For today’s bulletin, we take a look at our latest BUY upgrades. We also provide a link to download a FREE STOCK REPORT on Union Pacific $UNP, one of our top upgrades for the day.

VALUATION WATCH: Overvalued stocks now make up 52.05% of our stocks assigned a valuation and 22.15% of those equities are calculated to be overvalued by 20% or more. Thirteen sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. There were no STRONG BUY upgrades today. All of the stocks below are rated BUY.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| DGLY | DIGITAL ALLY IN | 4.25 | 11.73% | N/A | 0.58% | 6.96% | N/A | Industrial Products |

| UNP | UNION PAC CORP | 163.7 | 9.25% | 46.12% | 0.58% | 6.92% | 23.18 | Transportation |

| AVP | AVON PRODS INC | 2.29 | 20.75% | N/A | 0.57% | 6.82% | 26.42 | Consumer Staples |

| EGN | ENERGEN CORP | 79.36 | 4.39% | 50.27% | 0.54% | 6.43% | 28.18 | Oils-Energy |

| KAI | KADANT INC | 109.05 | 16.18% | 16.57% | 0.53% | 6.35% | 23.19 | Industrial Products |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

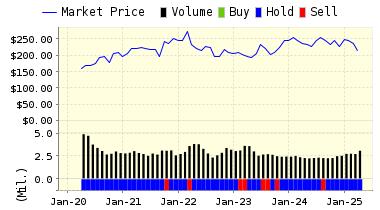

Today, we take a look at Union Pacific (UNP). Union Pacific Corporation is one of America’s leading transportation companies. Its principal operating company, Union Pacific Railroad, is North America’s premier railroad franchise, covering 23 states across the western two-thirds of the United States. One of America’s most recognized companies, Union Pacific Railroad proves a critical link in the global supply chain. Union Pacific’s network and operations is to support America’s transportation infrastructure. The railroad’s diversified business mix is classified into its Agricultural Products, Energy, Industrial and Premium business groups. Union Pacific serves many of the fastest-growing U.S. population centers, operates from all major West Coast and Gulf Coast ports to eastern gateways, connects with Canada’s rail systems and is the only railroad serving all six major Mexico gateways. Union Pacific provides value to its customers by delivering products in a safe, reliable, fuel-efficient and environmentally responsible manner.

Union Pacific has been on a tear much of the year and is currently at or near its 52-week high. A strong economy typically features strong transportation stocks, and we certainly see that with this company. All of their numbers look strong and the guidance for the year is impressive.

Analysts have also raised their consensus estimates for earnings lately. Revenues also look strong with decent growth. IN addition, the company features a good dividend and that dividend has been increasing as the company rewards shareholders.

ValuEngine updated its recommendation from HOLD to BUY for UNION PAC CORP on 2018-09-18. Based on the information we have gathered and our resulting research, we feel that UNION PAC CORP has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Momentum.

You can download a free copy of detailed report on Union Pacific (UNP) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 164.64 | 0.58% |

| 3-Month | 163.91 | 0.13% |

| 6-Month | 167.42 | 2.27% |

| 1-Year | 175.03 | 6.92% |

| 2-Year | 168.82 | 3.13% |

| 3-Year | 164.76 | 0.65% |

| Valuation & Rankings | |||

| Valuation | 9.25% overvalued | Valuation Rank(?) | 37 |

| 1-M Forecast Return | 0.58% | 1-M Forecast Return Rank | 87 |

| 12-M Return | 46.12% | Momentum Rank(?) | 89 |

| Sharpe Ratio | 0.74 | Sharpe Ratio Rank(?) | 85 |

| 5-Y Avg Annual Return | 13.48% | 5-Y Avg Annual Rtn Rank | 81 |

| Volatility | 18.14% | Volatility Rank(?) | 71 |

| Expected EPS Growth | 19.16% | EPS Growth Rank(?) | 54 |

| Market Cap (billions) | 145.55 | Size Rank | 100 |

| Trailing P/E Ratio | 23.18 | Trailing P/E Rank(?) | 53 |

| Forward P/E Ratio | 19.45 | Forward P/E Ratio Rank | 33 |

| PEG Ratio | 1.21 | PEG Ratio Rank | 35 |

| Price/Sales | 6.61 | Price/Sales Rank(?) | 17 |

| Market/Book | 7.31 | Market/Book Rank(?) | 21 |

| Beta | 0.84 | Beta Rank | 45 |

| Alpha | 0.22 | Alpha Rank | 85 |

DOWNLOAD A FREE SAMPLE OF OUR UNION PACIFIC (UNP) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com