Elon Musk’s latest twitter posts caused buy-out rumours to swirl around Tesla. For today’s bulletin, we take a look at Tesla $TSLA and provide a link to download a FREE STOCK REPORT on the company.

VALUATION WATCH: Overvalued stocks now make up 52.62% of our stocks assigned a valuation and 20.33% of those equities are calculated to be overvalued by 20% or more. Eleven sectors are calculated to be overvalued.

Tesla Inc. (TSLA) designs, develops, manufactures, and sells electric vehicles and stationary energy storage products. It operates primarily in the United States, China, Norway and internationally. Tesla Inc., formerly known as Tesla Motors Inc., is headquartered in Palo Alto, California.

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

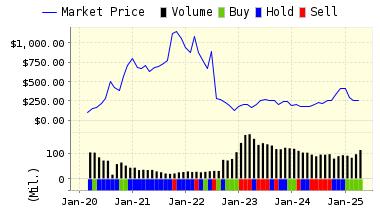

We have been tracking Tesla for a while here. As long-time readers know, we are definitely on the side of the shorts. Our models typically rate this stock a SELL, and despite the high share prices and the long-term trend, we cannot shake the feeling that something is wrong here.

Tesla, despite the massive valuation, has NEVER made a profit–and it most certainly isn’t Amazon, so that argument doesn’t fly with us. We believe Elon Musk benefits from a level of “fanboy” worship we haven’t seen since Steve Jobs died. We believe that all other Musk-linked activities–hyper loops, battery projects and rocket launches, serve as little more than PR to justify the share price of Tesla and hype the stock.

However–to paraphrase a wise trader, when you’re short you can definitely go broke even if you’re right. And so far, the shorts here have taken a bath. Musk seems to take their bets as a personal affront, and recent events show he may be taking actions to make their positions as expensive as possible.

We see evidence in support of this thesis in the latest Tesla news, where Musk has reportedly been considering taking the company private. He dropped this bombshell on the markets–“Am considering taking Tesla private at $420. Funding secured”–yesterday. Of course, he did this via his Twitter account. This followed other recent news that Musk had sold 5% of Tesla to Saudi investors.

At that $420/share price level, Tesla would be worth @$70 billion. This is for a car company currently unable to produce more than a few thousand vehicles a month which is also unable to support dealers and owners with spare parts, maintenance, etc.

We find this amusing. We find this problematic. We find in this recent dust up more evidence that something is wrong with this company. While Musk did nothing illegal by announcing this seemingly critical info on Twitter, to us it reeks of market manipulation.

Is it just a PR stunt? Tesla’s board has confirmed that taking the company private has been discussed. But, is this what happens when you have a supposedly revolutionary entity that is about to take over the auto world? You are going to sell the firm when all is well and you are about to break out with the holy grail for automakers, a mass-produced and affordable electric vehicle?

And of course, as the news broke out on Twitter, Musk followed up his initial announcement with an argument that taking his flagship firm private would end “negative propaganda” from the shorts betting against him. We think that speaks volumes about what is really going on here.

Of course, our computerized system cannot consider the Tesla/Musk “story,” the latest tweets, or the level of “fanboy” devotion to all things Elon. But, while we know betting short against this firm has been a losing proposition so far, we cannot help but maintain our subjective view that something stinks here. And objectively, our models find that this company is ready to take a fall.

VALUENGINE RECOMMENDATION: ValuEngine continues its SELL recommendation on TESLA INC for 2018-08-07. Based on the information we have gathered and our resulting research, we feel that TESLA INC has the probability to UNDERPERFORM average market performance for the next year. The company exhibits UNATTRACTIVE Book Market Ratio and P/E Ratio.

You can download a free copy of detailed report on Tesla (TSLA) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 377.93 | -0.43% |

| 3-Month | 368.19 | -3.00% |

| 6-Month | 355.81 | -6.26% |

| 1-Year | 359.91 | -5.18% |

| 2-Year | 263.15 | -30.67% |

| 3-Year | 207.56 | -45.32% |

| Valuation & Rankings | |||

| Valuation | 46.90% undervalued | Valuation Rank(?) | 93 |

| 1-M Forecast Return | -0.43% | 1-M Forecast Return Rank | 20 |

| 12-M Return | 6.87% | Momentum Rank(?) | 50 |

| Sharpe Ratio | 0.37 | Sharpe Ratio Rank(?) | 72 |

| 5-Y Avg Annual Return | 15.95% | 5-Y Avg Annual Rtn Rank | 85 |

| Volatility | 42.68% | Volatility Rank(?) | 37 |

| Expected EPS Growth | 90.04% | EPS Growth Rank(?) | 84 |

| Market Cap (billions) | 47.59 | Size Rank | 98 |

| Trailing P/E Ratio | n/a | Trailing P/E Rank(?) | 22 |

| Forward P/E Ratio | n/a | Forward P/E Ratio Rank | n/a |

| PEG Ratio | 0.28 | PEG Ratio Rank | 70 |

| Price/Sales | 3.48 | Price/Sales Rank(?) | 32 |

| Market/Book | 9.70 | Market/Book Rank(?) | 16 |

| Beta | 0.63 | Beta Rank | 54 |

| Alpha | -0.16 | Alpha Rank | 29 |

DOWNLOAD A FREE SAMPLE OF OUR TESLA (TSLA) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com