Weekly Market Recap – Week Ending November 21, 2025

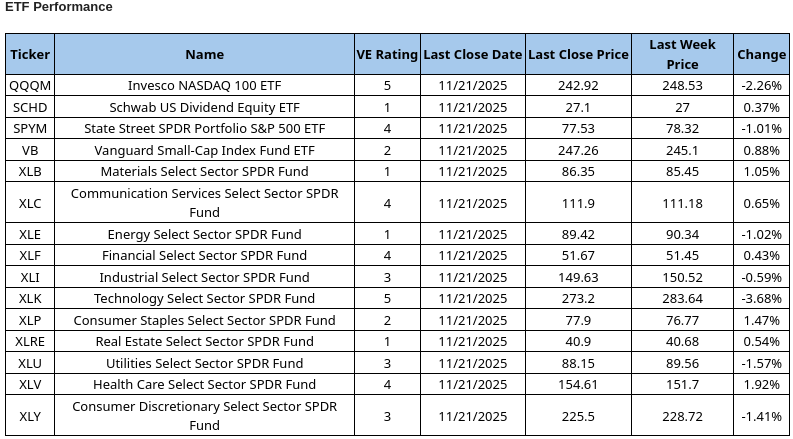

Despite Friday’s partial bounce-back, the order of magnitude of returns for most of the market benchmark index ETFs for the month remains in reverse order after a brutal four-day start to the week. The notable exception has been gold as GLDM has bounced back smartly from a minor correction at the end of October with a 1.7% gain. Indeed, the November markets continue to confirm a swing from a “risk-on” to a “risk-off” environment, and gold is the traditional safe harbor for nervous equity investors.

The relatively small uptick for the Nasdaq-100 on Friday did little to reduce the massive sell-off in the Mag 7 Big Tech stocks dominating the index. Consequently, its benchmark ETF, QQQM, is now the worst-performing in our equity benchmark group with a loss of 6.2% month-to-date. Since QQQM is comprised largely of growth names, it is no surprise that Vanguard Growth ETF (VUG) is the second-worst performer with a 5.8% decline. Small-cap stocks (IWM) and emerging markets (EEM)—both generally higher-risk market segments—follow with losses of 4.3% and 4.0%, respectively.

Utilities (VPU) and value stocks (VTV) have suffered relatively modest declines of 1.0% and 0.1% so far this month. The bellwether S&P 500 ETF (SPYM) is now down 2%, matching the decline in developed foreign markets represented by EFA. Meanwhile, bitcoin exposure via IBIT is in a full-fledged correction with a steep month-to-date loss of 23%.

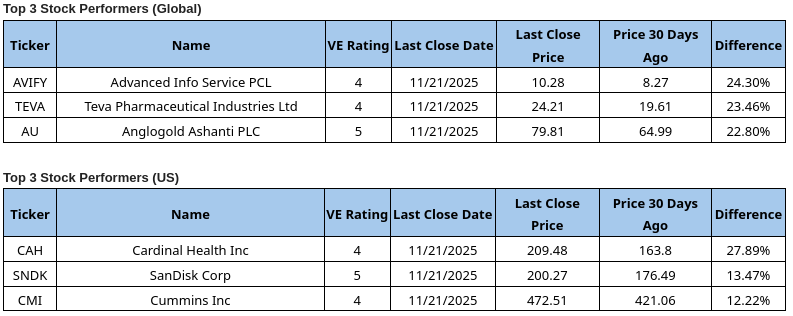

Among individual stocks, Apple (AAPL) has avoided major damage with a 0.9% gain this month, helped by a significant investment last week. Travelers (TRV) is up 8.4%, while James River (JRVR) has gained 5.8% and carries a ValuEngine rating of 5 (Strong Buy). TRV is rated 4, while AAPL remains a 3. One notable downgrade is NextEra Energy (NXE), which has fallen from a 3 (Hold) to a 2 (Sell).

Thanksgiving week typically features normal trading volume on Monday and Tuesday, with lighter activity on Wednesday and Friday. Limit orders are strongly recommended during holiday-week trading when spreads tend to widen.

Happy Thanksgiving to all of our readers in the US!

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

____________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com