Weekly Market Recap – Week Ending December 12, 2025

Markets delivered a choppy and highly differentiated week, with performance driven less by broad index direction and more by sector and style dispersion. While several economically sensitive and defensive sectors posted solid gains, technology and growth-oriented exposures lagged meaningfully. This divergence reflects a market that is increasingly selective as year-end approaches, with investors reallocating toward areas showing improving relative strength rather than maintaining uniform exposure to 2025’s earlier leadership.

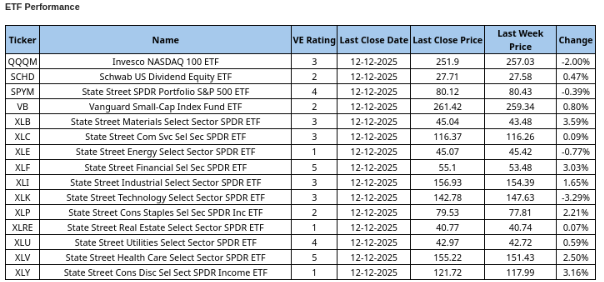

In the below table we use major ETF’s as a proxy for some major indexes as well as each of the sector groups into which we divide the overall markets. Tracking these over time provides a more defined picture of the US markets than simply tracking major indexes.

Current ValuEngine reports on all covered stocks and ETFs can be viewed asHERE

Trade ValuEngine designed portfolio strategies, www.ValuEngineCapital.com

Strategy Note:

Last week was more reminiscent of the rotation towards small cap and value we saw in the first three weeks of last month than the first week of this month and the last week of December where large cap tech more than held its own. U.S. equities were mixed this week as investors digested the Federal Reserve’s December rate cut, corporate earnings, and—most critically—a major shift in market leadership. Small-cap and value stocks outperformed, while the mega-cap tech giants that fueled the 2025 rally took a hard hit.

The second half of this year has been as strong a second half of the year for the small cap asset class as it has enjoyed in more than a decade after a dismal first half. Value, on the other hand, has not made much of a recovery in the same period. With two weeks to go, the second half gain for small cap standard-bearer iShares Russell 2000 ETF, IWM, is 17.6% while SPLG, the lowest fee S&P 500 ETF, rose only 10.4%. In fact, IWM outperformed all of the asset class index ETFs we feature regularly in this column, quite a reversal from the first half of 2025 and relative performance in 2023 and 2024.

The many pundits looking for a major rebound in value stocks during the second half of this year have been disappointed. After being trounced by VUG (Vanguard Growth ETF) in the first half of the year, Vanguard Value ETF (VTV) lost more ground to SPLG with a gain of just 8.9% in the second half of 2025. The iShares Emerging Markets ETF didn’t quite manage to keep up with IWM with a 12.4% second half gain which is still better than Invesco Nasdaq-100 ETF QQQM’s second half gain of 11.2%.

Of course QQQM’s superiority in the first half of the year coupled with a reasonably good second half has kept it the top equity asset class ETF year-to-date. As in the first half, however, nothing could keep pace with gold, adding another 29.9% to the 24.4% it enjoyed in the first half this year for a whopping 61.5%.

Looking at small cap stocks between $1 billion and $3.5 billion that ValuEngine’s rates as 5 (Strong Buy), selected US stocks include: biotech companies Pacira Pharmaceutical (PCRX), Kodiak Sciences (KOD); and Sana Biotech (SANA). Strong Buy small caps in other industries include: solar energy provider Shoals Technologies (SHLS); office technology fallen angel Pitney Bowes (PBI); media company Madison Square Entertainment (MSGE); consumer medical products company National Vision Holdings (EYE); and gaming company Melco Resorts (MLCO). For those who think that small cap firms will continue to be a major opportunity set, these eight might be interesting stocks to investigate.

Interestingly, our ETF ratings disagree at first glance with the timing on small cap as an asset class. Despite the relative second-half success of IWM, our model rating is 2 (Sell). That rating is even more surprising considering the top 10 holdings have an average rating of 4 (Buy) with three strong buys with 5 ratings. These stocks are tech companies Credo Corp (CRDO) and Fabrinet (FN) along with solar energy solutions provider Nextracker (NXT). The rest of the stocks holdings simply overcome these attractive ones.

This week is the last week before interruptions for the holiday season. Will we see a “Santa Claus Rally” or do last week’s mega-cap declines presage more weekly declines ahead? At this moment, we’re leaning slightly toward a mild rally and maintaining present positions through year-end. By then, major investors will have updated their portfolios to get ready for 2026.

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

____________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com