Weekly Market Recap – Week Ending October 17, 2025

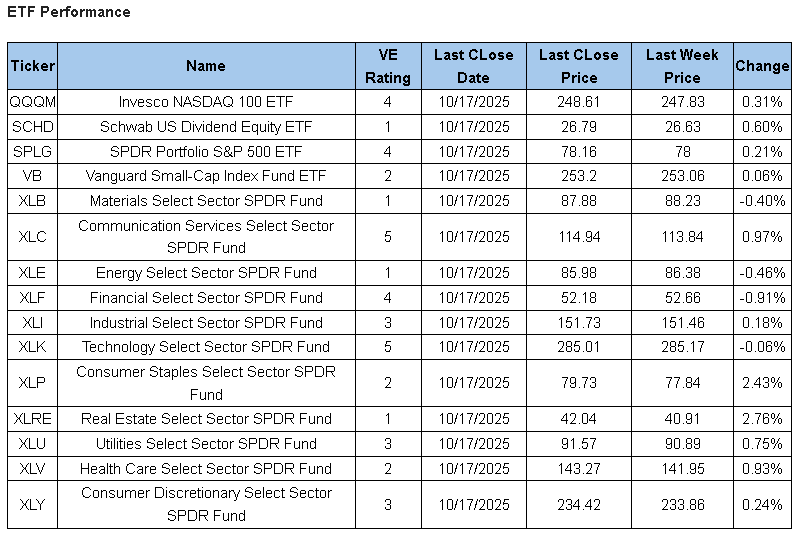

U.S. equities ended the week on a resilient note, with broad-based gains across most sectors. The S&P 500 ETF (SPLG) rose modestly ay 0.21%, while the tech-heavy Invesco Nasdaq 100 ETF (QQQM) added 0.31%-extending its strong year-to-date leadership. Notably, defensive and rate-sensative segments led performance this week, signaling a subtle shift in market tone as earnings season intensifies.

In the below table we use major ETF’s as a proxy for some major indexes as well as each of the sector groups into which we divide the overall markets. Tracking these over time provides a more defined picture of the US markets than simply tracking major indexes.

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Strategy Note

SPLG, the SPDR Portfolio S&P 500 ETF, parlayed Monday’s euphoria into a strong week, a 1.7% gain, with only Wednesday flat-to-slightly down alongside small gains on the remaining three days. Since this space expressed a positive outlook for the S&P 500 Index last week, we’re happy it turned out that way. As usual, QQQM, the Invesco Nasdaq-100 ETF, fared even better with a 2.5% gain. Not as usual, IWM, iShares Russell 2000 Small Cap ETF continued its second half strength with an even higher 2.8% gain. Foreign developed markets standard-bearer, EFA, iShares MSCI EAFE Index ETF gained 1.9%. However, GLDM, SPDR Gold MiniShares overshadowed all of them with a whopping 5.4% gain.

On the other end of the spectrum, emerging markets as represented by EEM, iShares MSCI Emerging Markets ETF lost 0.4% while VPU, Vanguard Utilities ETF fell 1.8%. That said, the biggest losers this week were bank stocks, especially regional bank stocks. As a group, they sold off sharply last week, primarily on Thursday, due to fears of bad loans after two banks, Zions Bancorp (ZION) and Western Alliance (WAL), both rated 3 (hold) by ValuEngine, disclosed losses and allegations of fraud related to a commercial mortgage lending, leading to fears of contagion. The largest Regional Banking ETF, KRE, SPDR KBW Regional Bank ETF is rated 1 (Strong Sell) by ValuEngine, although one of its larger holdings, we still have a positive rating on is CNG, Citizen’s National Financial Group.

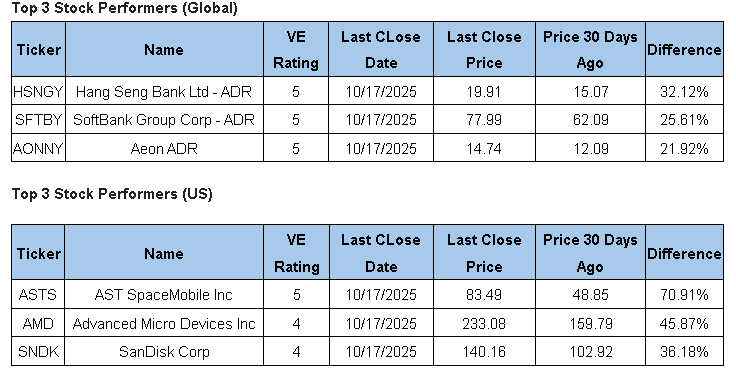

There are a few stocks reporting the week rated 5 (Strong Buy) including NVDA, Nvidia and VRT, Vertiv Holdings, a leading digital infrastructure provider. 4-rated (Buy) stocks also in this week’s report cycle include financial companies RJF, Raymond James Financial and CME, futures exchange CME group. Other tech company reporters with the same ratings include Advanced Micro, AMD, Tesla, TSLA, Lam Research, (LRCX) and Intel (INTC). Another noteworthy reporter, leading gold miner Newmont Corp (NEM) is also rated 4. With more than 200 other listed companies reporting, it is going to be a busy week.

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

_______________________________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com