Weekly Market Recap – Week Ending October 24, 2025

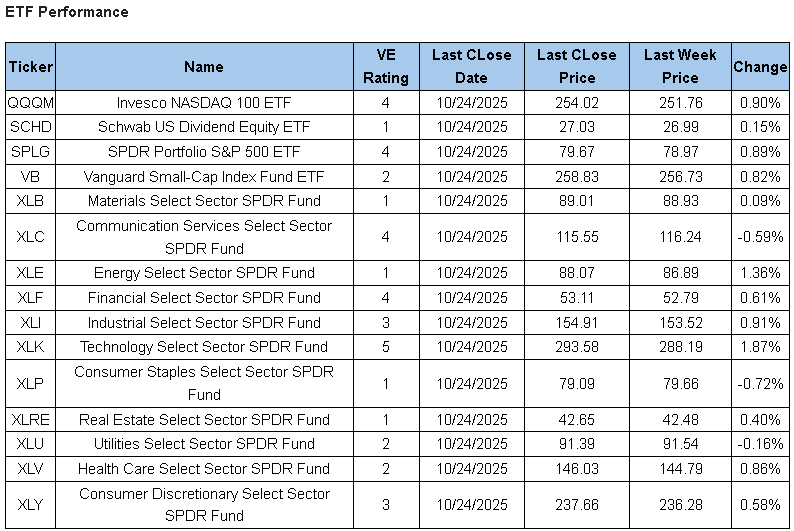

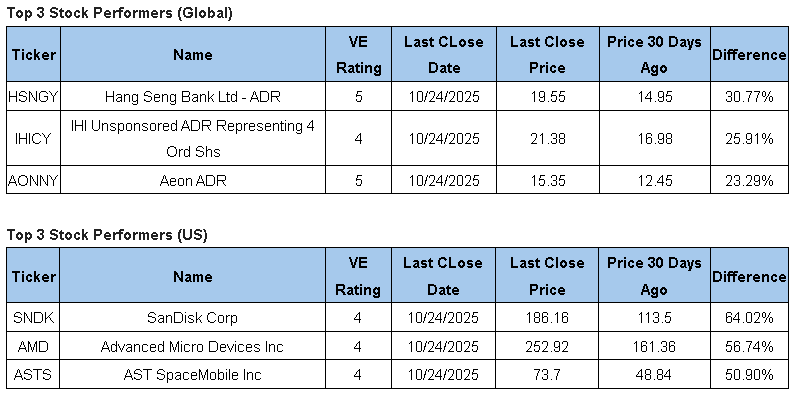

Tech led the week, with XLK +1.87% and QQQM +0.90%, while defensives lagged (XLP –0.72%, XLU -0.16%). Energy firmed (XLE +1.36%) and small-caps inched up (VB +0.82%). Over 30 days, AMD, SNDK, and ASTS headline U.S. gainers, while HSGNY tops ADRs.

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

In the below table we use major ETF’s as a proxy for some major indexes as well as each of the sector groups into which we divide the overall markets. Tracking these over time provides a more defined picture of the US markets than simply tracking major indexes.

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Strategy Note

Last week saw a stunning change in asset-class index ETF leadership for October 2025 thus far. Following a 5%+ gain in the week ending October 13, gold—represented here by GLDM, SPDR Gold MiniShares Trust—gave all of that back and more. The 6.3% loss for the week now reduces its October gain to 3.7%, barely ahead of the 3.5% month-to-date gain posted by QQQM, the Invesco Nasdaq-100 ETF. This is a sharp reversal from GLDM’s 230-basis-point lead at the end of last week.

The great rotation to value stocks predicted by many market pundits hasn’t worked out in all but one month this year—and certainly not in October. VUG (Vanguard Growth Index Fund ETF) gained 2.8% versus 0.8% for VTV (Vanguard Value Index Fund ETF). One rotation that has been working better since midyear is the recovery in small-cap stocks. Our barometer IWM (iShares Russell 2000 ETF) has gained 3.4% so far in October, double the 1.7% gain of SPLG (SPDR Portfolio S&P 500 ETF). Surprisingly, the top gainer among the index ETFs we follow this month has been VPU (Vanguard Utilities Index Fund ETF) with a spectacular 5.2% rise.

Despite fears from some analysts, third-quarter earnings have not disappointed. Of the 174 S&P 500 companies that reported so far this month, 87% beat earnings estimates and 84% exceeded revenue expectations. One noteworthy stock, INTC (Intel), justified its 4 (Buy) ValuEngine rating: the company reported $13.7B in revenue and $0.23 in adjusted EPS, both above expectations, helping the stock rise more than 7%.

Looking ahead, several well-rated firms report this week, including Twilio (TWLO), rated 5 (Strong Buy), and “Magnificent 7” names Amazon (AMZN), Meta (META) and Alphabet (GOOGL), each rated 4 (Buy). If the better-than-expected earnings trend persists, it could be another strong week—so much for the pundits who entered the month with “Octoberphobia.” That said, the month isn’t over; skeptics still have one more week to be validated by a mini-crash. A potential headwind could be the Fed’s upcoming report, which is expected to outline its latest stance on interest rates and quantitative tightening. Next week, we’ll be able to wrap up the month.

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

_______________________________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com