For today’s bulletin, we take a look at market overvaluation calculations.

VALUATION WATCH: Overvalued stocks now make up 58.8% of our stocks assigned a valuation and 22.6% of those equities are calculated to be overvalued by 20% or more. Twelve sectors are calculated to be overvalued. Overvaluation has now dropped into “normal” range and we no longer operate under a Valuation Watch.

To subscribe to our bulletins and receive content whenever it is published, subscribe at our blog HERE

ValuEngine tracks more than 7000 US equities, ADRs, and foreign stock which trade on US exchanges as well as @1000 Canadian equities. When EPS estimates are available for a given equity, our model calculates a level of mispricing or valuation percentage for that equity based on earnings estimates and what the stock should be worth if the market were totally rational and efficient–an academic exercise to be sure, but one which allows for useful comparisons between equities, sectors, and industries. Using our Valuation Model, we can currently assign a VE valuation calculation to more than 2800 stocks in our US Universe.

We combine all of the equities with a valuation calculation to track market valuation figures and use them as a metric for making calls about the overall state of the market. Two factors can lower these figures– a market pullback, or a significant rise in EPS estimates. Vice-versa, a significant rally or reduction in EPS can raise the figure. Whenever we see overvaluation levels in excess of @ 65% for the overall universe and/or 27% for the overvalued by 20% or more categories, we issue a valuation warning.

We now calculate that 58.8% of the stocks to which we can assign a valuation are overvalued and 22.6% of those stocks are overvalued by 20% or more. These numbers are running below what we saw when we published our last valuation study in April. Since that time, we have removed our overvaluation watch.

We fell below the critical 60% threshold for an overvaluation watch for the first time on May 18th, this was after numbers fell below the warning level back in April. We have seen some fluctuation, with short stints above 60% since then, but the trend is clear at this point: lower overall valuations.

The models have responded positively to the end of the so-called “Trump Rally” where investors seemed to have believed campaign rhetoric about lower taxes, increased infrastructure spending, etc. that made up a large part of the current president’s campaign speeches.

The failure of Trump to successfully implement any major agenda items via legislation–despite controlling both houses of Congress, may have provided a much-needed “reality check” to those inclined to believe the rhetoric, rather than the reality in Washington DC.

We have yet to see any indication whatsoever that the current occupant of the White House possesses the ability to get his legislative agenda–such as it exists–through the Congress and into law. That means the much-anticipated economic stimulus of the proposed plans may never appear.

So, stocks have come back to earth a bit from a valuation perspective–despite indices that keep making record highs. This is a good thing because earnings are now more in line with prices. Credit the continuing good news on the economic front for this development rather than any actions in DC.

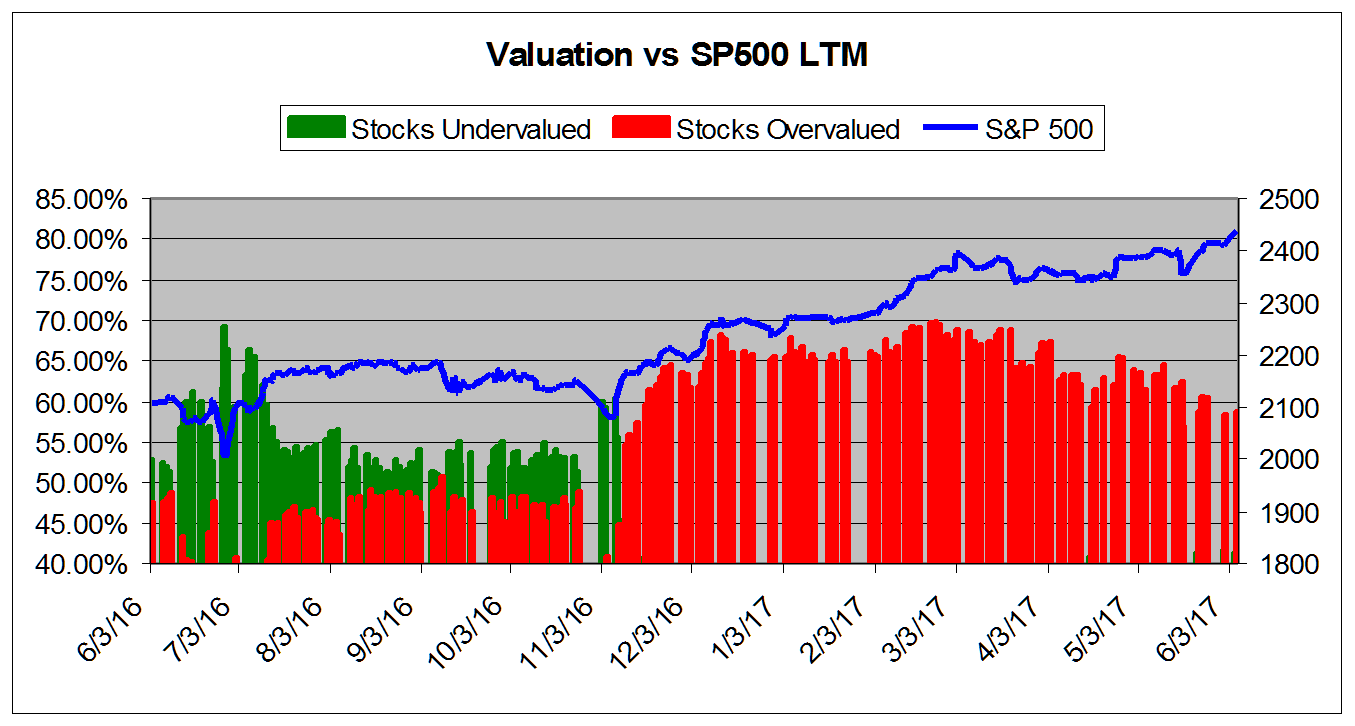

The chart below tracks the valuation metrics from June 2016. It shows levels in excess of 40%.

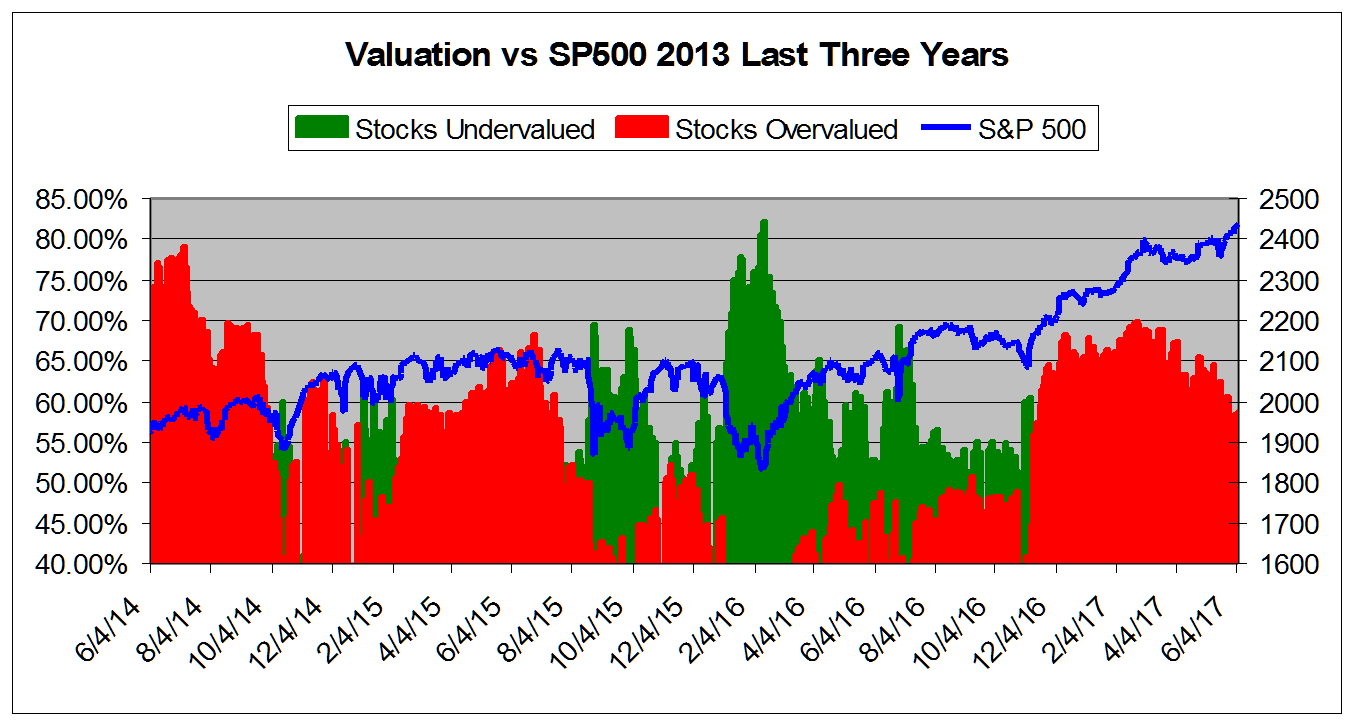

This chart shows overall universe over valuation in excess of 40% vs the S&P 500 from June 2014

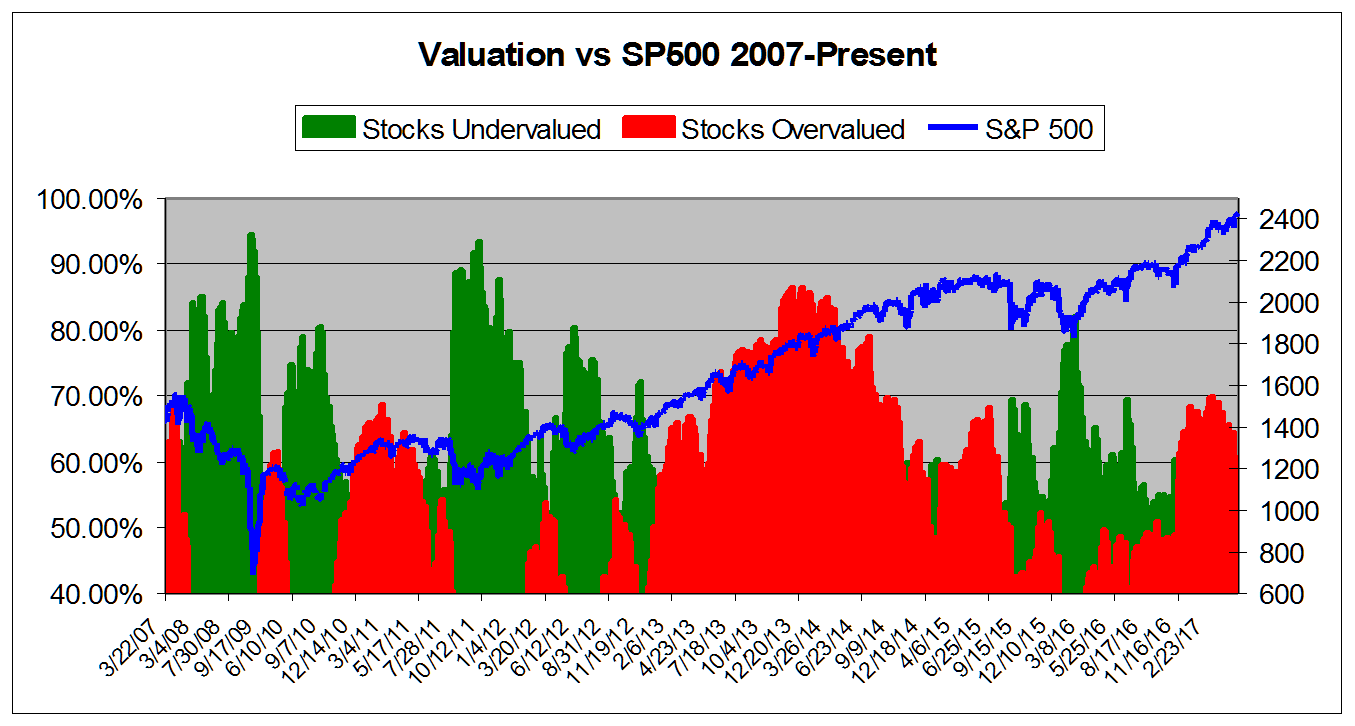

This chart shows overall universe under and over valuation in excess of 40% vs the S&P 500 from March 2007*

*NOTE: Time Scale Compressed Prior to 2011.

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information