This week, we provide top-five ranked VE data for our Business Services Stocks. We take a look at our latest data on General Mills. We currently have an overvaluation warning underway. You can now sign up online for ValuEngine Capital, the investment advisory firm.

VALUATION WARNING: Overvalued stocks now make up 68.96% of our stocks assigned a valuation and 34.47% of those equities are calculated to be overvalued by 20% or more. Sixteen sectors are calculated to be overvalued.

ValuEngine Index Overview

|

Index

|

Week Open

|

Friday AM

|

Change

|

% Change

|

YTD

|

|

DJIA

|

20338.54

|

20561.21

|

222.67

|

1.09%

|

4.04%

|

|

NASDAQ

|

5753.19

|

5818.67

|

65.48

|

1.14%

|

8.09%

|

|

RUSSELL 2000

|

1390.41

|

1395.44

|

5.03

|

0.36%

|

2.82%

|

|

S&P 500

|

2321.72

|

2343.29

|

21.57

|

0.93%

|

4.67%

|

ValuEngine Market Overview

|

Summary of VE Stock Universe

|

|

|

Stocks Undervalued

|

31.04% |

|

Stocks Overvalued

|

68.96% |

|

Stocks Undervalued by 20%

|

13.24% |

|

Stocks Overvalued by 20%

|

34.47% |

ValuEngine Sector Overview

|

Sector

|

Change

|

MTD

|

YTD

|

Valuation

|

Last 12-MReturn

|

P/E Ratio

|

| Industrial Products |

0.13%

|

1.13%

|

3.97%

|

22.54% overvalued

|

39.49%

|

24.16

|

| Multi-Sector Conglomerates |

0.69%

|

2.65%

|

5.63%

|

19.49% overvalued

|

31.23%

|

19.95

|

| Finance |

0.39%

|

3.03%

|

4.33%

|

19.11% overvalued

|

29.31%

|

18.53

|

| Computer and Technology |

0.31%

|

2.68%

|

7.22%

|

17.54% overvalued

|

33.88%

|

31.02

|

| Aerospace |

0.74%

|

1.10%

|

3.41%

|

15.96% overvalued

|

36.41%

|

20.88

|

| Transportation |

0.53%

|

2.15%

|

6.99%

|

15.74% overvalued

|

29.24%

|

19.22

|

| Business Services |

0.59%

|

1.15%

|

2.67%

|

14.00% overvalued

|

24.62%

|

23.68

|

| Basic Materials |

-0.27%

|

3.91%

|

12.34%

|

12.48% overvalued

|

84.69%

|

28.10

|

| Utilities |

0.40%

|

0.56%

|

2.81%

|

12.35% overvalued

|

23.15%

|

23.65

|

| Consumer Staples |

0.40%

|

2.01%

|

3.52%

|

11.62% overvalued

|

21.98%

|

24.86

|

| Auto-Tires-Trucks |

0.29%

|

3.88%

|

6.20%

|

10.66% overvalued

|

44.27%

|

14.74

|

| Construction |

0.68%

|

3.55%

|

5.32%

|

10.16% overvalued

|

45.84%

|

21.08

|

| Oils-Energy |

-0.31%

|

0.71%

|

3.34%

|

9.95% overvalued

|

58.07%

|

28.27

|

| Consumer Discretionary |

0.21%

|

1.20%

|

2.89%

|

9.33% overvalued

|

28.15%

|

24.57

|

| Medical |

0.98%

|

4.32%

|

8.96%

|

3.64% overvalued

|

17.25%

|

27.59

|

| Retail-Wholesale |

0.55%

|

3.31%

|

1.74%

|

3.44% overvalued

|

13.59%

|

23.56

|

Sector Talk–Business Services

Below, we present the latest data on Business Services stocks from our Professional Stock Analysis Service. Top- five lists are provided for each category. We applied some basic liquidity criteria–share price greater than $3 and average daily volume in excess of 100k shares.

Top-Five Business Services Stocks–Short-Term Forecast Returns

|

Ticker

|

Name

|

Mkt Price

|

Valuation (%)

|

Last 12-M Return (%)

|

|

FDC

|

FIRST DATA CORP

|

16.18

|

-36.41%

|

58.32%

|

|

EVTC

|

EVERTEC INC

|

17.25

|

-9.43%

|

40.82%

|

|

ACTG

|

ACACIA RESEARCH

|

5.8

|

N/A

|

55.91%

|

|

LAMR

|

LAMAR ADVER CO

|

78.45

|

N/A

|

47.55%

|

|

CAR

|

AVIS BUDGET GRP

|

35.76

|

-20.09%

|

29.57%

|

Top-Five Business Services Stocks–Momentum

|

Ticker

|

Name

|

Mkt Price

|

Valuation (%)

|

Last 12-M Return (%)

|

|

AQMS

|

AQUA METALS INC

|

18.11

|

N/A

|

269.59%

|

|

AGX

|

ARGAN INC

|

71.25

|

N/A

|

136.24%

|

|

TNET

|

TRINET GROUP

|

26.14

|

7.40%

|

98.93%

|

|

BID

|

SOTHEBYS

|

41.2

|

N/A

|

86.68%

|

|

LQDT

|

LIQUIDITY SVCS

|

8.5

|

174.71%

|

86.00%

|

Top-Five Business Services Stocks–Composite Score

|

Ticker

|

Name

|

Mkt Price

|

Valuation (%)

|

Last 12-M Return (%)

|

|

FDC

|

FIRST DATA CORP

|

16.18

|

-36.41%

|

58.32%

|

|

EVTC

|

EVERTEC INC

|

17.25

|

-9.43%

|

40.82%

|

|

CAR

|

AVIS BUDGET GRP

|

35.76

|

-20.09%

|

29.57%

|

|

ADS

|

ALLIANCE DATA

|

231.41

|

-9.55%

|

23.43%

|

|

SCS

|

STEELCASE INC

|

16.25

|

-6.93%

|

36.44%

|

Top-Five Business Services Stocks–Most Overvalued

|

Ticker

|

Name

|

Mkt Price

|

Valuation (%)

|

Last 12-M Return (%)

|

|

HRI

|

HERC HOLDINGS

|

50.35

|

300.00%

|

-58.69%

|

|

LQDT

|

LIQUIDITY SVCS

|

8.5

|

174.71%

|

86.00%

|

|

BCO

|

BRINKS CO THE

|

52.95

|

70.28%

|

81.21%

|

|

RSG

|

REPUBLIC SVCS

|

59.05

|

37.23%

|

29.98%

|

|

GDOT

|

GREEN DOT CP-A

|

26.75

|

36.52%

|

36.34%

|

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

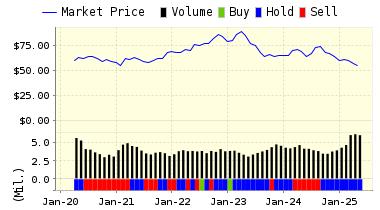

General Mills, Inc. (GIS) is one of the leading producers of packaged consumer foods and markets its products primarily through its own sales organizations, supported by advertising and other promotional activities. Such products are primarily distributed directly to retail food chains, cooperatives, membership stores and wholesalers.

VALUENGINE RECOMMENDATION: ValuEngine continues its HOLD recommendation on General Mills for 2017-02-16. Based on the information we have gathered and our resulting research, we feel that General Mills has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio.

You can download a free copy of detailed report on General Mills, Inc. (GIS) from the link below.

Read our Complete Rating and Forecast Report on General Mills (GIS) HERE.

|

ValuEngine Forecast

|

||

|

Target

Price* |

Expected

Return |

|

|---|---|---|

|

1-Month

|

63.08 | -0.17% |

|

3-Month

|

63.29 | 0.16% |

|

6-Month

|

62.50 | -1.09% |

|

1-Year

|

61.88 | -2.07% |

|

2-Year

|

65.27 | 3.30% |

|

3-Year

|

64.66 | 2.32% |

|

Valuation & Rankings

|

|||

|

Valuation

|

9.74% overvalued | Valuation Rank(?) |

|

|

1-M Forecast Return

|

-0.17% | 1-M Forecast Return Rank |

|

|

12-M Return

|

6.73% | Momentum Rank(?) |

|

|

Sharpe Ratio

|

0.64 | Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return

|

9.00% | 5-Y Avg Annual Rtn Rank |

|

|

Volatility

|

14.08% | Volatility Rank(?) |

|

|

Expected EPS Growth

|

12.42% | EPS Growth Rank(?) |

|

|

Market Cap (billions)

|

37.15 | Size Rank |

|

|

Trailing P/E Ratio

|

20.65 | Trailing P/E Rank(?) |

|

|

Forward P/E Ratio

|

18.37 | Forward P/E Ratio Rank |

|

|

PEG Ratio

|

1.66 | PEG Ratio Rank |

|

|

Price/Sales

|

2.33 | Price/Sales Rank(?) |

|

|

Market/Book

|

8.21 | Market/Book Rank(?) |

|

|

Beta

|

0.56 | Beta Rank |

|

|

Alpha

|

0.01 | Alpha Rank |

|

ValuEngineCapital Money Management

Services

We are pleased to announce that ValuEngine Capital has begun trading for our clients. ValuEngine Capital, a registered investment advisory firm, offers our clients investment-management services based on industry-leading ValuEngine research. ValuEngine Capital melds the cutting-edge financial theory of ValuEngine’s award-winning quantitative independent research with the best real-world Wall St. practices. ValuEngine Capital offers refined investment portfolios for investors of all risk-reward profiles.

ValuEngine Capital is offering several investment strategies to clients, including the the ValuEngine View Strategy and the ValuEngine Diversified Strategy

Professional Portfolio Management Services

ValuEngine View Strategy: The ValuEngine View Strategy is the product of a sophisticated stock valuation model that was first developed by ValuEngine’s academic research team.

- It utilizes a three factor approach: fundamental variables such as a company’s trailing 12-month Earnings-Per-Share (EPS), the analyst consensus estimate of the company’s future 12-month EPS, and the 30-year Treasury yield are all used to create a more accurate reflection of a company’s fair value.

- A total of eleven additional firm specific variables are also used. The ValuEngine View portfolio is constructed by integrating both our Aggressive Growth—based on the Valuation Model–and Diversified Growth—based on the Forecast Model– Portfolio Strategies.

- The ValuEngine View Strategy is constructed by integrating this model along with some basic rules for market capitalization and industry diversification. The portfolio has 15 stocks and is rebalanced once each month.

Strategies To Suit All Investor Types

The ValuEngine Diversified Strategy: The ValuEngine Diversified Strategy invests in a variety of asset classes in order to provide investors with stable returns and a high- dividend yield coupled with significantly lower risk than single-asset products.

- The ValuEngine Diversified Strategy may include ETFs focused on commodities, stock indices, REITS, bonds, emerging markets, and other suitable products.

- By reaping the benefits of diversification, the ValuEngine Diversified Strategy seeks to remain resilient during times of market volatility.

- The ValuEngine Diversified Strategy is designed for investors seeking management for their IRA and other retirement funds as well as those whose risk-profile is not suitable for our other strategies.

For more information, please contact us by email at info@ValuEngineCapital.com

or by phone at (407) 308-5686.

Or, sign up online with our easy-to-use portal HERE:

ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and valuations on over 7,000 US and Canadian equities every trading day.