Weekly Market Recap – Week Ending October 10, 2025

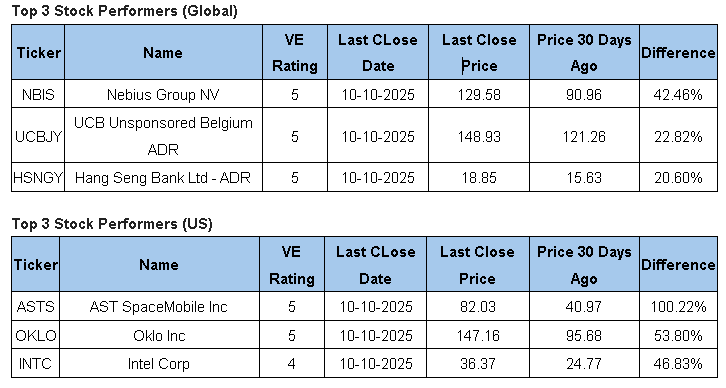

Markets endured a turbulent week as global equities faced renewed volatility driven by escalating U.S.–China trade tensions. Gold surged to record highs while major U.S. and international equity benchmarks declined sharply.

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

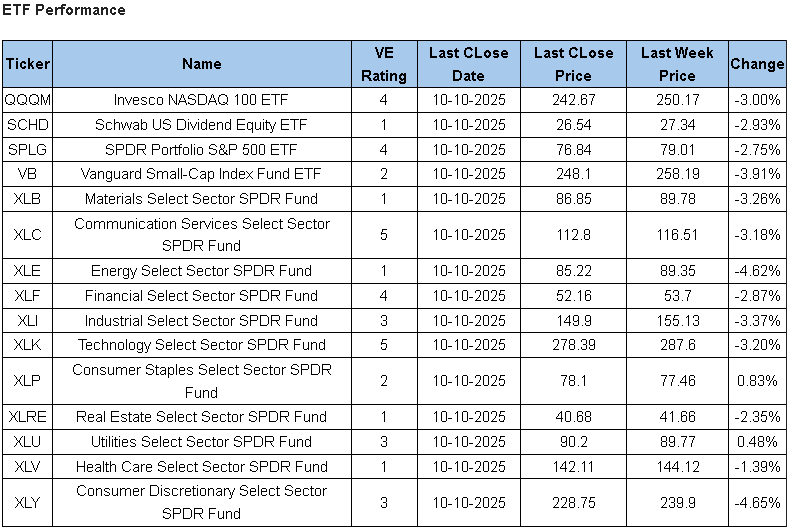

In the below table we use major ETF’s as a proxy for some major indexes as well as each of the sector groups that we divide the market into. Tracking these over time provides a more defined picture of the US markets than simply tracking major indexes.

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Strategy Note

GLDM (SPDR Gold MiniShares Trust) hit yet another all-time high on Friday as QQQ and SPY tumbled amidst China’s latest protectionist policies and Trump’s renewed tariff escalation. International benchmark ETFs fared even worse — representing global markets, the iShares MSCI EAFE ETF (EFA) lost 3.2%, while the iShares MSCI Emerging Markets ETF (EEM) dropped a steep 4.7% for the week. U.S. Bonds provided relative stability, with the iShares Core U.S. Aggregate Bond ETF (AGG) gaining 0.5%.

Most major U.S. financial stocks will be reporting this week, and according to our forecast model, the sector should continue to perform well. Leading the pack, Citigroup (C) and Wells Fargo (WFC) maintain a 5 (Strong Buy) rating. Bank of America (BAC), Morgan Stanley (MS), Goldman Sachs (GS), and American Express (AXP) all hold a 4 (Buy) rating. The related sector ETF, XLF, is also rated 4 (Buy). Another stock likely to attract investor attention, Taiwan Semiconductor (TSM), remains rated 4 (Buy). With these factors in play, it could be a bounce-back week for the S&P 500.

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

_______________________________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com