For today’s bulletin, we take a look at TWIN DISC $TWIN. We also provide a link to download a FREE STOCK REPORT on the company.

VALUATION WATCH: Overvalued stocks now make up 53.66% of our stocks assigned a valuation and 20.89% of those equities are calculated to be overvalued by 20% or more. Twelve sectors are calculated to be overvalued.

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. All of our upgrades today are rated BUY. There were no STRONG BUY upgrades today.

| Ticker | Company Name | Market Price | Valuation | Last 12-M Return | 1-M Forecast Return | 1-Yr Forecast Return | P/E Ratio | Sector Name |

| USAC | USA COMPRESSION | 18.31 | 63.21% | 8.41% | 0.63% | 7.61% | 72.27631 | Oils-Energy |

| QUOT | QUOTIENT TECH | 13.45 | 11.93% | 28.10% | 0.57% | 6.80% | N/A | Business Services |

| TGH | TEXTAINER GROUP | 17 | 1.96% | 49.78% | 0.56% | 6.74% | 17.05685 | Transportation |

| TWIN | TWIN DISC | 28.51 | 3.13% | 58.74% | 0.54% | 6.44% | 29.4931 | Industrial Products |

| HRTG | HERITAGE INSUR | 17.04 | 1.09% | 34.92% | 0.51% | 6.14% | 9.431734 | Finance |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

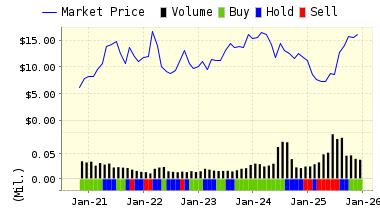

TWIN DISC, INC. (TWIN) designs, manufactures and sells heavy duty off-highway power transmission equipment. Products offered include: hydraulic torque converters; power-shift transmissions; marine transmissions and surface drives; universal joints; gas turbine starting drives; power take-offs and reduction gears; industrial clutches; fluid couplings and control systems. Principal markets are: construction equipment, industrial equipment, government, marine, energy and natural resources and agriculture.

The company reported Q3 2018 results last week and, like so many of our featured stocks lately, they had decent results. Sales for the fiscal 2018 third quarter increased to $65,349,000, from $45,084,000 for the same period last year. The 44.9% increase in 2018 third quarter sales was primarily due to improved demand for the Company’s 8500 series transmission systems from North American fracking customers, and higher sales of aftermarket components. In addition, global demand year-over-year has improved across many of the Company’s other markets. Year-to-date, sales were $166,960,000, compared to $114,591,000 for the fiscal 2017 nine months. Currency movement contributed $2,141,000 and $3,599,000 to the third quarter and year to date volume growth, respectively.

CEO John Batten had this to say about the latest results:

Strengthening demand trends from customers in the North American fracking market, as well as throughout many of our other global markets, is driving significant growth in sales and profitability, The actions we took during the past two years aimed at realigning our cost structure, investing in our products, and supporting our customers is paying off and we are extending our leadership position throughout many of our product categories. As our financial results benefit from improving demand, we are working to further expand our competitive position, enhance our operations, and improve the diversification of our business. We have created a compelling global platform that is well positioned for continued growth.

ValuEngine updated its recommendation from HOLD to BUY for TWIN DISC on 2018-05-15. Based on the information we have gathered and our resulting research, we feel that TWIN DISC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Earnings Growth Rate.

You can download a free copy of detailed report on TWIN DISC, INC. (TWIN) from the link below.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 28.66 | 0.54% |

| 3-Month | 28.21 | -1.05% |

| 6-Month | 28.77 | 0.91% |

| 1-Year | 30.35 | 6.44% |

| 2-Year | 27.15 | -4.77% |

| 3-Year | 24.85 | -12.82% |

| Valuation & Rankings | |||

| Valuation | 3.13% overvalued | Valuation Rank(?) | 47 |

| 1-M Forecast Return | 0.54% | 1-M Forecast Return Rank | 87 |

| 12-M Return | 58.74% | Momentum Rank(?) | 92 |

| Sharpe Ratio | 0.01 | Sharpe Ratio Rank(?) | 51 |

| 5-Y Avg Annual Return | 0.70% | 5-Y Avg Annual Rtn Rank | 52 |

| Volatility | 46.79% | Volatility Rank(?) | 35 |

| Expected EPS Growth | 48.28% | EPS Growth Rank(?) | 73 |

| Market Cap (billions) | 0.32 | Size Rank | 46 |

| Trailing P/E Ratio | 29.49 | Trailing P/E Rank(?) | 45 |

| Forward P/E Ratio | 19.89 | Forward P/E Ratio Rank | 32 |

| PEG Ratio | 0.61 | PEG Ratio Rank | 53 |

| Price/Sales | 1.46 | Price/Sales Rank(?) | 59 |

| Market/Book | 2.46 | Market/Book Rank(?) | 47 |

| Beta | 1.75 | Beta Rank | 13 |

| Alpha | -0.06 | Alpha Rank | 41 |

DOWNLOAD A FREE SAMPLE OF OUR TWIN DISC (TWIN) REPORT BY CLICKING HERE

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.Com