Weekly Market Recap – Week Ending September 19, 2025

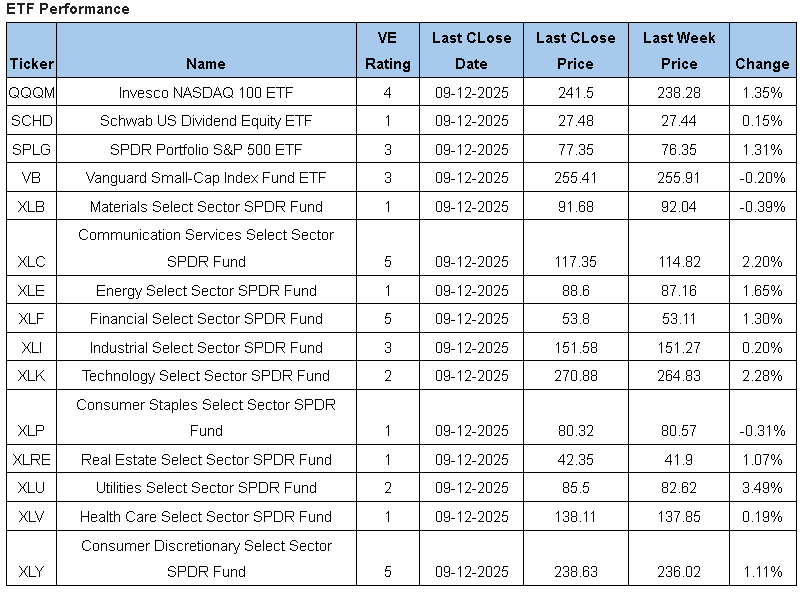

It was a mixed week for stock indexes with the Nasdaq once again standing out as the clear leader. Large-cap tech strength helped the Invesco Nasdaq 100 ETF (QQQM) outpace broader benchmarks, while small caps and equal-weighted strategies lagged. Sector performance was uneven, with leadership concentrated in growth and technology-linked areas.

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

In the below table we use major ETF’s as a proxy for some major indexes as well as each of the sector groups that we divide the market into. Tracking these over time provides a more defined picture of the US markets than simply tracking major indexes.

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Strategy Note:

It was a mixed week for stock index performance other than for the Nasdaq QQQ Trust (QQQ) which outpaced the other major US indexes including the SPDR S&P 500 Index ETF (SPLG). The latter gained a meager 2 basis points, so it was basically flat for the week. There was little breadth however as the Invesco equal-weighted ETF (RSP) lost 0.76% while the AI frenzy continued. The top five stocks in the S&P 500 now comprise more than 27% of the index’s weight while continuing to be the engine driving the market higher. Despite the month’s negative history and overvaluation, September has been a mildly positive month thus far.

The 2nd half of the year “rotation trade” also had mixed results. Value continued to outperform growth as represented by the Vanguard S&P 500 Value Index ETF (VTV) vs. the Vanguard S&P 500 Growth Index ETF (VUG). However, it was a bad week for the size rotation trade as the S&P 500 finished slightly in positive territory while the iShares Russell 2000 Index ETF (IWM) had a loss reflecting the relatively poor performance of small cap stocks last week. MDY, the SPDR Midcap Index, outperformed IWM but still finished negatively. Developed foreign markets enjoyed modest gains as measured by the iShares MSCI EAFE index ETF (EFA) while the iShares MSCI Emerging Markets Index ETF (EEM) was down slightly.

In an overvalued market, avoiding losers can be as important as picking winners. Stocks in our system with sell ratings that are at least 25% overvalued include construction company D R Horton (DHI) and tech companies Celestica (CLS) and Microchip Technologies (MCHP).

______________________________________________________________________________________________

www.ValuEngine.com (Valuengine, Inc) is a stock valuation and forecasting service founded by Ivy League finance academics. VE utilizes the most advanced quantitative techniques and analysis available to analyze over 4,200 US stocks, 700 US ETfs, and 1,000 Canadian stocks. Fair market valuations, forecasted target prices, and buy/hold/sell recommendations are updated DAILY.

www.ValuEngineCapital.com (ValuEngine Capital Management, LLC) is a Registered Investment Advisory firm that trades a variety of different portfolios based upon the ValuEngine.com research models. Each portfolio has a different risk/return profile, so clients can be placed in strategies that fit their specific investment needs.

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

_______________________________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com