Weekly Market Recap – Week Ending February 06, 2026

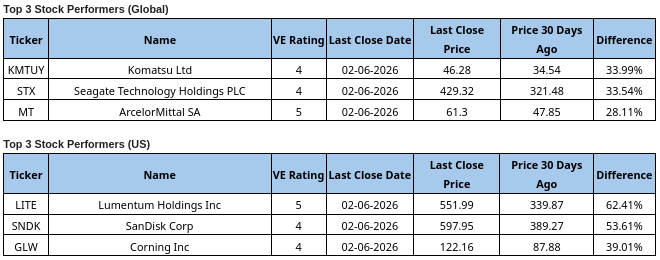

Market action last week depended heavily on where investors chose to look. Beneath largely unchanged headline index levels, sharp rotations continued across style, size, and geography. Value stocks outperformed growth by a wide margin, while large-cap technology names increasingly served as sources of funds for smaller-cap, value-oriented, and non-US equities. The result was a volatile but ultimately directionless week for broad US benchmarks, even as select sectors, international markets, and commodities delivered solid gains—reinforcing the view that this remains a stock-picker’s and allocator’s market rather than a simple index-driven one.

Trade ValuEngine supported portfolio strategies, www.ValuEngineCapital.com

Free Trial: Research on over 5,000 stocks and 700 ETFs HERE

Current ValuEngine reports on all covered 6000+ stocks and ETFs can be viewed HERE

Strategy Note:

Your perspective on how the stock market performed last week depended on which index ETF you used as your barometer. From feast to famine and back again, SPYM — the lowest fee S&P 500 ETF from State Street SPDRs — had a roller coaster week worthy of the end of the MacBeth soliloquy. It was “full of sound and fury, signifying nothing.”

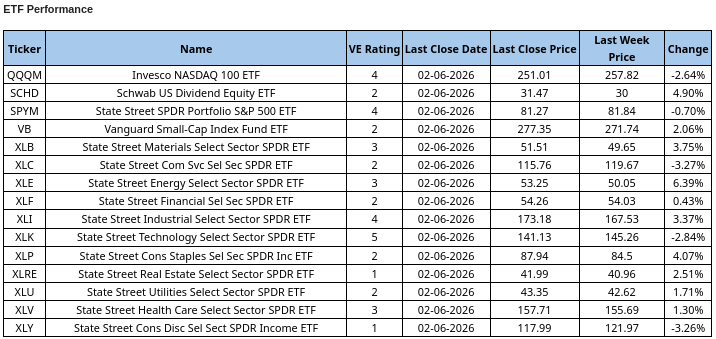

It was a far worse week for large-cap growth investors as the Invesco Nasdaq-100 ETF (QQQ) lost roughly 2% and Vanguard Growth ETF (VUG) declined 2.7%, while Vanguard Value ETF (VTV) gained more than 3%. In short, it was a market of stocks focused on value opportunities tied to earnings rather than earnings growth — a classic stock-picker’s market.

In other markets, both iShares Emerging Markets ETF (EEM) and iShares MSCI EAFE ETF (EFA) gained more than 1.5%, while SPDR Gold MiniShares (GLDM) advanced 2.1%. Viewed through the lenses of SPY and QQQ, the “Sell America” trade continues to work alongside the value-and-size rotation trade, with large Nasdaq-100 constituents increasingly used as sources of funds.

We are now past the halfway point of earnings season, though it is far from over. Seventy-nine S&P 500 companies are scheduled to report this week. Among the most closely followed names is one 5-rated (Strong Buy) stock — Robinhood Markets (HOOD), our highest-rated broker-dealer. Five additional companies scheduled to report carry 4 (Buy) ratings, including health-care firms Moderna (MRNA), Gilead Sciences (GILD), and CVS Health (CVS), along with Ford Motor (F) and semiconductor equipment maker Applied Materials (AMAT).

GILD is the second-largest holding in the Invesco Nasdaq Biotech ETF (IBBQ), our only Health-Care-related ETF rated 5 (Strong Buy). Notably, three other biotech stocks within IBBQ also carry 5 ratings: AstraZeneca (AZN), Argenx (ARGX), and Insmed (INSM). The first two align particularly well with a “Sell America” allocation theme.

The most efficient “Sell America” ETF currently aligned with ValuEngine ratings is the AdvisorShares Dorsey Wright ADR ETF (AADR). The ETF itself is rated 5, and each of its ten largest holdings also carries a 5 rating. Brazilian aerospace and defense firm Embraer (ERJ) represents the ETF’s largest position. Materials exposure is significant as well, with Gold Fields (GFI) holding the largest allocation among that group.

Opinions vary on how long large U.S. growth stocks will continue to serve as sources of funds for other investments. For those who believe this trend is still in its early stages, several highly rated ETFs and stocks stand out below.

www.ValuEngine.com (

www.ValuEngineCapital.com (

BLOG.VALUENGINE.COM for the full history of ValuEngine.com financial blog posts

____________________________________________________________________________

Existing subscribers alert: ValuEngine has launched a completely redesigned and new website! Please check it out at www.ValuEngine.com

Free trials available for new subscribers. Over 4,200 stocks and 600 ETFs covered.

Full Two Week Free Trial HERE

5,000 stocks, 600 ETFs, 16 sector groups, and 140 industries updated on www.ValuEngine.com.

Financial Advisory Services based on ValuEngine research available through www.ValuEngineCapital.com