For today’s bulletin, we take a look at our latest STRONG BUY and BUY upgrades and focus on one of our top upgrades for the day, Buckle INc $BKE. We also provide a link to download a FREE STOCK REPORT on the company.

VALUATION WATCH: Overvalued stocks now make up 56.72% of our stocks assigned a valuation and 22.91% of those equities are calculated to be overvalued by 20% or more. Fourteen sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Buckle is a STRONG BUY stock. H&E Equipment, FTI Consulting, Triton INternational, and LA-Z Boy are rated BUY.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| BKE | BUCKLE INC | 22 | 32.24% | 11.96% | 1.09% | 13.12% | 12.64 | Retail-Wholesale |

| HEES | H&E EQUIP SVCS | 38.98 | 14.41% | 65.03% | 0.68% | 8.11% | 19.62 | Industrial Products |

| FCN | FTI CONSULTING | 48.26 | 21.07% | 15.43% | 0.51% | 6.12% | 19.94 | Business Services |

| TRTN | TRITON INTL LTD | 30.4 | -26.99% | 21.55% | 0.50% | 6.04% | 10.64 | Transportation |

| LZB | LA-Z-BOY INC | 32.2 | 11.41% | 20.60% | 0.50% | 6.04% | 18.61 | Consumer Discretionary |

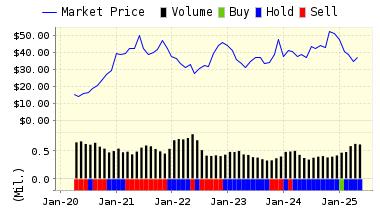

For today’s bulletin, we take a look at Buckle (BKE). The Buckle, Inc. is a leading retailer of medium to better-priced casual apparel, footwear, and accessories for fashion-conscious young men and women. Buckle markets a wide selection of brand names and private label casual apparel, including denims, other casual bottoms, tops, sportswear, outerwear, accessories and footwear. The Company emphasizes personalized attention to its guests (customers) and provides individual customer services such as free alterations, layaways, and a frequent shopper program.

We keep hitting this retail picture lately, and today our top upgrade is retailer Buckle Inc. Our models like the stock due to its PE Ratio and the price/sales ratio. Buckle is due to once again report quarterly results on or about March 9th. Consensus analyst estimates for the firm right now are looking for @$0.75/share.

Below is our latest data for Buckle Inc, our top STRONG BUY upgrade for the day.

ValuEngine updated its recommendation from BUY to STRONG BUY for BUCKLE INC on 2018-02-23. Based on the information we have gathered and our resulting research, we feel that BUCKLE INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE P/E Ratio and Price Sales Ratio.

You can download a free copy of detailed report on Buckle (BKE) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 22.24 | 1.09% |

| 3-Month | 22.79 | 3.59% |

| 6-Month | 23.33 | 6.05% |

| 1-Year | 24.89 | 13.12% |

| 2-Year | 29.40 | 33.62% |

| 3-Year | 32.41 | 47.33% |

| Valuation & Rankings | |||

| Valuation | 32.24% overvalued | Valuation Rank(?) | 14 |

| 1-M Forecast Return | 1.09% | 1-M Forecast Return Rank | 99 |

| 12-M Return | 11.96% | Momentum Rank(?) | 56 |

| Sharpe Ratio | -0.52 | Sharpe Ratio Rank(?) | 15 |

| 5-Y Avg Annual Return | -16.94% | 5-Y Avg Annual Rtn Rank | 22 |

| Volatility | 32.70% | Volatility Rank(?) | 48 |

| Expected EPS Growth | -2.87% | EPS Growth Rank(?) | 15 |

| Market Cap (billions) | 1.06 | Size Rank | 62 |

| Trailing P/E Ratio | 12.64 | Trailing P/E Rank(?) | 86 |

| Forward P/E Ratio | 13.02 | Forward P/E Ratio Rank | 68 |

| PEG Ratio | n/a | PEG Ratio Rank | n/a |

| Price/Sales | 1.17 | Price/Sales Rank(?) | 66 |

| Market/Book | 2.39 | Market/Book Rank(?) | 49 |

| Beta | 0.99 | Beta Rank | 39 |

| Alpha | -0.27 | Alpha Rank | 24 |

DOWNLOAD A FREE SAMPLE OF OUR BUCKLE (BKE) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information