Weekly Market Recap – Week Ending October 31, 2025

October opened the final quarter of the year with a mixed tone. Large-cap ETFs regained leadership after a brief small-cap rebound in Q3. Tech and growth ETFs once again outperformed value and defensive sectors, while mid-caps and utilities struggled amid renewed rate volatility. Gold remained volatile but still managed to post solid monthly gains, keeping its year-to-date leadership intact.

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

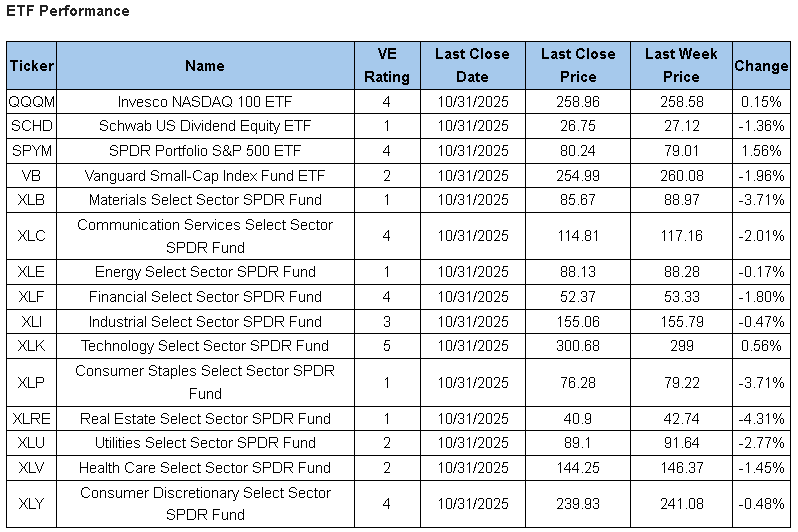

In the below table we use major ETF’s as a proxy for some major indexes as well as each of the sector groups into which we divide the overall markets. Tracking these over time provides a more defined picture of the US markets than simply tracking major indexes.

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

Strategy Note

After a third quarter with some rebounds for lagging benchmark ETFs, the first month of the year’s final quarter returned to a much better reflection of the headlines from the first six months of this year. Large-cap ETFs beat small-cap ETFs by a wider margin, although the latter still finished the month respectably in positive territory. Mid-cap ETFs returned to being miserable and finished slightly negative, with benchmark ETF MDY, the SPDR S&P 400 MidCap Trust, down 0.5%. That was the worst return among the benchmark ETFs followed closely in this blog.

Growth crushed value all around. Once again, tech ETFs led the way with Invesco Nasdaq 100 ETF (QQQM) gaining 4.8% this month and Vanguard Growth ETF (VUG) up 4%. Both are dominated by “Magnificent 7” tech, growth, and other high-flying stocks. Both beat the not-too-shabby 2.4% gain posted by SPDR Portfolio S&P 500 ETF (SPLG), which powered the benchmark ETFs’ year-to-date rise to 17.1%. The iShares Russell 2000 Small Cap ETF (IWM) posted a smaller, although still respectable, 1.8% gain. Near the bottom of the barrel, Vanguard Value ETF (VTV) was down 0.4%, second worst to MDY.

Utilities keep steadily chugging along. October’s nearly 2% increase of the Vanguard Utilities ETF (VPU) lifted its year-to-date return to 17.1%. In foreign markets, emerging markets as represented by iShares MSCI Emerging Markets ETF (EEM) were up 3.6%. This continued its year-long superiority over developed foreign market ETFs, as iShares MSCI EAFE ETF (EFA) only gained 1.2%. Bonds continued to gain steadily but unspectacularly, as the 0.29% gain by iShares Core Aggregate Bond ETF (AGG) barely achieved the 0.25% increase needed to keep up with the 3% rate of inflation reported by the Fed this week.

In some ways, it can be said we buried the headline this week by not getting to gold until now. After continuing to dominate all index ETFs this year in the first two weeks of the month—reaching new highs almost every day—GLDM endured extreme volatility in the past two weeks but held onto a 3.6% gain, finishing in third place overall among the 11 index ETFs we continually follow here.

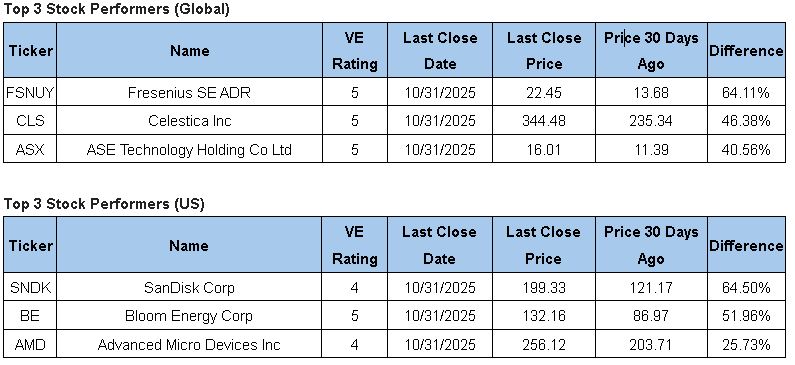

Looking ahead, earnings season is still in full swing. Remember that reports frequently affect not only the reporting stock but many stocks in the same industry group. Looking at past November and December returns for guidance, both months have historically been strong as investors look for a potential “Santa Claus rally.”

One sector we do not expect to rebound is Consumer Staples. The Select Sector SPDR Consumer Staples ETF (XLP) has easily been the group’s worst performer this year, with its 1.6% year-to-date performance contrasting sharply with the nearly 30% year-to-date gain posted by its Technology counterpart (XLK). ValuEngine sees this miserably lagging performance continuing. XLP gets our lowest rating of 1 (Strong Sell). Our equally-weighted sector report gives little enthusiasm, as the average forecasted three-month gain for the 124 stocks we cover in the sector is a mere 0.2%.

Among beat-up stocks we would still avoid are Pilgrim’s Pride (PPC) and recent meme stock Krispy Kreme (DNUT). Both receive a 2 (Sell) rating and are also rated as overvalued by our proprietary valuation model. To end on a cheerier note, the outlook for all stocks in this sector is not entirely bleak. Cosmetics giant Estee Lauder (EL) just rose to our forecast model’s highest rating of 5 (Strong Buy). This demonstrates that savvy investors can occasionally still find diamonds hidden in coal mines as we check for new events this week.

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

_______________________________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com