This week, we provide top-five ranked VE data for our Industrial Products Sector stocks, we also take a look at Tesla $TSLA and provide a free download link for our stock report on the company.

VALUATION WATCH: Overvalued stocks now make up 29.52% of our stocks assigned a valuation and 10.51% of those equities are calculated to be overvalued by 20% or more. One sector is calculated to be overvalued.

ValuEngine Index Overview

| Index | Week Open | Friday PM | Change | % Change | YTD |

| DJIA | 24360.95 | 24105.18 | -255.77 | -1.05% | -2.48% |

| NASDAQ | 6959.63 | 6943.42 | -16.21 | -0.23% | 0.58% |

| RUSSELL 2000 | 1448.01 | 1417.5 | -30.51 | -2.11% | -7.69% |

| S&P 500 | 2630.86 | 2603.39 | -27.47 | -1.04% | -2.63% |

ValuEngine Market Overview

| Summary of VE Stock Universe | |

| Stocks Undervalued | 70.48% |

| Stocks Overvalued | 29.52% |

| Stocks Undervalued by 20% | 38.8% |

| Stocks Overvalued by 20% | 10.51% |

ValuEngine Sector Overview

| Sector | Change | MTD | YTD | Valuation | Last 12-MReturn | P/E Ratio |

| Utilities | -0.84% | -3.21% | 1.55% | 5.32% overvalued | -0.35% | 20.36 |

| Computer and Technology | -0.98% | -4.43% | -3.31% | 1.75% undervalued | 5.30% | 27.74 |

| Consumer Staples | -0.47% | -3.20% | -3.66% | 3.12% undervalued | -1.95% | 22.79 |

| Aerospace | -0.95% | -2.70% | -5.83% | 3.69% undervalued | -0.42% | 24.32 |

| Medical | -1.33% | -5.39% | 7.58% | 4.44% undervalued | 16.97% | 26.76 |

| Retail-Wholesale | -1.67% | -7.12% | -9.03% | 7.38% undervalued | -1.62% | 20.50 |

| Business Services | -0.92% | -5.57% | -2.86% | 7.76% undervalued | -1.93% | 20.95 |

| Finance | -0.80% | -4.81% | -8.85% | 10.69% undervalued | -6.68% | 15.53 |

| Auto-Tires-Trucks | -1.00% | -6.06% | -19.92% | 12.19% undervalued | -21.05% | 10.61 |

| Consumer Discretionary | -1.46% | -4.94% | -11.42% | 12.53% undervalued | -4.43% | 23.19 |

| Multi-Sector Conglomerates | -0.41% | -3.61% | -15.66% | 12.90% undervalued | -12.56% | 16.03 |

| Transportation | -1.77% | -7.79% | -13.05% | 16.08% undervalued | -11.33% | 17.15 |

| Industrial Products | -0.99% | -6.15% | -12.60% | 16.53% undervalued | -8.63% | 20.21 |

| Basic Materials | -0.87% | -4.05% | -13.29% | 19.58% undervalued | -17.66% | 18.02 |

| Construction | -0.90% | -6.86% | -17.87% | 23.33% undervalued | -19.92% | 17.02 |

| Oils-Energy | -0.54% | -4.24% | -9.49% | 33.89% undervalued | -10.63% | 17.73 |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

Sector Talk–Industrial Products

Below, we present the latest data on Industrial Products stocks from our Professional Stock Analysis Service. Top- five lists are provided for each category. We applied some basic liquidity criteria–share price greater than $3 and average daily volume in excess of 100k shares.

Top-Five Industrial Products Stocks–Short-Term Forecast Returns

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| CDXS | CODEXIS INC | 19.86 | 120.95% | 159.61% |

| CYRX | CRYOPORT INC | 10.01 | 28.51% | 17.08% |

| AAXN | AXON ENTERPRISE | 45.12 | 28.42% | 76.25% |

| KRNT | KORNIT DIGITAL | 18.98 | 24.83% | 20.51% |

| LXFR | LUXFER HOLDINGS | 23.25 | 54.91% | 60.01% |

Top-Five Industrial Products Stocks–Momentum

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| CDXS | CODEXIS INC | 19.86 | 120.95% | 159.61% |

| AAXN | AXON ENTERPRISE | 45.12 | 28.42% | 76.25% |

| ZBRA | ZEBRA TECH CL A | 172.79 | 0.01% | 63.02% |

| LXFR | LUXFER HOLDINGS | 23.25 | 54.91% | 60.01% |

| ALRM | ALARM.COM HLDGS | 53 | 10.94% | 42.21% |

Top-Five Industrial Products Stocks–Composite Score

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| ZBRA | ZEBRA TECH CL A | 172.79 | 0.01% | 63.02% |

| IR | INGERSOLL RAND | 97.28 | -5.77% | 11.65% |

| CTAS | CINTAS CORP | 171.84 | -4.58% | 9.25% |

| ENS | ENERSYS INC | 79.29 | 5.49% | 16.84% |

| MSA | MSA SAFETY INC | 100.54 | -0.96% | 27.70% |

Top-Five Industrial Products Stocks–Most Overvalued

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| CDXS | CODEXIS INC | 19.86 | 120.95% | 159.61% |

| LXFR | LUXFER HOLDINGS | 23.25 | 54.91% | 60.01% |

| CYRX | CRYOPORT INC | 10.01 | 28.51% | 17.08% |

| AAXN | AXON ENTERPRISE | 45.12 | 28.42% | 76.25% |

| KRNT | KORNIT DIGITAL | 18.98 | 24.83% | 20.51% |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

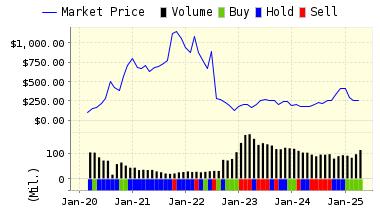

Tesla Inc. (TSLA) designs, develops, manufactures, and sells electric vehicles and stationary energy storage products. It operates primarily in the United States, China, Norway and internationally. Tesla Inc., formerly known as Tesla Motors Inc., is headquartered in Palo Alto, California.

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on TESLA INC for 2018-12-13. Based on the information we have gathered and our resulting research, we feel that TESLA INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Earnings Growth Rate.

You can download a free copy of detailed report on Tesla Inc. (TSLA) from the link below.

Read our Complete Rating and Forecast Report HERE.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 380.98 | 1.11% |

| 3-Month | 388.64 | 3.15% |

| 6-Month | 401.62 | 6.59% |

| 1-Year | 427.06 | 13.34% |

| 2-Year | 448.74 | 19.09% |

| 3-Year | 448.89 | 19.14% |

| Valuation & Rankings | |||

| Valuation | 38.99% overvalued | Valuation Rank(?) | 6 |

| 1-M Forecast Return | 1.11% | 1-M Forecast Return Rank | 99 |

| 12-M Return | 11.14% | Momentum Rank(?) | 83 |

| Sharpe Ratio | 0.50 | Sharpe Ratio Rank(?) | 85 |

| 5-Y Avg Annual Return | 20.26% | 5-Y Avg Annual Rtn Rank | 94 |

| Volatility | 40.51% | Volatility Rank(?) | 40 |

| Expected EPS Growth | 173.03% | EPS Growth Rank(?) | 92 |

| Market Cap (billions) | 47.24 | Size Rank | 98 |

| Trailing P/E Ratio | n/a | Trailing P/E Rank(?) | 27 |

| Forward P/E Ratio | 73.50 | Forward P/E Ratio Rank | 4 |

| PEG Ratio | 0.31 | PEG Ratio Rank | 66 |

| Price/Sales | 2.70 | Price/Sales Rank(?) | 35 |

| Market/Book | 9.55 | Market/Book Rank(?) | 14 |

| Beta | 0.60 | Beta Rank | 59 |

| Alpha | 0.10 | Alpha Rank | 83 |

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.com