EDITOR’S NOTE: We will be on a limited publication schedule later this month. Bulletins will be reduced the weeks of August 20-24 (we will publish M-W) and September 3-7 (we will publish W-F). There will be no bulletins the week of August 27-31. We will return to our normal publication schedule the week of September 10th.

For today’s bulletin, we take a look at our latest STRONG BUY upgrades. We also provide a link to download a FREE STOCK REPORT on Aldeyra Therapeutics $ALDX, one of our top upgrades for the day.

VALUATION WATCH: Overvalued stocks now make up 50.11% of our stocks assigned a valuation and 19.75% of those equities are calculated to be overvalued by 20% or more. Eleven sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. ALL of our top upgrades for today are from the medical sector and ALL of them are rated STRONG BUY.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| FGEN | FIBROGEN INC | 59.95 | 145.66% | 45.86% | 1.15% | 13.86% | N/A | Medical |

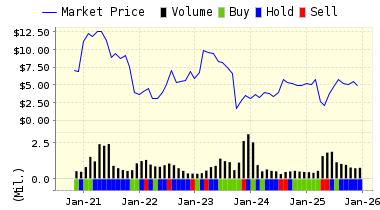

| ALDX | ALDEYRA THERAPT | 7.75 | 24.19% | 74.16% | 1.11% | 13.32% | N/A | Medical |

| FOLD | AMICUS THERAPT | 15.35 | 81.59% | 30.75% | 1.10% | 13.22% | N/A | Medical |

| RGNX | REGENXBIO INC | 67.4 | 39.33% | 231.20% | 1.09% | 13.06% | 35.66138 | Medical |

| PTCT | PTC THERAPEUTIC | 43.64 | 25.90% | 137.82% | 1.09% | 13.05% | N/A | Medical |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

For today’s bulletin, we look at Aldeyra Therapeutics (ALDX). Aldeyra Therapeutics, Inc. is a biotechnology company. The company’s products target immune-mediated, inflammatory, orphan, and other diseases. It is developing NS2, a compound that binds and traps free aldehydes. Aldeyra Therapeutics, Inc. is based in Burlington, Massachusetts.

When the company reported Q2 results last week, they noted their latest progress for a variety of drugs in their pipeline. Highlights included the latest on reproxalap, one of their important drug programs. Todd C. Brady, M.D., Ph.D., President and CEO of Aldeyra, noted that reproxalap “has advanced to four late-stage clinical programs, our development pipeline continues to grow, and now features a number of novel compounds across multiple diseases and mechanisms of action.”

As is typical with drug companies, the overall numbers showed losses. Aldeyra reported a net loss of approximately $9.1 million, compared to a net loss of approximately $5.3 million for the quarter ended June 30, 2017. Basic and diluted net loss per share was $0.46 for the quarter ended June 30, 2018, compared to $0.35 per share for the same period in 2017.

ValuEngine updated its recommendation from BUY to STRONG BUY for ALDEYRA THERAPT on 2018-08-10. Based on the information we have gathered and our resulting research, we feel that ALDEYRA THERAPT has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Book Market Ratio.

You can download a free copy of detailed report on Aldeyra Therapeutics (ALDX) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 7.84 | 1.11% |

| 3-Month | 7.94 | 2.46% |

| 6-Month | 8.17 | 5.43% |

| 1-Year | 8.78 | 13.32% |

| 2-Year | 8.23 | 6.14% |

| 3-Year | 7.60 | -1.97% |

| Valuation & Rankings | |||

| Valuation | 24.19% overvalued | Valuation Rank(?) | 17 |

| 1-M Forecast Return | 1.11% | 1-M Forecast Return Rank | 99 |

| 12-M Return | 74.16% | Momentum Rank(?) | 94 |

| Sharpe Ratio | 0.04 | Sharpe Ratio Rank(?) | 53 |

| 5-Y Avg Annual Return | 3.12% | 5-Y Avg Annual Rtn Rank | 58 |

| Volatility | 74.43% | Volatility Rank(?) | 19 |

| Expected EPS Growth | -16.86% | EPS Growth Rank(?) | 10 |

| Market Cap (billions) | 0.04 | Size Rank | 23 |

| Trailing P/E Ratio | n/a | Trailing P/E Rank(?) | 11 |

| Forward P/E Ratio | n/a | Forward P/E Ratio Rank | n/a |

| PEG Ratio | n/a | PEG Ratio Rank | n/a |

| Price/Sales | n/a | Price/Sales Rank(?) | n/a |

| Market/Book | 1.20 | Market/Book Rank(?) | 74 |

| Beta | 0.95 | Beta Rank | 38 |

| Alpha | 0.26 | Alpha Rank | 87 |

DOWNLOAD A FREE SAMPLE OF OUR ALDEYRA THERAPEUTICS (ALDX) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com