 20.95% | 21.21% | 0.53% | 6.39% | 21.43 | Finance |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

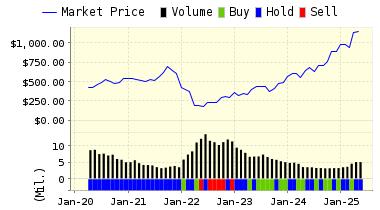

Netflix (NFLX) is the world’s leading Internet television network with millions of subscribers in nearly 50 countries who have access to an ever-expanding library of TV shows and movies, including original programming, documentaries and feature films. The company offers the ability to watch as subscribers want, anytime, anywhere, on nearly any Internet-connected screen.

For investors worried about tariffs, tech stocks are often a safe harbor. We see that in today’s trading, as tech stocks have helped NASDAQ hold on despite unrest in other areas. Netflix has hit an all-time high. According to market cap, the company is now worth more than Comcast or Disney.

This may seem “weird,” given the fact that DVDs by mail aren’t a big thing these days AND the company depends on cable monopolies such as Comcast to reach users via streaming. But, Netflix is proving that the old adage ‘content is king” still holds sway. The company is riding a wave of successful programming that viewers cannot find anyplace else and that is powering the stock despite any other supposed limitations.

ValuEngine updated its recommendation from BUY to STRONG BUY for NETFLIX INC on 2018-06-19. Based on the information we have gathered and our resulting research, we feel that NETFLIX INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Company Size.

You can download a free copy of detailed report on Netflix (NFLX) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 409.38 | 1.09% |

| 3-Month | 412.02 | 1.74% |

| 6-Month | 424.66 | 4.86% |

| 1-Year | 457.82 | 13.05% |

| 2-Year | 443.17 | 9.43% |

| 3-Year | 427.84 | 5.64% |

| Valuation & Rankings | |||

| Valuation | 24.97% overvalued | Valuation Rank(?) | 18 |

| 1-M Forecast Return | 1.09% | 1-M Forecast Return Rank | 99 |

| 12-M Return | 164.00% | Momentum Rank(?) | 98 |

| Sharpe Ratio | 1.15 | Sharpe Ratio Rank(?) | 95 |

| 5-Y Avg Annual Return | 47.74% | 5-Y Avg Annual Rtn Rank | 98 |

| Volatility | 41.38% | Volatility Rank(?) | 39 |

| Expected EPS Growth | 90.12% | EPS Growth Rank(?) | 84 |

| Market Cap (billions) | 24.47 | Size Rank | 95 |

| Trailing P/E Ratio | 210.56 | Trailing P/E Rank(?) | 31 |

| Forward P/E Ratio | 110.75 | Forward P/E Ratio Rank | 3 |

| PEG Ratio | 2.34 | PEG Ratio Rank | 15 |

| Price/Sales | 1.92 | Price/Sales Rank(?) | 51 |

| Market/Book | 6.09 | Market/Book Rank(?) | 24 |

| Beta | 0.99 | Beta Rank | 38 |

| Alpha | 0.65 | Alpha Rank | 96 |

DOWNLOAD A FREE SAMPLE OF OUR NETFLIX (NFLX) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com