Weekly Market Recap – Week Ending September 26, 2025

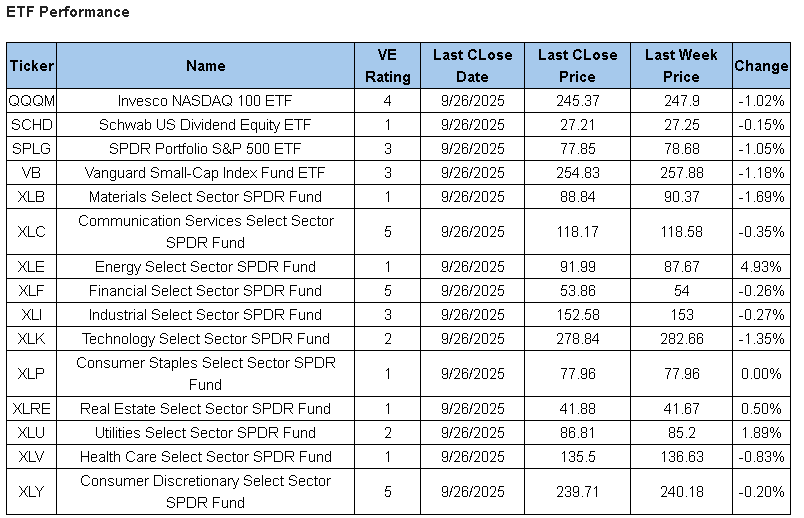

The markets are in the process closing out the month September on a stronger note than its reputation would suggest, with gains across most major equity indexes and sector ETFs. Energy and utilities outperformed as defensive sectors found strength, while technology and growth pulled back modestly. Gold continued to shine as a hedge, significantly outpacing equities, while select global and US stocks delivered sharp gains.

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

Strategy Note

Despite September being historically the worst month of the year for the S&P 500 Index, every index ETF followed regularly in this strategy note provided positive returns between the August 29 close and the September 26 close.

Among domestic strategy index ETFs, QQQM (Invesco Nasdaq-100 Index ETF) led the way with a 4.5% gain, followed by VUG (Vanguard US Equity Growth ETF) at 3.9%, VPU (Vanguard Utilities ETF) at 3%, and IWM (iShares Russell 2000 Small Cap ETF) at 2.6%, tying with SPLG (SPDR S&P 500 ETF) which also gained 2.6%.

The laggard among domestic strategy indexes this month was MDY (S&P 400 MidCap Index Trust) with only 0.3%, while US Value Stocks, represented by VTV (Vanguard US Value Equity Index ETF), also underperformed with a modest 1.8% return. Developed foreign markets, as tracked by EFA (iShares MSCI EAFE ETF), gained 1.5%, trailing the stronger US growth and technology sectors.

Two ETFs outpaced QQQM. The first was EEM (iShares Emerging Markets Index ETF), up a robust 5.7% month-to-date. Beating all of our equity index ETFs was the SPDR Gold Mini-Trust (GLDM), which soared 9%. This margin of nearly 640 basis points over QQQM further cements GLDM’s year-to-date, decade-to-date, and even century-to-date performance edge over S&P 500 index ETFs.

As mentioned last week and still true now, current all-time high levels for the spot price of gold do not deter us from considering it no more overvalued than equities in today’s “hedged risk-on” market environment. Less volatile but attractively valued stocks recently upgraded by our models include Travelers (TRV) and Allstate (ALL).

Current ValuEngine reports on all covered stocks and ETFs can be viewed at HERE

______________________________________________________________________________________________

www.ValuEngine.com (Valuengine, Inc) is a stock valuation and forecasting service founded by Ivy League finance academics. VE utilizes the most advanced quantitative techniques and analysis available to analyze over 4,200 US stocks, 700 US ETfs, and 1,000 Canadian stocks. Fair market valuations, forecasted target prices, and buy/hold/sell recommendations are updated DAILY.

www.ValuEngineCapital.com (ValuEngine Capital Management, LLC) is a Registered Investment Advisory firm that trades a variety of different portfolios based upon the ValuEngine.com research models. Each portfolio has a different risk/return profile, so clients can be placed in strategies that fit their specific investment needs.

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

_______________________________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com