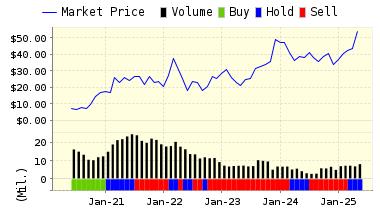

| For today’s bulletin, we take a look at United States Steel $X. We also provide a link to download a FREE STOCK REPORT on the company. United States Steel Corporation (X) is an integrated steel producer with major production operations in the United States and Central Europe. United States Steel manufactures a wide range of value-added steel sheet and tubular products for the automotive, appliance, container, industrial machinery, construction, and oil and gas industries. An integrated steel producer uses iron ore and coke as primary raw materials for steel production. United States Steel is also engaged in other business activities consisting primarily of railroad services and real estate operations. Politics in the US continues in its crisis/chaos mode this week as the “Establishment” and the markets deal with Donald J. Trump’s latest bombshell, a propsed program of punitive tariffs on commodities such as Aluminum and Steel. Trump stunned legislators, economists, and various members of the business-side of the GOP with his surprise announcement of 25% tariffs on steel imports late last week. This proposal, which directly led to the resignation of top economic advisor Gary Cohn–widely regarded as one of the last “adults” in the White House, has put a spotlight on industries whose workers were a key part of Trump’s voter base. However, while many analysts believe that this move marks yet another attempt by Trump to change the subject from bad news– such as the Russia investigation, the inability of key aides to secure needed security clearances, staff instability, a lawsuit from a porn star with whom he is alleged to have committed adultery, and other ongoing crises– they also warn that there are no “easy” trade wars and that Trump’s actions could have extremely negative consequences for the US economy. But, steelworkers and industry chiefs are pleased by this move. And, to the extent that the tariffs support local production, they may be helpful for an industry which has been in decline since the 1970s. In fact, US Steel has already announced plans to restart at least one plant in Illinois to meet the increased demand forecast if Trump’s tariff plan goes into effect. This would include the re-hiring of @500 employees. Of course, these tariffs are not “reality” just yet. News reports indicate that Trump is pushing advisors to finalize and implement the plans later this week. These advisors are currently struggling to do so in the face of opposition from Speaker of the House Paul Ryan and other high-ranking GOP officials, donors, and industry leaders. We caution investors not to take this one to the bank just yet as this trade has some extreme risks involved. Trump has shown that he often proposes ideas only to fail to follow through on them. He faces opposition here from within his own party as the business-wing of the GOP and their allies in Congress are not eager to return to the days of Smoot-Hawley which–anyone? anyone?–famously set off a retaliatory trade war and made the Great Depression worse after their implementation. But if Trump does manage to get these propsed tariffs implemented, we would expect that giant US producers such as US Steel would stand to gain. We already have a STRONG BUY on the stock because our models found its underlying financial fundamentals appealing. Shares have also increased in price this week in response to Trump’s announcement. So, if you still maintain faith in Trump’s policy acumen and his ability to follow through on this proposal, you may want to start your search for investment targets with “X.” We are pleased to announce that some of our services have been included in a New Affordable and Professional Investing Membership by our new partner, Value Stocks Pro. Check out the Video Tour of this amazing membership >>>HERE<<< ValuEngine continues its STRONG BUY recommendation on United States Steel Corporation for 2018-03-06. Based on the information we have gathered and our resulting research, we feel that United States Steel Corporation has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Price Sales Ratio. You can download a free copy of detailed report on United States Steel Corporation (X) from the link below.

DOWNLOAD A FREE SAMPLE OF OUR UNITED STATES STEEL (X) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day. ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||