Weekly Market Recap – Week Ending December 19, 2025

U.S. equity markets continued to exhibit late-December cross-currents as investors balanced concerns around valuation in mega-cap technology and utilities against seasonal strength and improving breadth. While early-month weakness in large-cap growth persisted through mid-December, the final trading days of the week saw selective rebounds, particularly in technology, even as defensive and income-oriented segments lagged.

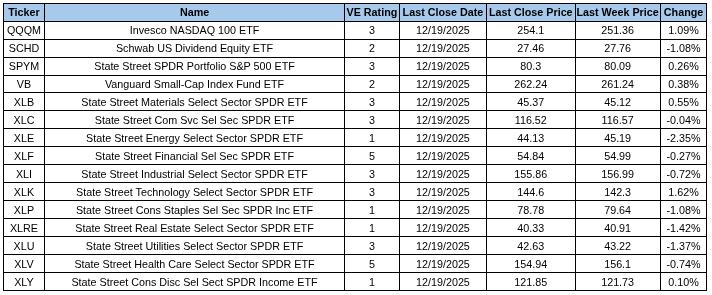

In the below table we use major ETF’s as a proxy for some major indexes as well as each of the sector groups into which we divide the overall markets. Tracking these over time provides a more defined picture of the US markets than simply tracking major indexes.

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

Current ValuEngine reports on all covered stocks and ETFs can be viewed HERE

Trade ValuEngine designed portfolio strategies, www.ValuEngineCapital.com

Strategy Note:

Through December 17, SPY and QQQ were both down for the month. Amid fears that AI and utilities were in a bubble due to over-exuberant projections, large-cap tech and utility stocks were down for the month. The last two days, however, created a strong enough reversal that SPY is now slightly up for the month while QQQ is just mildly down. VPU, Vanguard Utilities Index Fund, however, only recovered from -7.1% to -5.8% for the month. Meanwhile, small cap as measured by IWM, the iShares Russell 2000 Index, has gained steadily and is now up more than 1.5% for the month. VTV, Vanguard Value ETF, has outperformed VUG, Vanguard Growth, benefitting from rotation out of big tech that had progressed through Wednesday’s close. The margin of the past two days’ outperformance by VUG relative to VTV has put both in positive territory for the month while narrowing the gap considerably.

This type of reversal from the first half of November to the last nine trading days of the month is not unusual. In fact, according to Sevens Report Research by Kinsale Trading, there has been this type of dichotomy in more than 70% of Decembers between 1950 and 2024. On one hand, December has been one of the stock market’s best months of the year, with the S&P 500 averaging a 1.4% return over the past 75 years and finishing higher 73.3% of the time. That makes December the month with the highest historical win rate, with an average monthly return surpassed only by November. On the other hand, the Sevens report says the pattern within the month has generally been uneven. In fact, the pattern for the month until the tenth-to-last trading day has a mean return of 0.1%. Almost all of the positive juice of the “Santa Claus Rally” does not happen until those last two weeks. The Stock Traders Almanac verifies the same patterns. Our inclination is to go with these strong annual trends and stay with positions in large-cap and tech positions through the remainder of 2025.

That said, there have been major changes in ValuEngine’s predictive ratings for these key benchmark ETFs since November. Specifically, VUG and QQQ have fallen from ratings of 4 (Buy) to 3 (Hold). Meanwhile, VTV has risen from a 3 to a 4 (Buy). BankAmerica (BAC), the eighth largest holding of VTV, is rated 4 (Buy). This tells us that the rotations into value and smaller cap may continue into the New Year once the Santa Rally has run its course.

If trading between now and January 2, the same rules we followed for Thanksgiving apply. Try to make any trades, especially ETF trades, with limit (not market) orders and only between 10:30 AM and 1:30 PM. Beware of high spreads. Volume will thin out and mutual fund companies are making repositioning trades for “window dressing.” As detailed above, we think that staying the course makes sense for now until 2026 for anyone who doesn’t trade daily for a living. Thoughts about family, food, and presents will probably prove far more satisfying.

HAPPY HOLIDAYS from everyone at ValuEngine.com!

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

____________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com