The Russell US Indexes are designed to reflect the ever-changing US equity market, and the annual reconstitution process is critical to maintaining accurate representation. The Russell Indexes differ from other major US stock market indexes in a variety of ways. Russell was also the first index family to use float-adjusted market capitalization, using only shares available for trading and not including shares held by the primary owner if that amount exceeds 50%. It is also important to note that although these indexes are now owned by the London Stock Exchange Group (LSEG), which also owns the globally oriented FTSE Indices that employs very different methodologies, the Russell name is still used for the sake of continuity to a 40-year legacy.

All 5,000 stocks, 16 sector groups, 140 industries, and 500 ETFs have been updated:

Two-week free trial: www.ValuEngine.com

The reconstitutions are important for the resetting of benchmarks and passive asset allocations. Because of this, the reconstitutions have also become the focus of proprietary traders and hedge funds seeking to collect arbitrage profits by front-running trades that passive institutional ownership must make before they are due to happen.

For many investors and traders, the most important part of this process is what happens to the Russell 2000 Index. Although Russell maintains and produces many indexes, the Russell 2000 is the only one that is the recognized leader of its category, small cap US stocks. In fact, it was this family of indexes that established small cap as a separate institutional allocation.

That said, there exist many institutions that use all or most of the Russell indexes that stem from the total US market for benchmarking. In some cases, the Russell 3000 is used for benchmarking while the Russell 1000 Growth, Russell 1000 Value, Russell 2000 Growth and Russell 2000 Value indexes are used for actual passive investing. This should help explain the importance the markets give to the reconstitution events. Unlike the S&P indexes, Russell does not replace stocks that drop out during the year between annual reconstitutions. This has the consequence that by the time of the reconstitution the Russell 2000 becomes a misnomer as it frequently contains less than 1800 stocks.

During the highly anticipated reconstitution event, the breakpoints between large, mid, and small cap are redefined to ensure market changes that have occurred in the preceding year are captured.

Companies are also re-evaluated to determine where they rank along the investment styles spectrum.

The next reconstitution changes and the newly recalibrated indexes took effect after the close of US equity markets on Friday, June 28, 2024; the new Russell US Indexes membership, weights and performance were set on the open of US equity markets on Monday, July 1, 2024.

As of December 2023, approximately $10.5 trillion in assets were benchmarked to a Russell index, and more than $134 billion traded across US exchanges at the close of 2023 reconstitution.

The major Russell US Indexes were designed as performance benchmarks, not alpha generators. The starting point is the Russell 3000 which was designed to represent the entire US Market. All other major Russell indexes, Russell 1000 large/midcap, the Russell 2000 small cap and all value, growth and style variants begin with the Russell 3000 Index.

Since the Russell 2000 could not exist without the Russell 3000. It would make sense to understand more about the Russell 3000 in order to analyze the effects of the recent rebalancing on the Russell 2000.

Let’s take a look at some statistics for the Russell 3000:

- Total number of stocks at Rebalancing = 3000 – Decreases during the year.

- Total market capitalization = $53.0 trillion in 2024 (Up 20% from 2023).

- The breakpoint between large/mid cap and small cap = $4.6 billion (Up 9.5% from 2023).

- The total market cap of the ten largest companies increased 41.1% since last year’s reconstitution, from a combined $10.9 trillion to $15.4 trillion.

- Nine of the largest ten companies in the index increased their total market caps from 2023.

- 4 of the top 10 companies exceeded $2 trillion in total market capitalization.

- Nvidia had the highest increase in total market cap among these companies, increasing 215.2%.

- Microsoft replaced Apple as the largest company, after an increase in market cap of 26.7% compared to Apple’s decrease of 2.0%.

- Eli Lilly and Broadcom are two new entries to the list of ten largest companies in the index, ranked as the eighth and ninth respectively; they replaced ExxonMobil and Visa.

Current ValuEngine reports on all covered stocks and ETFS can be viewed HERE

The Russell 1000 is sometimes called Russell’s Large Cap Index even though it contains twice as many companies as the S&P 500 Index. It is sometimes called a Large/MidCap Index. Russell also has a MidCap Index that contains the lower 500 of these companies along with the largest 500 companies in the Russell 2000. Confusing? Yes, the entire Russel nomenclature system and its growth and value methodologies can be very confusing until one gets used to them.

Some fast facts about the Russell 1000:

- Number of stocks after Rebalancing = 1000 – Decreases during the year.

- Total market capitalization = $50.2 trillion in 2024 (Up 21% from 2023).

- The smallest company in the Russell 1000 index is now Leggett & Platt with a total market capitalization of $2.4 billion.

- 38 companies are being added to the Russell 1000 Index, with 27 of those moving up from the Russell 2000 Index. 7 companies moving up are Technology companies;

Other additions from the Russell 2000 include:- Consumer Discretionary (5),

- Energy (5)

- Industrials (5)

- Health Care (3)

- Consumer Staples (2).

- 3 IPOs just joined the Russell 1000: Astera Labs (Technology), Amer Sports (Consumer Discretionary) and Loar Holdings (Industrials).

- 30 companies are migrating from the Russell 1000 Index to the Russell 2000 Index.

With the above background as foundation, it becomes easier to view these changes to the Russell 2000 in context. The Russell 2000 is the most-followed Russell US Index by far. It has been the US preferred benchmark by pension plans, consultants and most other major institutional investors since its inception in 1984. Its closest rival is the S&P 600 Small Cap Index. In recent years, an increasing number of institutional investors have switched to the latter, but the Russell 2000 remains the most-referenced small cap benchmark.

Here are the vital statistics for the changes made at the end of June to the Russell 2000:

- Number of stocks after Rebalancing = 2000 (Decreases during the year).

- Total market capitalization = $7.1 billion in 2024 (Up 18% from 2023).

- The smallest company in the Russell 2000 Index is Richardson Electronics with a total market cap of $150.4 million, a decrease of 5.7% from $159.5 million in 2023

- 235 companies are joining the Russell 2000 Index, with 30 dropping down from the Russell 1000 Index and 114 shifting up from the Russell Microcap® Index.

- 12 IPOs just joined the Russell 2000

- 30 companies are migrating from the Russell 1000 Index to the Russell 2000 Index.

- 79 companies are joining from outside of the Russell US Indexes universe, with the highest number of companies from Health Care (27 companies) and Technology (12 companies), followed by Industrials (11 companies), Consumer Discretionary (8 companies), Financials (6 companies) and Energy (5 companies).

Here is a Statistical Overview from a market cap perspectives of the key Russell Institutional Benchmarks (not including Growth and Value):

| Number of Securities | High | Low | Median | |

| Russell 3000®

(US Stock Market proxy, #1 – #3000 in float-adjusted cap spectrum) |

3,000 | 2.9 B | 150.4M | 2.1B |

| Russell 1000® , (#1 – #3000 in float-adjusted cap spectrum) | 1,000 | 2.9 B | 2.4B | 13.8B |

| Russell 2000® (small cap, #1001 – #3000 in float-adjusted cap spectrum) | 2,000 | 7.1B | 150.4M | 869.6M |

| Russell 2500 (Mid + small cap, #501- #3000 in spectrum) | 2,500 | 18.0B | 150.4M | 1.4B |

| Russell Microcap®

(#3001- lowest in exchange-traded stock spectrum) |

1,478 | 1.4B | 30.0M | 240.0M |

| Russell 3000E (2000 + Microcap)* also called “extended small cap” | 3,538 | 2.9 | 30.0M | 1.4B |

Current ValuEngine reports on all covered stocks and ETFS can be viewed HERE

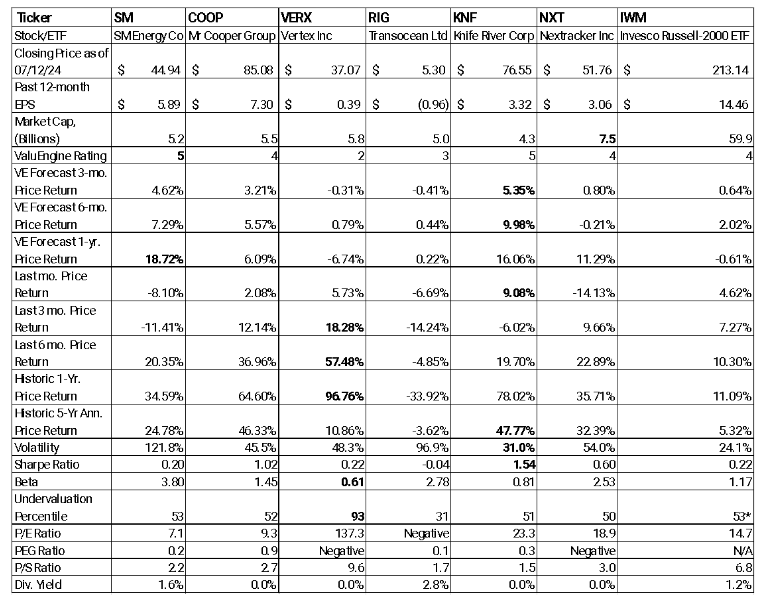

Having explained the US Stock Market from a Russell perspective, let’s hone in on six of the largest stocks that were added during the reconstitution. They include:

SM Energy Company (SM), an independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas.

Mr. Cooper Group Inc. (COOP), together with its subsidiaries, operates as a non-bank servicer of residential mortgage loans in the United States. The company operates through Servicing and Originations segments.

Vertex Inc. (VERX), together with its subsidiaries, provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally.

TransOcean Ltd. (RIG), together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide.

Knife River Corp. (KNF), together with its subsidiaries, provides aggregates- led construction materials and contracting services in the United States. The company mines, processes, and sells construction aggregates, including crushed stone and sand, and gravel; and produces and sells asphalt and ready-mix concrete.

NEXTracker Inc. (VERX), an energy solutions company, provides solar tracker and software solutions for utility-scale and distributed generation solar projects in the United States and internationally.

For benchmarking purposes, the iShares Russell 2000 ETF (IWM) is employed.

This table illustrates the comparisons between the six stocks and the benchmark ETF.

Current ValuEngine reports on all covered stocks and ETFS can be viewed HERE

Observations

- Five of these stocks have strong recent price gains of more than 35% which catapulted them from below the old Russell 2000 threshold up more than 2000 spots to the top 100 of the reconstituted Russell 2000. The lone exception is TransOcean (RIG), a classic “old economy” company that provides equipment for oil exploration. It lost 34% in the past 12 months to fall down into the Russell 2000 from the Russell 1000.

- The ValuEngine predictive model foresees superior price returns from four of the six stocks. SM Energy (SM) and Knife River (KNF) get the highest possible rating of 5 (Strong Buy). Also getting favorable ratings are Mr. Cooper Group (COOP) and Nextracker (NXT) with 4 (Buy). TransOcean gets an average rating of 3 (Hold), Only Vertex (VERX) is rated below average with a 2 (Sell).

- Looking at traditional ratios, SM Energy and Mr. Cooper Group both have very attractive price-to-earnings, price-to-sales and price-to-earnings growth values. All are lower than that of the industry as represented by IWM. SM Energy gives small cap investors the rare bonus of paying a dividend and one that looks like it can be supported by consistent earnings.

- IWM, the iShares ETF representing the small cap index, looks rather inexpensive relative to historical levels.

Despite all the institutional focus on the Russell 2000 index, there are many ETFs that provide investment in small cap US stocks, some indexed and others that are active. The ETFs profiled here include:

iShares Core Small-Cap S&P 600 ETF (IJR) – tracks the S&P SmallCap 600 Index, a market-cap-weighted index of 600 primarily small-cap US stocks. The S&P Committee selects the stocks based upon a quantitative screen and index consistency considerations. The ETF represents about 3% of the publicly available market.

iShares Russell 2000 ETF (IWM) –the oldest and longest-history ETF offering exposure to the Russell 2000 Index, a widely followed measure of small cap U.S. stocks.

Vanguard Small Cap Index Fund ETF (VB) – uses an indexing investment approach designed to track the performance of the CRSP US Small Cap Index, a broadly diversified index of stocks of small U.S. companies.

Pacer US Small Cap Cash Cows 100 ETF (CALF) – tracks an index of 100 companies out of the S&P Small Cap 600 Index selected and weighted by the ratio of last-12-months free cash flow and enterprise value.

Avantis US Small Cap Equity ETF (AVSC) – is an actively managed exchange-traded fund (ETF). The portfolio managers continually analyze market and financial data to make buy, sell, and hold decisions. Morningstar classifies them as a Small Cap Value Fund.

SPDR Portfolio S&P 500 ETF (SPLG)– is the S&P 500 ETF with the lowest expense ratio, one basis point less than IVV and VOO. All three of these are much more cost and return-effective than buying new shares of SPY despite the latter having a much higher level of Assets Under Management.

Blog_Stock and ETF Comparison_July15.xlsx - ETFs

Financial Advisory Services based on ValuEngine research available: www.ValuEngineCapital.com

Observations

- Of the three index ETFs using different indexes to represent Small Cap US Stocks, the Vanguard Small Cap Index (VB) is a double winner. It has the lowest total expense ratio and it has the best three-year and five-year performance. It also has ValuEngine’s top projected performance for three months and six months. It is rated 4, which means that our predictive model recommends buying it for superior projected performance.

- The iShares Russell 2000 ETF (IWM) with the most assets under management is also rated a buy at 4. However, its expenses ratio is nearly quadruple that of VB.

- iShares also has an ETF on the iShares S&P Small Cap 600 (IJR). Many financial advisors prefer it because it has fewer but easier-to-follow stocks and does not have a huge annual rebalancing event that can be gamed by hedge funds. However, it is rated just 3 (Hold) and nothing in its historical performance or future projections would seem to make it more attractive than VB.

- The Pacer US Small Cap Cash Cows (CALF) is the only 5 (Strong Buy) ETF. It is top-rated for 1-year projected performance and 5-year compounded historic performance. However, it also has a very high expense ratio for an index fund.

- Avantis (AVSC) is the active small cap ETF in this selection. Its fee of just 25 basis points (25/100th of a percent) is very low for active management. Thus far, AVSC has underperformed IWM and VB in almost every period, so its active management is adding negative alpha in the historical periods since inception.

Small cap US ETFs is an asset class that outperformed large caps in most 10-year and longer periods in the 20th Century. This is why it is considered a “Smart Beta” factor that many portfolio experts assert will add alpha over time. In the past 20 years, that has not been the case. In 2023, the Russell 2000 had its worst year ever vs. the S&P 500. In the past 8 weeks, small cap has outperformed the S&P 500. How long that might last is unknown. Should small cap be considered its own asset class that should always be represented in equity allocations? Historically, the answers have been cyclical and time-period dependent since the Russell 2000 had been adopted by pension fund consultants as the preferred Small Cap benchmark in 1984.

_______________________________________________________________

By Herbert Blank

Senior Quantitative Analyst, ValuEngine Inc

www.ValuEngine.com

support@ValuEngine.com

All of the over 5,000 stocks, 16 sector groups, over 250 industries, and 600 ETFs have been updated on www.ValuEngine.com

Financial Advisory Services based on ValuEngine research available through ValuEngine Capital Management, LLC

Free Two-Week Trial to all 5,000 plus equities covered by ValuEngine HERE

Subscribers log in HERE