For today’s bulletin, we take a look at our latest STRONG BUY and BUY upgrades. We also provide a link to download a FREE STOCK REPORT on CIENA Corp $CIEN, one of our top upgrades for the day.

VALUATION WATCH: Overvalued stocks now make up 30.58% of our stocks assigned a valuation and 10.6% of those equities are calculated to be overvalued by 20% or more. Two sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. INPHI, CIENA, and Fair Isaac are STRONG BUY upgrades. The other components of our top-five list are BUY upgrades.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| IPHI | INPHI CORP | 34.12 | 59.39% | 8.59% | 1.13% | 13.54% | N/A | Computer and Technology |

| CIEN | CIENA CORP | 38.38 | 62.86% | 73.51% | 1.09% | 13.05% | 32.16 | Computer and Technology |

| FICO | FAIR ISAAC INC | 212.88 | 43.32% | 30.19% | 1.08% | 13.02% | 47.73 | Computer and Technology |

| SEMG | SEMGROUP CORP-A | 16.66 | 82.63% | -43.24% | 0.69% | 8.25% | N/A | Oils-Energy |

| CENT | CENTRAL GARDEN | 40.07 | 2.83% | 5.95% | 0.55% | 6.60% | 21.78 | Consumer Discretionary |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

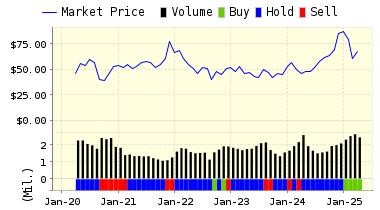

Ciena Corporation (CIEN) is the network specialist, focused on expanding the possibilities for its customers’ networks while reducing their cost of ownership. The Company’s systems, software and services target and cure specific network pain points so that telcos, cable operators, governments and enterprises can best exploit the new applications that are driving their businesses forward.

ValuEngine updated its recommendation from BUY to STRONG BUY for Ciena Corporation on 2019-01-22. Based on the information we have gathered and our resulting research, we feel that Ciena Corporation has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Company Size.

You can download a free copy of detailed report on Ciena Corporation (CIEN) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 38.80 | 1.09% |

| 3-Month | 39.20 | 2.14% |

| 6-Month | 40.60 | 5.79% |

| 1-Year | 43.39 | 13.05% |

| 2-Year | 43.99 | 14.63% |

| 3-Year | 46.92 | 22.25% |

| Valuation & Rankings | |||

| Valuation | 62.86% overvalued | Valuation Rank(?) | 4 |

| 1-M Forecast Return | 1.09% | 1-M Forecast Return Rank | 99 |

| 12-M Return | 73.51% | Momentum Rank(?) | 98 |

| Sharpe Ratio | 0.21 | Sharpe Ratio Rank(?) | 77 |

| 5-Y Avg Annual Return | 6.97% | 5-Y Avg Annual Rtn Rank | 81 |

| Volatility | 33.45% | Volatility Rank(?) | 48 |

| Expected EPS Growth | 26.26% | EPS Growth Rank(?) | 64 |

| Market Cap (billions) | 4.15 | Size Rank | 80 |

| Trailing P/E Ratio | 32.16 | Trailing P/E Rank(?) | 40 |

| Forward P/E Ratio | 25.47 | Forward P/E Ratio Rank | 16 |

| PEG Ratio | 1.22 | PEG Ratio Rank | 35 |

| Price/Sales | 1.34 | Price/Sales Rank(?) | 57 |

| Market/Book | 2.80 | Market/Book Rank(?) | 39 |

| Beta | 0.96 | Beta Rank | 42 |

| Alpha | 0.54 | Alpha Rank | 97 |

DOWNLOAD A FREE SAMPLE OF OUR CIENA CORPORATION (CIEN) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com