Weekly Market Recap – Week Ending August 29, 2025

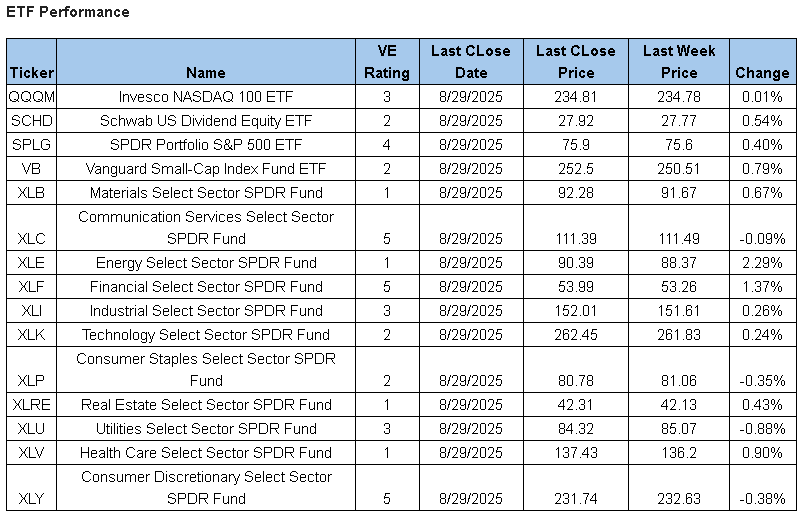

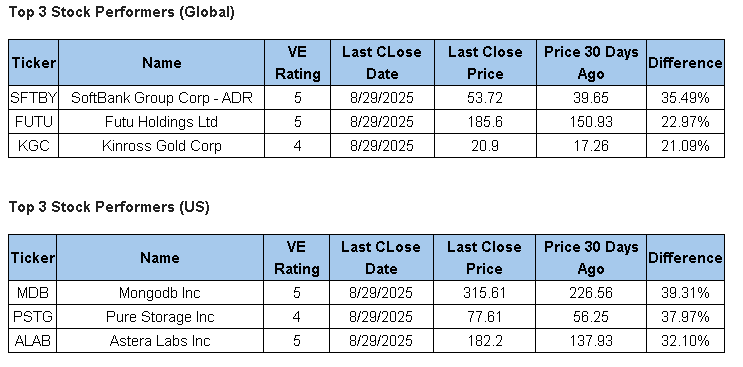

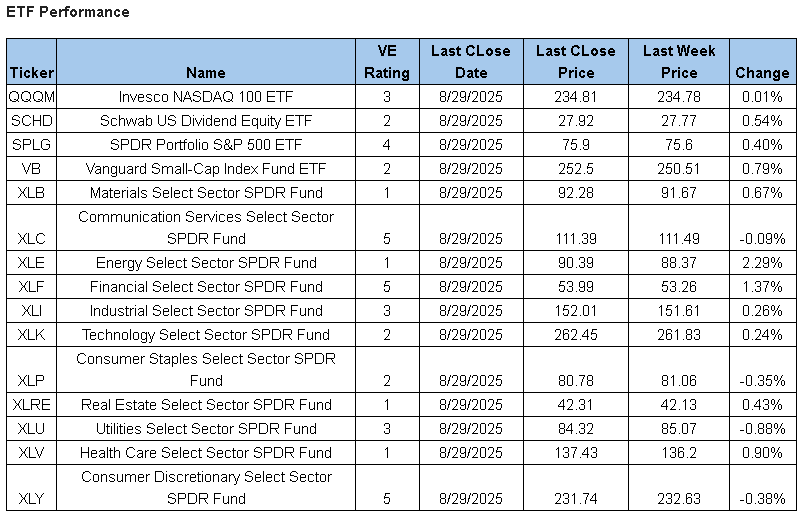

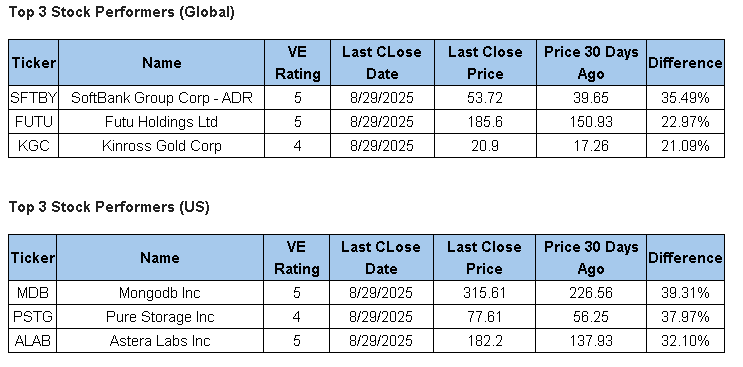

Markets ended the week on a mixed note, with sector ETFs largely stable but with notable strength in Energy, Financials, and Small Caps. On the stock side, technology and select growth names posted outsized gains over the past 30 days, highlighting continued investor appetite for innovation-driven companies.

5,000+ Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Strategy Note:

August 2025 closed as a strong month for the equity markets, here and abroad. The S&P 500 Index most-traded ETF,

SPY, the SPDR S&P 500 Trust, rose in price by a tinge over 2% while

QQQ , Invesco QQQ Trust, rose by half that at 1%. In contrast, the iShares ETF, based on MSCI EAFE,

EFA, the popular institution benchmark for developed world minus US and Canada returned 4.8%.

There were many signs of a continuation of July’s rotation to cap sizes, styles and that were laggards in the first half of the year. Vanguard US Equities Value ETF,

VTV, outgained its growth stock equivalent,

VUG, 3.5% to 0,8%. The SPDR S&P 400 Midcap ETF (

MDY) and the iShares Russell 2000 ETF,

IWM, representing an index of small-cap US stocks, posted robust gains of 4.9% and 7.1% respectively. The Select Sector SPDRs by State Street Global Advisors had mostly positive returns for the month. Once again, Year-to-date laggards outpaced gainers for the month.

On the other hand, while gold as represented by SPDR Mini Gold Trust

GLDM was highly touted by some of the major strategists in their August newsletters but only rose 0.3% for the month. Its year-to-date return of 26% is still quite impressive.

For the upcoming short Labor Day week, proceed with caution. Although the upward trend may well continue to be the investors’ friend, many warning signs abound. The trends we noted last week still persist. Looking at the stocks covered by our proprietary valuation model, our data support the premise that US stocks, large cap stocks in particular, are quite overvalued now. Of the more than 3000 stocks covered by both our forecast model and our valuation model, more than 58% are trading above the price our model calculates as their “fair values.” However, of the 305 stocks we cover with a market capitalization of greater than $50 million, 261 or nearly 85% are trading above their fair values. While these numbers are slightly less ominous than the 59% and 87%, we reported last week, they are still cautionary. Moreover, we are now in the month of September. During the past 94 years, September is the only month with an average negative return, -0.9%. It also has the highest frequency of negative returns.

As most veterans know, historical trends do not control the future. They also do not apply for every single year. September has been a positive-price-change month for the S&P 500 more than 40% of the time. Also, even in a market rated as highly overvalued by most widely used valuation techniques including ours, there may be buying opportunities. Stocks that we rank as Strong Buy and undervalued include Servicenow (NOW) and Travelers (TRV). We certainly wouldn’t advise bailing on the market altogether. There are just market-level signs that there may be dangerous riptides in the current market seas as we head into early fall.

www.ValuEngine.com (Valuengine, Inc) is a stock valuation and forecasting service founded by Ivy League finance academics. VE utilizes the most advanced quantitative techniques and analysis available to analyze over 4,200 US stocks, 700 US ETfs, and 1,000 Canadian stocks. Fair market valuations, forecasted target prices, and buy/hold/sell recommendations are updated DAILY.

www.ValuEngineCapital.com (ValuEngine Capital Management, LLC) is a Registered Investment Advisory firm that trades a variety of different portfolios based upon the ValuEngine.com research models. Each portfolio has a different risk/return profile, so clients can be placed in strategies that fit their specific investment needs.

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

_______________________________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com

_______________________________________________________________________________________________

ValuEngine.com DISCLAIMER is HERE and PRIVACY POLICY is HERE

support@ValuEngine.com | ValuEngine, Inc | (321) 325-0519