This week, we provide top-five ranked VE data for our Consumer Discretionary stocks. We take a look at our latest data on Best Buy $BBY and provide a free download of our report on the company.

VALUATION: Overvalued stocks now make up 53.11% of our stocks assigned a valuation and 20.16% of those equities are calculated to be overvalued by 20% or more. Twelve sectors are calculated to be overvalued.

ValuEngine Index Overview

| Index | Week Open | Friday PM | Change | % Change | YTD |

| DJIA | 21832.5 | 22020.24 | 187.74 | 0.86% | 11.42% |

| NASDAQ | 6286.01 | 6437.08 | 151.07 | 2.40% | 19.58% |

| RUSSELL 2000 | 1377.76 | 1410.81 | 33.05 | 2.40% | 3.96% |

| S&P 500 | 2447.35 | 2479.51 | 32.16 | 1.31% | 10.75% |

ValuEngine Market Overview

| Summary of VE Stock Universe | |

| Stocks Undervalued | 46.89% |

| Stocks Overvalued | 53.11% |

| Stocks Undervalued by 20% | 19.98% |

| Stocks Overvalued by 20% | 20.16% |

ValuEngine Sector Overview

| Sector | Change | MTD | YTD | Valuation | Last 12-MReturn | P/E Ratio |

| Aerospace | 1.00% | -0.10% | 5.31% | 26.05% overvalued | 34.13% | 21.38 |

| Computer and Technology | 1.02% | -0.89% | 20.10% | 11.91% overvalued | 14.37% | 32.07 |

| Multi-Sector Conglomerates | 0.09% | -0.88% | 8.85% | 10.52% overvalued | 9.13% | 19.87 |

| Industrial Products | 0.56% | -3.07% | 6.58% | 10.21% overvalued | 16.41% | 23.70 |

| Utilities | -0.31% | 0.43% | 22.99% | 8.22% overvalued | 15.52% | 23.69 |

| Transportation | 0.39% | 1.90% | 11.94% | 7.03% overvalued | 19.11% | 21.16 |

| Finance | 0.17% | -1.61% | 6.17% | 4.82% overvalued | 12.85% | 17.80 |

| Consumer Discretionary | 0.17% | -0.84% | 9.69% | 4.36% overvalued | 15.53% | 25.50 |

| Basic Materials | -0.24% | 1.71% | 11.23% | 1.64% overvalued | 14.20% | 26.13 |

| Consumer Staples | 0.08% | -2.13% | 3.49% | 1.49% overvalued | 2.90% | 24.62 |

| Construction | 0.89% | -2.24% | 12.46% | 1.47% overvalued | 14.78% | 21.89 |

| Business Services | 0.80% | -1.42% | 5.04% | 0.60% overvalued | 5.01% | 24.41 |

| Medical | 0.27% | -0.51% | 15.62% | 0.08% undervalued | 8.32% | 29.79 |

| Auto-Tires-Trucks | 0.51% | 2.16% | 14.31% | 0.53% undervalued | 24.75% | 13.74 |

| Retail-Wholesale | 0.09% | -1.65% | -1.68% | 7.31% undervalued | 0.97% | 21.99 |

| Oils-Energy | 0.20% | -5.81% | -6.95% | 17.52% undervalued | -8.56% | 29.87 |

Sector Talk–Consumer Discretionary

Below, we present the latest data on Consumer Discretionary stocks from our Professional Stock Analysis Service. Top- five lists are provided for each category. We applied some basic liquidity criteria–share price greater than $3 and average daily volume in excess of 100k shares.

Top-Five Consumer Discretionary Stocks–Short-Term Forecast Returns

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| MSGN | MSG NETWORKS | 21.45 | -55.83% | 22.71% |

| ATGE | ADTELUM GBL EDU | 34.2 | -6.71% | 48.44% |

| AMCX | AMC NETWORKS- A | 60.78 | -15.94% | 11.85% |

| HRB | BLOCK H & R | 26.74 | -15.33% | 23.45% |

| RICK | RCI HOSPITALITY | 23.3 | N/A | 112.01% |

Top-Five Consumer Discretionary Stocks–Momentum

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| WTW | WEIGHT WATCHERS | 46.81 | 108.52% | 345.39% |

| NPSND | NASPERS LTD-N | 45.59 | N/A | 177.48% |

| HTHT | CHINA LODGING | 113.51 | 92.22% | 154.34% |

| TTWO | TAKE-TWO INTER | 97.79 | 148.00% | 124.96% |

| SODA | SODASTREAM INTL | 60.23 | 9.59% | 112.30% |

Top-Five Consumer Discretionary Stocks–Composite Score

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| MSGN | MSG NETWORKS | 21.45 | -55.83% | 22.71% |

| HRB | BLOCK H & R | 26.74 | -15.33% | 23.45% |

| ATGE | ADTELUM GBL EDU | 34.2 | -6.71% | 48.44% |

| CMCSA | COMCAST CORP A | 40.61 | -37.43% | 24.46% |

| AMCX | AMC NETWORKS- A | 60.78 | -15.94% | 11.85% |

Top-Five Consumer Discretionary Stocks–Most Overvalued

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| TTWO | TAKE-TWO INTER | 97.79 | 148.00% | 124.96% |

| WTW | WEIGHT WATCHERS | 46.81 | 108.52% | 345.39% |

| MSG | MADISON SQUAR-A | 212.51 | 92.44% | 17.64% |

| HTHT | CHINA LODGING | 113.51 | 92.22% | 154.34% |

| CWH | CAMPING WORLD | 36.75 | 63.82% | N/A |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

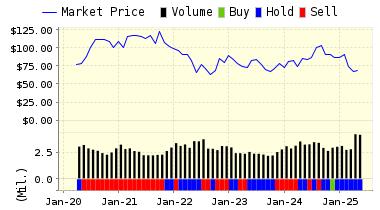

Best Buy (BBY) operates in a single business segment, selling personal computers and other home office products, consumer electronics, entertainment software, major appliances and related accessories principally through its retail stores. They operate retail stores and commercial Websites under the brand names Best Buy, Media Play, On Cue, Sam Goody, Suncoast, Magnolia Hi-Fi and Future Shop. They also operate in three segments: Best Buy, Musicland and International.

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on Best Buy for 2017-08-31. Based on the information we have gathered and our resulting research, we feel that Best Buy has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Momentum.

You can download a free copy of detailed report on Best Buy (BBY) from the link below.

Read our Complete Rating and Forecast Report HERE.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 54.80 | 1.00% |

| 3-Month | 53.60 | -1.22% |

| 6-Month | 54.03 | -0.43% |

| 1-Year | 60.77 | 12.00% |

| 2-Year | 53.34 | -1.69% |

| 3-Year | 51.25 | -5.55% |

| Valuation & Rankings | |||

| Valuation | 5.63% undervalued | Valuation Rank(?) | 64 |

| 1-M Forecast Return | 1.00% | 1-M Forecast Return Rank | 98 |

| 12-M Return | 41.01% | Momentum Rank(?) | 85 |

| Sharpe Ratio | 0.57 | Sharpe Ratio Rank(?) | 77 |

| 5-Y Avg Annual Return | 23.42% | 5-Y Avg Annual Rtn Rank | 90 |

| Volatility | 41.24% | Volatility Rank(?) | 39 |

| Expected EPS Growth | 10.62% | EPS Growth Rank(?) | 43 |

| Market Cap (billions) | 19.03 | Size Rank | 94 |

| Trailing P/E Ratio | 14.06 | Trailing P/E Rank(?) | 81 |

| Forward P/E Ratio | 12.71 | Forward P/E Ratio Rank | 72 |

| PEG Ratio | 1.32 | PEG Ratio Rank | 36 |

| Price/Sales | 0.48 | Price/Sales Rank(?) | 84 |

| Market/Book | 4.67 | Market/Book Rank(?) | 29 |

| Beta | 1.51 | Beta Rank | 20 |

| Alpha | 0.36 | Alpha Rank | 90 |

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information