Weekly Market Recap – Week Ending December 05, 2025

Trade ValuEngine designed portfolio strategies, www.ValuEngineCapital.com

Strategy Note:

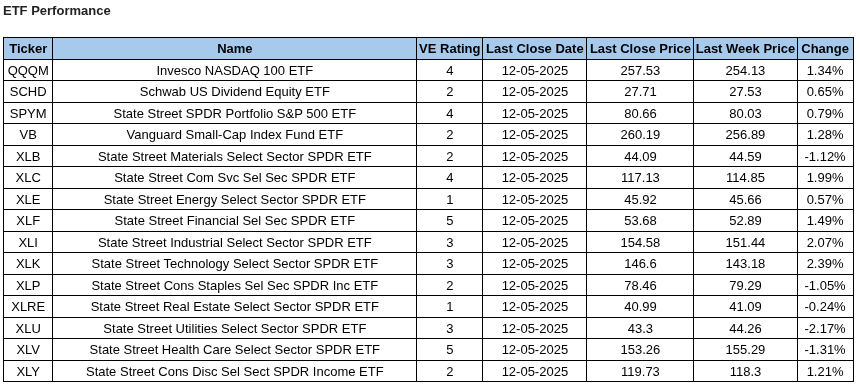

Last week resembled business as usual for December in most years past. The total gains were more docile and all positive as opposed to a November characterized by very high volatility and daily returns resembling a roller coaster ride. Tech—as characterized loosely by the Invesco Nasdaq-100 ETF QQQM—led the way again with a 1% gain for the week. Small-cap U.S. and foreign equity markets didn’t quite keep pace but were close. iShares Russell 2000 ETF (IWM) gained 0.8%. Developed markets standard bearer EFA, iShares MSCI EAFE ETF, rose 0.7% while iShares Emerging Markets ETF (EEM) gained 0.8%. The Vanguard S&P 500 ETF (VOO), representing a broad section of U.S. stocks, had trouble keeping up with a gain of only 0.3%.

The big news at the end of last week was the massive, industry-shifting acquisition by Netflix (NFLX) of the film and television studio assets of Warner Bros. Discovery (WBD) for around $82.7 billion (including debt). Legal approval is in question. That said, there are global industry ramifications at play. It will be interesting to see how traders react to this news. In terms of ValuEngine ratings on the companies most likely to be affected, both WBD and NFLX are rated 4 (Buy). Sony (SONY) is also rated 4 while Comcast (CMCSA), Paramount Group (PGRE) and Disney (DIS) are rated 3 (Hold). Theater owners AMC Entertainment (AMC) and Cinemark (CNK) are also rated 3. Two other companies that may be partially affected are Amazon (AMZN) and Apple (AAPL) as entertainment production and services form a portion, but not the bulk, of their revenue streams. Our industry report rated the Entertainment Services sector 3 (Hold). Its principal sector, Consumer Discretionary, is also rated 3.

Beyond these companies, we have a few noteworthy upgrades this week. They include internet-based bank Ally Financial (ALLY) and satellite service provider EchoStar Corp. (SATS), which are now rated 4 (Buy). Given the major acquisition and normal seasonal patterns of trading activity prior to holiday vacation weeks, we are expecting fairly heavy trading volume this week. At any rate, given the possibility of a major acquisition fueling other acquisitions, things could be very interesting before the end of the year.

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

____________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com