As classified by ETF Database (etfdb.com) by VettaFi, there are currently 92 dividend focused US ETFs with nearly $460 billion under management. If you are seeking dividend income from your ETFs, which should you take a close look at? That’s the objective of the analysis in today’s research blog entry.

All 5,200+ stocks US and Canadian stocks, 16 sector groups, 200+ industries, and 600+ ETFs have been updated:

Two-week free trial: www.ValuEngine.com

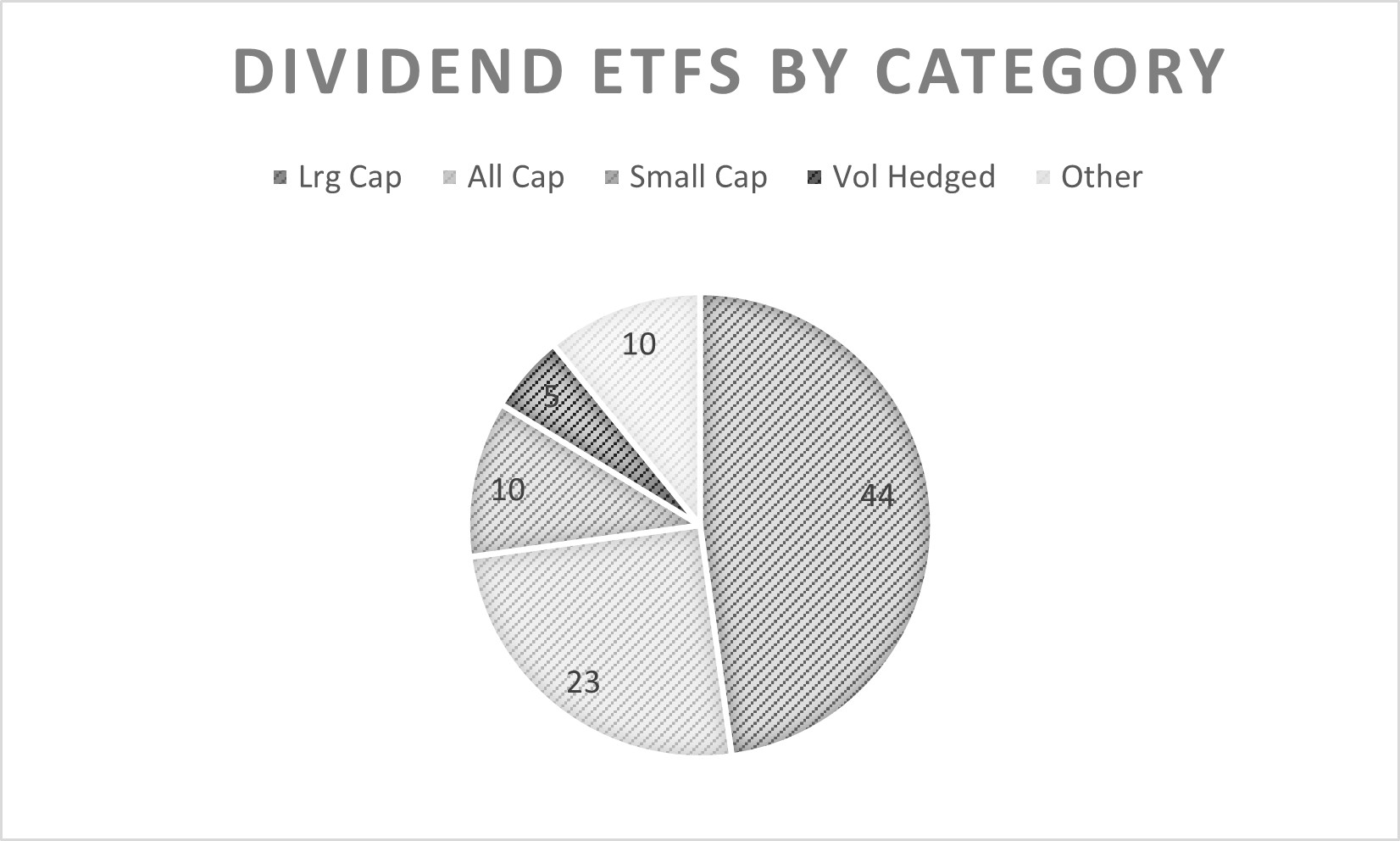

ETFdb divides these ETFs into subcategories as shown by this pie chart:

The largest category is large cap ETFs, constituting about 45% of the total. Next in line are all-cap dividend ETFs which includes small- and mid-cap dividend-paying stocks but their allocations still tend to be dominated by large cap stocks. I was somewhat surprised to find that there are as many as 20 small cap dividend ETFs since most people think of small cap stocks as rarely paying dividends. The fact that there are five volatility hedged dividend ETFs, tailored for risk-averse dividend investors seems more intuitive. Finally, the other category includes international stocks, midcaps, sectors and leveraged ETFs.

This analysis starts with the top 10 dividend-focused ETFs ranked by Assets Under Management (AUM).

Here is a brief description of each with the help of ETFdb:

Current ValuEngine reports on all covered stocks and ETFS can be viewed HERE

Vanguard Dividend Appreciation Fund (VIG) – tracks the performance of the NASDAQ US Dividend Achievers Select Index. VIG offers exposure to dividend paying large-cap US companies that exhibit growth characteristics. Securities are chosen for inclusion in the fund based on their history of increasing dividends; only companies that have increased payouts for at least ten consecutive years are included in the fund. This methodology focuses more on dividend safety and steady growth of companies likely to have accompanying price appreciation that keeps dividend yield stable rather than high current yield. This is an excellent strategy for buy-and-hold investors that wish to reduce price volatility and increase holdings’ quality, but not so good for high current dividend yield. As a result, VIG has a dividend yield of 1.7%, just slightly higher than SPY (the SPDR Trust ETF representing the S&P 500), but with higher potential for capital preservation in a bear market.

Schwab US Dividend Equity ETF (SCHD) – offers exposure to dividend-paying U.S. equities, making SCHD a potentially useful tool for either enhancing current returns derived from the equity portion of a portfolio or for scaling back risk exposure within a portfolio. The underlying index methodology requires a long track record of distributions, meaning that SCHD is unlikely to include speculative firms that are offering an attractive distribution yield because their stock price has been depressed. The methodology also considers multiple metrics, including dividend growth and dividend yield, resulting in a portfolio that generally offers an above average payout ratio. Its current yield of 3.5% ranks second highest among the top 10.

Vanguard High Dividend Yield Index (VYM) – is linked to the FTSE High Dividend Yield Index, which offers exposure to dividend paying large-cap companies that exhibit value characteristics within the U.S. equity market. VYM is linked to an index consisting of roughly 440 holdings and exposure is tilted most heavily towards consumer, energy, and industrials. Securities are chosen for inclusion in the fund based on their current yield; only the highest yielding companies are chosen. Thanks to this focus, VYM offers investors broad exposure to dividend paying companies. Its current dividend yield of 2.8% ranks it fourth highest out of 10 in this group.

iShares Core Dividend Growth Index ETF (DGRO) – tracks an index of US stocks that are selected by dividends, dividend growth and payout ratio, then weighted by dividend dollars. The focus on dividend growth rather than yield makes it more similar to VIG and NOBL (description further down). Its current 2.2% dividend yield represents the median for this group.

SPDR S&P Dividend ETF (SDY) – is linked to the S&P High Yield Dividend Aristocrats Index, which offers exposure to dividend paying large-cap companies that exhibit value characteristics within the U.S. equity market. Securities are chosen for inclusion in the fund based on their current yield; only the highest yielding companies are chosen, and these firms must have increased dividends every year for at least 25 consecutive years. Its current yield is 2.4%.

iShares Select Dividend ETF (DVY) – is linked to a Dow Jones index that screens the equity universe by factors such as dividend per share growth rate, dividend payout percentage rate, and dividend yield. DVY can be used as a long-term strategic holding as its 100 stock portfolio is well balanced from a sector perspective. It also may serve as a tactical tool, shifting holdings towards companies that will often exhibit lower volatility in certain environments. It offers a competitive yield of 3.4% currently.

Schwab Fundamental US Quality Large Company ETF (FNDX) – is linked to the RAFI Fundamental High Liquidity Index. It is a non-price-weighted index strategy that aims to deliver excess returns versus the cap-weighted benchmark. This “smart beta” strategy, also referred to as “contrarian rebalancing,” uses fundamental measures of company size to select and weight to systematically rebalance against “overbought” stocks and toward undervalued ones. This combination currently results in a yield of 4.2%, highest in the group.

Wisdom Tree US Quality Dividend Growth Fund (DGRW) – tracks the performance of an index that invests in large- and mid-cap dividend-paying US common stocks with growth characteristics. With a current dividend yield of just 1.5% that is just equal to that of SPY, this ETF fits in the quality-first, low-volatility second category along with VIG and NOBL. This conservative strategy does not deliver high income but ranks strongly for capital preservation and low price volatility.

First Trust Rising Dividend Achievers ETF (RDVY) – tied to the NASDAQ US Rising Dividend Achievers Index, RDVY is comprised of securities that have increased their dividend value over the previous three year and five year annual periods, while being best positioned to continue the dividend increases. Eligible securities receive 3 ranks: by five year dollar dividend increase; by current dividend yield; and by payout ratio. Those ranks are equally combined and the top 50 stocks comprise the portfolio. Its current dividend yield is the second lowest of the group at 1.7%.

ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is tied to the oldest in-use index to institutionalize the rising-every-year-for-25-years methodology now mimicked by so many others. The twist is that it is equally-weighted, and no sector can comprise more than 30% of the portfolio. The methodology keeps NOBL diversified across most segments of the economy. Its current yield is 2.0%.

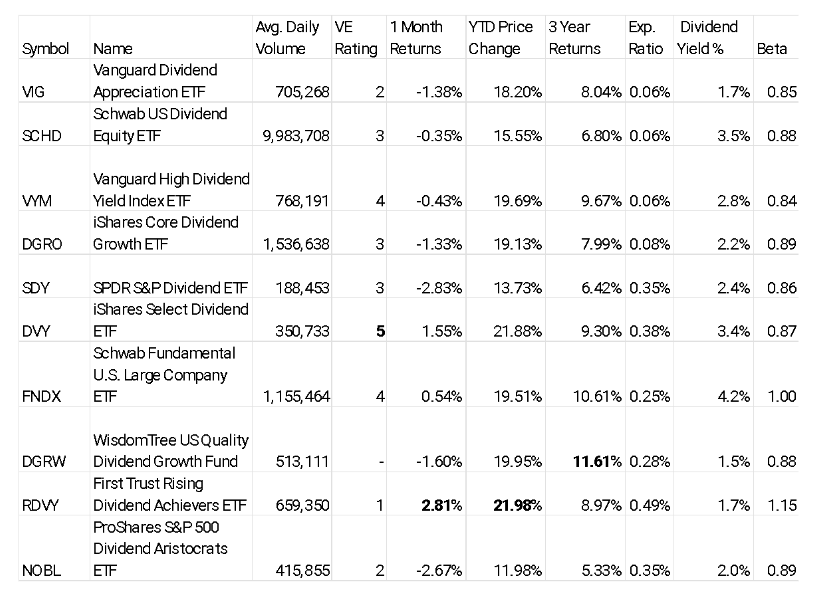

The table below shows how the ETFs compare in eight different categories.

Current ValuEngine reports on all covered stocks and ETFS can be viewed HERE

Ranked by assets under management, ranging from $20 Billion to $80 Billion, the top 10 ETFs are all in either the large cap or the all-cap categories, Within the categories, however, are three different “smart beta” strategies. The current dividend yield for the top 10 has a fairly high range, from 1.5% to 4.2%.

Six of the 10, Wisdom Tree US Quality Dividend Growth Fund (DGRW), First Trust Dividend Achievers (RDVY), Vanguard Dividend Appreciation ETF (VIG), ProShares S&P 500 Dividend Aristocrats (NOBL), iShares Core Dividend Growth ETF (DGRO) and SPDR S&P Dividend (SDY) focus on dividend stream consistency and/or steady dividend growth. These ETFs tend to distribute less income than ETFs focused primarily on high dividend yield.

Alternatively, Vanguard High Dividend Yield (VYM) and iShares Select Dividend ETF (DVY) focus primarily on aggregating high current dividend yield companies using different weighting rules. Finally, Schwab US Dividend Equity ETF (SCHD) and Schwab Fundamental Large Company ETF (FNDX) focus on high dividend paying companies that pass fundamental quality screens to identify value stocks. The last category delivered the highest current dividend yields amongst this group.

Ranking by recent price performance, the ETFs with the two lowest dividend yields ranked first in the three price return categories RDVY has enjoyed the highest year-to-date price gain of 22% as well as the highest 1-month price gain of nearly 3%. DGRW, holding up the best in 2022, has the best 3-year annualized gain of 11.6%. FNDX and DVY also finished in the top four in all three time frames. On the other end of the spectrum, the worst one month loss, -2.8%, was posted by SDY, just below the -2.7% posted by NOBL. The latter posted the lowest return on a year-to-date basis as well as for the 3-year period.

One thing that struck me as unexpected is that ranking the list of ETFs by AUM did not closely mimic the list’s ranking by average daily Trading dollar volume. For example, VIG, ranked #1 by AUM, ranked just 4th in daily volume. Meanwhile DGRO ranked 4th in AUM but 2nd in trading volume. SCHD, second to VIG in assets under management, is the trading volume titan by a six-to-one margin over second-place DGRO and roughly 12-to-1 versus VIG, the AUM leader.

From a volatility lens, there is little difference amongst 8 of the 10 ETF with price volatility betas between 0.84 and 0.89. As expected, the eight ETFs exhibit below-average volatility in response to market movements. FNDX exhibits price volatility identical to SPY at 1.00. The real outlier in volatility is RDVY with a Beta of 1.15 indicating it will respond to market moves with 15% greater volatility.

RDVY is also the outlier in the wrong direction on expense ratio, by far the highest at 0.49%. The five other “smart beta” ETFs have expense ratios between 0.25% and 0.38%. FNDX by Schwab has the low end of that range and DVY by iShares has the high end. The three ETFs with the highest amount of assets under management also have the lowest expense ratios that most large institutions prefer, 0.06%. These include Vanguard’s VIG, Schwab’s SCHD and Vanguard’s VYM. Just behind these three in AUM, DGRO by iShares has a fee of 0.08%.

Now that we’ve thoroughly covered the past, what lies ahead? According to ValuEngine’s predictive model, indicated by the VE Rating column in the table above, DVY is ranked highest in projected price performance with 5 (Strong Buy). VYM and FNDX are also ranked highly with ranks of 4 (Buy). Please visit the reports on these three to learn more. On the other end of the spectrum, despite strong performance in the two most recent periods, RDVY gets our lowest predictive rating of 1 (Strong Sell). AUM leader VIG and #10 in AUM NOBL are also ranked as having below average price gain prospects with 2 (Sell) ratings. SCHD, DGRO and SDY are all rated 3 (Hold) which is in the middle of the spectrum.

Beyond the top 10, are there any US Stock ETFs that give investors a chance at higher yields without using options, futures or swaps? The answer is yes so let’s take a quick look at 5 smaller high-dividend-yield ETFs as ranked by yield and screened to include only ETFs without derivatives or foreign stocks.

Current ValuEngine reports on all covered stocks and ETFS can be viewed HERE

Invesco KBW High Dividend Yield Financial ETF (KBWD) is a financial sector ETF only in the broadest interpretation of the term. It invests primarily in Business Development Companies (BDCs) and Special Purpose Acquisition Companies (SPACs). Both are highly speculative and are at least as prone to capital depreciation than appreciation. As such, this highest yielding ETF in the category is NOT recommended to most investors for further research except for the most speculative in search of yield.

Invesco S&P Small Cap High Dividend Low Volatility ETF (XSHD) tracks an index of 60 dividend-paying U.S. small-caps which are less susceptible to market swings. In doing so, it combines three smart beta factors.

Global X Super Dividend ETF (DIV) accesses 50 of the highest dividend paying equities in the US subject to a volatility screen based on beta.

Franklin US Low Volatility High Dividend Index ETF (LVHD) tracks an index of roughly 50-100 US stocks selected from across the market cap spectrum. Stocks are selected and weighted to emphasize profitability, high dividends, low price volatility and low earnings volatility.

Invesco High Yield Equity Dividend Achievers ETF (PEY) focuses on a select group of companies that have a solid track record as a source of consistent dividends and may offer attractive current yields relative to the broader market. Stocks are selected based on dividend yield and consistent dividend growth, resulting in a portfolio that should exhibit a beta less than 1.0 along with a high dividend yield.

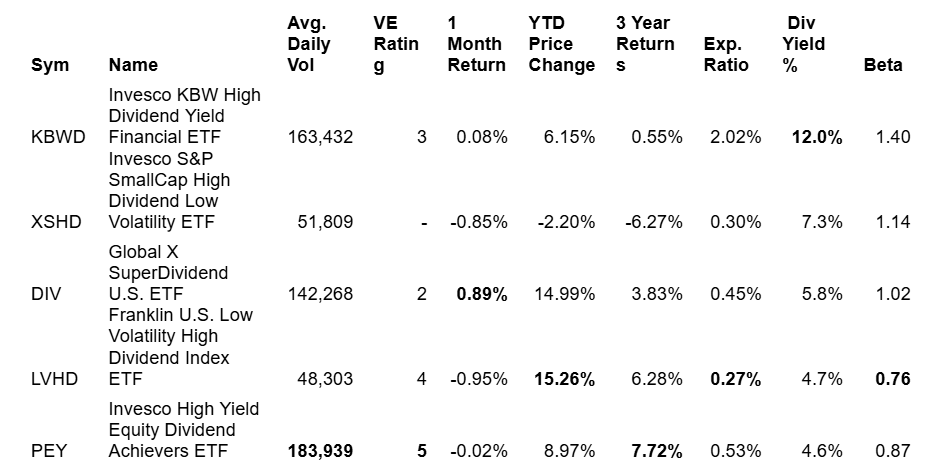

Once again, the table below shows how the ETFs compare in eight different categories.

Current ValuEngine reports on all covered stocks and ETFS can be viewed HERE

The first thing that struck me looking at this table is how much the expense ratio of The Invesco KBW High Dividend Yield ETF (KBWD) is out of whack with all the other ETFs. This is because special vehicles such as BDCs are already managed companies, and the 2.02% ER accumulates the fees charged by Invesco with the acquired fund fees. The 12.0% yield is certainly attractive and its historical returns for the three time frames combined with that yield would certainly be acceptable going forward if that were a reasonable expectation. The problem is that BDCs, SPACs and REITs are more vulnerable to recession than companies in most other sectors and it is not uncommon to see many companies in these categories simply go out of business. The credit risk and leverage ratios are through the roof on these entities. Its beta of 1.40 shows how much higher its volatility is during good times. It would be even higher in a recession. On the other hand, if no recession comes in the next two years, then the total returns including the income are very attractive. The ValuEngine model currently rates KBWD to perform in line with the market. Its rating is 3 (Hold).

XSHD has been this group’s worst performer in all three periods. The ultra-high dividend yield and the relatively low expense ratio enhance its appeal somewhat. However, it’s been the worst performer of the group in the past five years. Its projected future performance is also subpar according to ValuEngine’s model with a 2 (Sell) rating. It’s also disconcerting to see an ETF with “Low Volatility” in its name with a beta that is 14% above the market.

The Global X SuperDividend US ETF (DIV) combines an excellent track record during the free time frames measured that is even more impressive when it is combined with a well-above average dividend yield of 5.8%. Another plus for investors looking to use DIV to generate income is that it pays its dividend monthly rather than quarterly. For an ETF with a volatility screen a beta of 1.02 indicates slightly more volatility than the S&P 500, which is not what one would expect. And as ETFdb notes, an Expense Ratio of 0.45% seems a bit excessive compared to current industry norms for an ETF with a simple index algorithm and no special data. Our predictive model ranks it below average. Its ValuEngine rating is 2 (Sell).

The next two ETFs are more interesting to our predictive model even though the yields are lower. Franklin Templeton’s Franklin U.S. Low Volatility High Dividend Index ETF (LVHD) is performing quite well with a very low fee ratio of 0.27% for an ETF that combines smart beta factors. Although it was the group’s worst performer on a 1-month basis, it is the best performer year-to-date, and it is the second best performer for the three-year period. Its 4.7% dividend yield is higher than any of the ETFs we looked at in the earlier group of 10 which topped out with 4.2% by Schwab’s FNDX. Its beta of 0.76 makes it the least volatile of all 15 dividend-focused ETFs reviewed here. Its ValuEngine rating is 4 (Buy). The only caution flag is that its average daily dollar trading volume is the lowest among the 15 with an average of just above 48,000 shares per day. Therefore, it is not the type of ETF you want to trade in and out of, but it should be fine for a long-term buy-and-hold in a strategic equity allocation. I always advise to use limit orders when purchasing ETFs to ensure you are getting a price close to Net Asset Value. That rule would especially apply here. The underlying stocks are very liquid so if the bid-ask spread looks wide and you are purchasing 500 shares or more, use the number on the ETFs prospectus to call the fund. They may be able to get a market maker to get you a price at NAV. Beyond liquidity, LVHD appears to be a solid candidate to investigate for dividend investors. Its ValuEngine rating is 4 (Buy).

Finally, the Invesco High Yield Dividend Achievers ETF (PEY) uses a multifactor smart beta index by Research Affiliates from an index family they call RAFI. The F stands for fundamental-weighting and tilts toward undervalued stocks with low price volatility. Its 3-year annualized return of 7.72% is tops in this ultra-high dividend group. It also has the highest possible ValuEngine rating of 5 (Strong Buy) for projected performance to go along with a dividend yield of 4.6%. Its unusual methodology is worthy of reading more about before considering any action on PEY. Its fee structure for an indexed ETF is very high at 0.59%. However, the intricate weighting scheme and need to purchase, vet and process fundamental data may justify that fee in an investor’s eyes. As with everything else in investing, tradeoffs must be considered before making decisions.

Financial Advisory Services based on ValuEngine research available: www.ValuEngineCapital.com

Having reviewed 15 of the 92 dividend focused ETFs, I hope this gives many readers a good window for what to look for in evaluating these products. To recap, the most timely ETFs now according to our predictive model are DVY from iShares by Blackrock and PEY. However, as both have above-average expense ratios, fee-conscious investors who also want to take ValuEngine rating into consideration could delve into the more modestly priced VYM. We rate it 4 (Buy) and it ties for the lowest expense ratio of 0.06%. its yield of 2.8% is about double that of the S&P 500. The two other ETFs we covered that are rated 4 (Buy) are Schwab’s FNDX and Franklin’s LVHD. Both have yields above 4% and strong recent historical performance along with solid methodologies. As you can see, dear reader, this is a highly competitive, some say too crowded, segment of the indexed ETF market. There are also many other ETFs geared to derive dividend payout income from the market. In such a crowded market, research is the investor’s best friend.

________________________________________________________________

By Herbert Blank

Senior Quantitative Analyst, ValuEngine Inc

www.ValuEngine.com

support@ValuEngine.com

All of the over 4,200 stocks, 16 sector groups, over 250 industries, and 600 ETFs have been updated on www.ValuEngine.com

Financial Advisory Services based on ValuEngine research available through ValuEngine Capital Management, LLC

Free Two-Week Trial to all 5,000 plus equities covered by ValuEngine HERE

Subscribers log in HERE