For today’s bulletin, we take a look at Tesla $TSLA. We also provide a link to download a FREE STOCK REPORT on the company.

VALUATION WATCH: Overvalued stocks now make up 58.35% of our stocks assigned a valuation and 23.81% of those equities are calculated to be overvalued by 20% or more. Thirteen sectors are calculated to be overvalued.

Tesla Inc. (TSLA) designs, develops, manufactures, and sells electric vehicles and stationary energy storage products. It operates primarily in the United States, China, Norway and internationally. Tesla Inc., formerly known as Tesla Motors Inc., is headquartered in Palo Alto, California.

We have followed Tesla for a while now, interested by their battery technology and space program, but not so sanguine about their car business, their so-called “hyperloop,” or their promises vis-a-vis self-driving vehicles.

Lately, we have had the uncomfortable nagging sense that the company puts out press releases designed to foster hype, light on substance, in order to bolster their–in our view–wildly over-inflated stock price. We still don’t believe that this company is worth more now– or in the near future, than Ford, GM, etc.

Today, Tesla is in the news yet again. This time the PR concerns a new deal with DHL. According to the Wall Street Journal, Tesla has inked a deal where DHL will purchase Tesla semi-truck rigs and test them in a variety of capacities including shuttle runs and same-day customer deliveries in big US cities. The firm will also do some longer-range testing and will gather feedback from drivers to see how they feel about the Tesla rigs in terms of comfort and safety. DHL joins Wal-Mart, JB Hunt, and other trucking firms who have decided to purchase and evaluate these new Tesla electric vehicles for their own businesses.

Of course, the fine print reveals some of the same sorts of issues that challenge Teslas efforts in the passenger car market. The electric trucks have a shorter range than a standard diesel vehicle. Tesla’s trucks are also more expensive than the diesel standard and the costs of just reserving one for purchase–let alone taking delivery–has jumped to $20k.

Tesla will also have to show that they can produce and deliver these vehicles in a timely manner. As we have discussed in the past, the company has so far been unable to meet even the most modest of their goals for their Model 3 “affordable” electric passenger car.

And of course, while the DHL announcement provides more of that positive press for Tesla, we find that the order is hardly earth-shattering. As of now, DHL has only committed to purchase and test ten of the new electric semis.

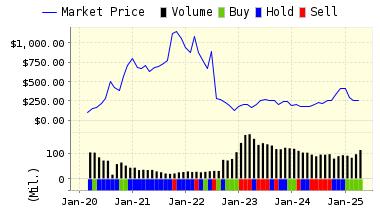

For now, our models continue to rank Tesla as a SELL. They are not swayed by positive press and PR efforts, they can only run off of fundamental financial data. We remain concerned that this company is overvalued and that the stock price is more reflective of hype and good “story” than sales and profits. We want to like Tesla, because we do feel strongly that battery technology will be a strong technology for the future, but we just don’t think Tesla’s results justify its lofty share price–yet.

ValuEngine continues its SELL recommendation on Tesla Inc. for 2017-11-27. Based on the information we have gathered and our resulting research, we feel that Tesla Inc. has the probability to UNDERPERFORM average market performance for the next year. The company exhibits UNATTRACTIVE Book Market Ratio and P/E Ratio.

You can download a free copy of detailed report on Tesla Inc. (TSLA) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 315.46 | -0.43% |

| 3-Month | 303.17 | -4.30% |

| 6-Month | 298.54 | -5.77% |

| 1-Year | 300.64 | -5.10% |

| 2-Year | 220.18 | -30.50% |

| 3-Year | 165.21 | -47.85% |

| Valuation & Rankings | |||

| Valuation | 34.93% undervalued | Valuation Rank(?) | 88 |

| 1-M Forecast Return | -0.43% | 1-M Forecast Return Rank | 20 |

| 12-M Return | 61.54% | Momentum Rank(?) | 90 |

| Sharpe Ratio | 0.98 | Sharpe Ratio Rank(?) | 89 |

| 5-Y Avg Annual Return | 49.34% | 5-Y Avg Annual Rtn Rank | 98 |

| Volatility | 50.34% | Volatility Rank(?) | 33 |

| Expected EPS Growth | 75.90% | EPS Growth Rank(?) | 81 |

| Market Cap (billions) | 39.72 | Size Rank | 97 |

| Trailing P/E Ratio | n/a | Trailing P/E Rank(?) | 24 |

| Forward P/E Ratio | n/a | Forward P/E Ratio Rank | n/a |

| PEG Ratio | 0.43 | PEG Ratio Rank | 65 |

| Price/Sales | 3.69 | Price/Sales Rank(?) | 30 |

| Market/Book | 7.41 | Market/Book Rank(?) | 20 |

| Beta | 0.87 | Beta Rank | 47 |

| Alpha | 0.35 | Alpha Rank | 90 |

DOWNLOAD A FREE SAMPLE OF OUR TESLA (TSLA) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information