This week, we provide top-five ranked VE data for our Transportation stocks. We take a look at our latest data on Intel $INTC. We currently have an overvaluation warning underway.

VALUATION WARNING: Overvalued stocks now make up 65.36% of our stocks assigned a valuation and 30.15% of those equities are calculated to be overvalued by 20% or more. Fifteen sectors are calculated to be overvalued.

ValuEngine Index Overview

| Index | Week Open | Thursday PM | Change | % Change | YTD |

| DJIA | 20723.59 | 20981.33 | 257.74 | 1.24% | 6.17% |

| NASDAQ | 5979.96 | 6048.94 | 68.98 | 1.15% | 12.37% |

| RUSSELL 2000 | 1380.53 | 1417.13 | 36.6 | 2.65% | 4.42% |

| S&P 500 | 2370.33 | 2388.77 | 18.44 | 0.78% | 6.70% |

ValuEngine Market Overview

| Summary of VE Stock Universe | |

| Stocks Undervalued | 34.64% |

| Stocks Overvalued | 65.36% |

| Stocks Undervalued by 20% | 15.6% |

| Stocks Overvalued by 20% | 30.15% |

ValuEngine Sector Overview

| Sector | Change | MTD | YTD | Valuation | Last 12-MReturn | P/E Ratio |

| Industrial Products | 0.59% | 2.37% | 6.59% | 17.65% overvalued | 24.69% | 25.28 |

| Computer and Technology | 0.03% | 1.51% | 12.90% | 17.53% overvalued | 20.32% | 30.85 |

| Multi-Sector Conglomerates | -0.09% | 0.66% | 7.31% | 17.45% overvalued | 11.70% | 20.19 |

| Aerospace | 0.30% | 3.72% | 4.51% | 16.03% overvalued | 21.69% | 20.86 |

| Finance | 0.11% | 1.84% | 4.62% | 14.01% overvalued | 15.90% | 17.98 |

| Utilities | 0.38% | 5.31% | 10.10% | 11.66% overvalued | 18.53% | 22.37 |

| Construction | 0.20% | 0.37% | 9.30% | 11.13% overvalued | 17.64% | 22.13 |

| Business Services | 0.48% | 1.83% | 7.24% | 10.34% overvalued | 10.51% | 24.68 |

| Consumer Staples | -0.02% | 2.25% | 6.45% | 9.19% overvalued | 12.34% | 25.07 |

| Consumer Discretionary | 0.38% | 1.71% | 7.60% | 9.17% overvalued | 19.81% | 26.93 |

| Transportation | -0.09% | 1.76% | 7.02% | 9.01% overvalued | 11.61% | 21.70 |

| Auto-Tires-Trucks | 0.59% | 0.66% | 6.75% | 8.82% overvalued | 22.72% | 14.95 |

| Basic Materials | -0.13% | -0.80% | 5.77% | 4.66% overvalued | 25.90% | 25.11 |

| Retail-Wholesale | 0.61% | 3.20% | 5.77% | 4.24% overvalued | 7.04% | 24.39 |

| Medical | 0.28% | -0.93% | 9.64% | 1.34% overvalued | 5.22% | 28.86 |

| Oils-Energy | -0.41% | -1.66% | -2.49% | 0.40% undervalued | 7.65% | 29.68 |

Sector Talk–Transportation

Below, we present the latest data on Transportation stocks from our Professional Stock Analysis Service. Top- five lists are provided for each category. We applied some basic liquidity criteria–share price greater than $3 and average daily volume in excess of 100k shares.

Top-Five Transportation Stocks–Short-Term Forecast Returns

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| CPLP | CAPITAL PRODUCT | 3.44 | -53.07% | 25.55% |

| ANW | AEGEAN MARINE | 11.3 | 10.24% | 40.20% |

| TGP | TEEKAY LNG PTNR | 16.8 | -4.21% | 19.57% |

| FLY | FLY LEASING LTD | 12.96 | -4.57% | 10.30% |

| HA | HAWAIIAN HLDGS | 54.35 | 7.09% | 23.49% |

Top-Five Transportation Stocks–Momentum

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| GOL | GOL LINHAS-ADR | 31.23 | -27.50% | 342.35% |

| SINO | SINO-GLOBAL SHP | 3.03 | N/A | 326.76% |

| CAI | CAI INTL INC | 21.65 | -0.57% | 115.64% |

| SBLK | STAR BULK CARRS | 9.97 | -66.02% | 103.47% |

| TRTN | TRITON INTL LTD | 30.5 | N/A | 91.82% |

Top-Five Transportation Stocks–Composite Score

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| CPLP | CAPITAL PRODUCT | 3.44 | -53.07% | 25.55% |

| ALK | ALASKA AIR GRP | 88.25 | 0.62% | 18.70% |

| TGP | TEEKAY LNG PTNR | 16.8 | -4.21% | 19.57% |

| CPA | COPA HLDGS SA-A | 115.13 | 0.59% | 71.55% |

| HA | HAWAIIAN HLDGS | 54.35 | 7.09% | 23.49% |

Top-Five Transportation Stocks–Most Overvalued

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| BRS | BRISTOW GROUP | 14.63 | 300.00% | -33.68% |

| EGLE | EAGLE BULK SHPG | 4.92 | 300.00% | -51.58% |

| SWFT | SWIFT TRANSPORT | 24.88 | 86.03% | 35.66% |

| KEX | KIRBY CORP | 72.4 | 74.57% | 11.69% |

| GBX | GREENBRIER COS | 44.05 | 74.33% | 46.01% |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

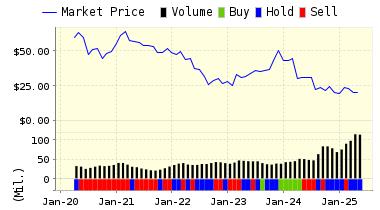

Intel Corporation (INTC) is one of the world’s largest semiconductor chip maker. The Company develops advanced integrated digital technology products, primarily integrated circuits, for industries such as computing and communications. It also develops platforms, which it defines as integrated suites of digital computing technologies that are designed and configured to work together to provide an optimized user computing solution compared to components that are used separately. Intel designs and manufactures computing and communications components, such as microprocessors, chipsets, motherboards, and wireless and wired connectivity products, as well as platforms that incorporate these components. The Company sells its products primarily to original equipment manufacturers, original design manufacturers, PC and network communications products users, and other manufacturers of industrial and communications equipment. Intel Corporation is based in Santa Clara, California.

VALUENGINE RECOMMENDATION: ValuEngine continues its BUY recommendation on INTEL CORP for 2017-04-26. Based on the information we have gathered and our resulting research, we feel that INTEL CORP has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

You can download a free copy of detailed report on Intel Corporation (INTC) from the link below.

Read our Complete Rating and Forecast Report on Intel (INTC) HERE.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 37.21 | 0.75% |

| 3-Month | 37.31 | 1.02% |

| 6-Month | 37.54 | 1.64% |

| 1-Year | 40.25 | 8.98% |

| 2-Year | 38.66 | 4.69% |

| 3-Year | 38.77 | 4.99% |

| Valuation & Rankings | |||

| Valuation | 6.61% overvalued | Valuation Rank(?) | 55 |

| 1-M Forecast Return | 0.75% | 1-M Forecast Return Rank | 92 |

| 12-M Return | 17.61% | Momentum Rank(?) | 61 |

| Sharpe Ratio | 0.25 | Sharpe Ratio Rank(?) | 65 |

| 5-Y Avg Annual Return | 4.98% | 5-Y Avg Annual Rtn Rank | 62 |

| Volatility | 20.34% | Volatility Rank(?) | 70 |

| Expected EPS Growth | -1.77% | EPS Growth Rank(?) | 19 |

| Market Cap (billions) | 178.56 | Size Rank | 100 |

| Trailing P/E Ratio | 13.05 | Trailing P/E Rank(?) | 85 |

| Forward P/E Ratio | 13.28 | Forward P/E Ratio Rank | 71 |

| PEG Ratio | n/a | PEG Ratio Rank | n/a |

| Price/Sales | 3.01 | Price/Sales Rank(?) | 37 |

| Market/Book | 4.19 | Market/Book Rank(?) | 31 |

| Beta | 1.02 | Beta Rank | 39 |

| Alpha | -0.03 | Alpha Rank | 38 |

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (800) 381-5576 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information