Weekly Market Recap – Week Ending January 30, 2026

Equity markets finished the week with a mixed tone as leadership continued to rotate across sectors and styles. While large-cap growth and technology-oriented exposures showed modest weakness, select income and defensive segments posted gains, underscoring an environment driven more by rotation than broad market momentum. Energy and communication services stood out on the upside, while materials, health care, and technology lagged. Overall, ValuEngine indicators suggest a selective market, with opportunities emerging where recent price action aligns with favorable predictive ratings.

Trade ValuEngine supported portfolio strategies, www.ValuEngineCapital.com

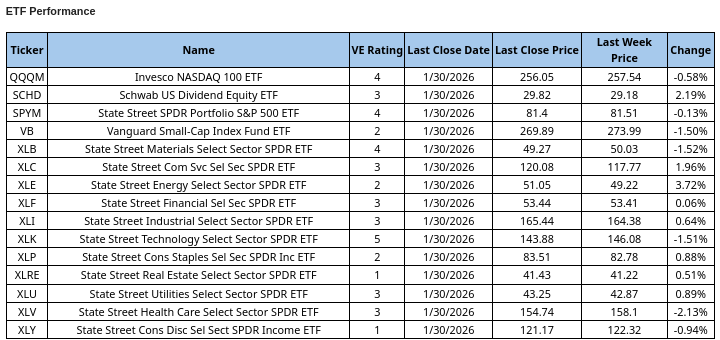

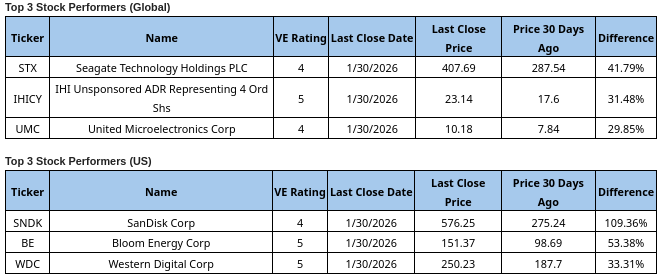

In the below tables we use major ETF’s as a proxy for some major indexes as well as each of the sector groups into which we divide the overall markets. Tracking these over time provides a more defined picture of the US markets than simply tracking major indexes. This is followed by notable individual stock movers over the past month, and finally our full strategy outlook.

Current ValuEngine reports on all covered 6000+ stocks and ETFs can be viewed HERE

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

Strategy Note:

The first capital markets’ month of 2026 is now complete. The overarching theme is still the “Sell America” trade amidst a weakening US Dollar and ever-climbing gold prices. However, Friday January 30th, the last trading day of January, saw a stark reversal of both trends after President Trump said that he intended nominate Kevin Warsh as the next Federal Reserve Chairman. The oldest gold exchange-traded vehicle, SPDR Gold Shares (GLD), dropped 10.3%, the largest single-day decline in its 22-year history. However, that just pared what would have been an almost 25% one-month increase to a still-robust 12.3% increase. Similarly DXY, the most commonly quoted US Dollar Index, rose nearly 1% and trimmed what had been a 2.6% decline to a mere 1.6% decline for the month. So, Trump’s stated intention to nominate Walsh restored some confidence in the resilience of the US dollar for one trading day. Has gold’s bubble finally burst? Will the dollar start to out perform other major currencies? It’s hard for us to believe that this in itself is enough to reverse the “Sell America” trade. It is more likely that this news was enough to de-escalate US currency stability concerns enough to set-off a wave of profit-taking from those investors experiencing record gains from betting on gold and against the US dollar.

Overall, we still would encourage investors with more than 90% of their strategic equity allocation in US stocks to consider diversifying by selling off perhaps 10% of that allocation to buy exposure into stocks or ETFs investing in foreign developed and/or emerging markets. VEU, the Vanguard All-World ex-US Shares Index ETF, is a very cost-efficient vehicle for gaining such exposure with an expense ratio of just 0.04% while providing exposure to developed and emerging markets. Its second- and third-largest positions are rated 5 (Strong Buy) by ValuEngine.com. They include Chinese internet/gamin conglomerate Tencent Holdings (TCEHY) and Dutch semiconductor equipment systems manufacturer AMSL Holdings NV, AMSL. Since both are volatile tech stocks albeit very attractive, VEU may represent a way to gain these exposures with less overall downside risks.

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

____________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com