EDITOR’S NOTE: We will be on a limited publication schedule later this month. Bulletins will be reduced the weeks of August 20-24 (we will publish M-W) and September 3-7 (we will publish W-F). There will be no bulletins the week of August 27-31. We will return to our normal publication schedule the week of September 10th.

For today’s bulletin, we take a look at our latest BUY and STRONG BUY upgrades. We also provide a link to download a FREE STOCK REPORT on AMAG Pharmaceuticals, one of our top upgrades for the day.

VALUATION WATCH: Overvalued stocks now make up 50.73% of our stocks assigned a valuation and 19.81% of those equities are calculated to be overvalued by 20% or more. Eleven sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. AMAG Pharma is our only STRONG BUY upgrade for the day. The rest of our top-five upgrades are rated BUY.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| AMAG | AMAG PHARMA INC | 23.9 | 111.29% | 26.79% | 1.11% | 13.33% | N/A | Medical |

| ERII | ENERGY RECOVERY | 9.17 | 22.69% | 34.75% | 0.87% | 10.43% | 51.91 | Industrial Products |

| CMPR | CIMPRESS NV | 146.58 | 9.67% | 60.23% | 0.79% | 9.49% | 125.28 | Industrial Products |

| DDD | 3D SYSTEMS CORP | 12.85 | 300.00% | -4.03% | 0.64% | 7.65% | N/A | Computer and Technology |

| PCRX | PACIRA PHARMACT | 45.2 | 10.78% | 19.58% | 0.64% | 7.61% | N/A | Medical |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

For today’s bulletin, we look at AMAG Pharmaceuticals, Inc. (AMAG). AMAG Pharmaceuticals, Inc. is a biopharmaceutical company that utilizes its proprietary nanoparticle technology for the development and commercialization of therapeutic iron compounds to treat anemia and novel imaging agents to aid in the diagnosis of cancer and cardiovascular disease. Ferumoxytol, the company’s key product candidate, is being developed for use as an intravenous iron replacement therapeutic for the treatment of iron deficiency anemia in chronic kidney disease patients.Combidexï, the company’s other product under development, is an investigational functional molecular imaging agent consisting of iron oxide nanoparticles for use in conjunction with magnetic resonance imaging to aid in the differentiation of cancerous from normal lymph nodes. In March 2005, the company received an approvable letter from the FDA with respect to Combidex, subject to certain conditions.

AMAG reported Q2 2018 earnings last week. Total revenues from continuing operations for the second quarter of 2018 increased 12% to $146.3 million, compared with $130.4 million in the second quarter of 2017. Sales of Feraheme and MuGard® increased 37% to $37.8 million in the second quarter of 2018, compared with $27.7 million in the second quarter of 2017.

Operating income from continuing operations in the second quarter of 2018 was $41.9 million, compared with of $3.3 million for the same period last year. The company reported a net loss from continuing operations of $25.8 million, or $0.75 loss per basic and diluted share, for the second quarter of 2018, compared with a net loss of $14.3 million, or $0.41 loss per basic and diluted share, for the same period in 2017. The primary driver of the second quarter 2018 net loss from continuing operations was the $52 million expense incurred to increase the company’s valuation allowance on its deferred tax assets.

Bill Heiden, AMAG’s president and chief executive officer, had the following to say about the results:

We have had an extraordinary first half of 2018, with the achievement of a number of important regulatory milestones and strong commercial success across the portfolio. In the second quarter, our commercial teams generated record setting sales performance for each of our products and these strong results, combined with confidence in our prospects for the second half of 2018, allow us to again raise both annual revenue and adjusted EBITDA guidance for our pharmaceutical business. The divestiture of CBR is another important step in our plan to align the company’s balance sheet with our strategic growth plan, which focuses on the development and commercialization of innovative pharmaceuticals.

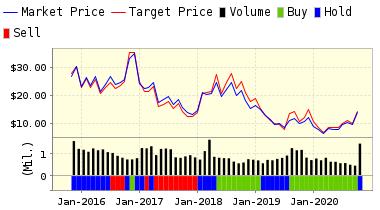

ValuEngine updated its recommendation from BUY to STRONG BUY for AMAG Pharmaceuticals, Inc. on 2018-08-03. Based on the information we have gathered and our resulting research, we feel that AMAG Pharmaceuticals, Inc. has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Book Market Ratio and Momentum.

You can download a free copy of detailed report on AMAG Pharmaceuticals, Inc. (AMAG) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 24.17 | 1.11% |

| 3-Month | 24.76 | 3.62% |

| 6-Month | 25.59 | 7.08% |

| 1-Year | 27.09 | 13.33% |

| 2-Year | 28.86 | 20.77% |

| 3-Year | 28.46 | 19.09% |

| Valuation & Rankings | |||

| Valuation | 111.29% overvalued | Valuation Rank(?) | 2 |

| 1-M Forecast Return | 1.11% | 1-M Forecast Return Rank | 99 |

| 12-M Return | 26.79% | Momentum Rank(?) | 79 |

| Sharpe Ratio | -0.01 | Sharpe Ratio Rank(?) | 44 |

| 5-Y Avg Annual Return | -0.40% | 5-Y Avg Annual Rtn Rank | 43 |

| Volatility | 58.78% | Volatility Rank(?) | 27 |

| Expected EPS Growth | -206.32% | EPS Growth Rank(?) | 2 |

| Market Cap (billions) | 0.60 | Size Rank | 54 |

| Trailing P/E Ratio | n/a | Trailing P/E Rank(?) | 20 |

| Forward P/E Ratio | n/a | Forward P/E Ratio Rank | n/a |

| PEG Ratio | n/a | PEG Ratio Rank | n/a |

| Price/Sales | 0.98 | Price/Sales Rank(?) | 70 |

| Market/Book | 0.82 | Market/Book Rank(?) | 85 |

| Beta | 0.55 | Beta Rank | 57 |

| Alpha | 0.04 | Alpha Rank | 70 |

DOWNLOAD A FREE SAMPLE OF OUR AMAG PHARMACEUTICALS (AMAG) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com