This week, we provide top-five ranked VE data for our Oils/Energy Sector stocks, we also take a look at ETSY $ETSY and provide a free download link for our stock report on the company.

VALUATION WATCH: Overvalued stocks now make up 30.74% of our stocks assigned a valuation and 10.96% of those equities are calculated to be overvalued by 20% or more. Three sectors are calculated to be overvalued.

ValuEngine Index Overview

| Index | Week Open | Friday PM | Change | % Change | YTD |

| DJIA | 24607.76 | 24757.24 | 149.48 | 0.61% | 6.13% |

| NASDAQ | 7109.57 | 7169.75 | 60.18 | 0.85% | 8.05% |

| RUSSELL 2000 | 1479.82 | 1481.73 | 1.91 | 0.13% | 9.87% |

| S&P 500 | 2657.88 | 2667.85 | 9.97 | 0.38% | 6.42% |

ValuEngine Market Overview

| Summary of VE Stock Universe | |

| Stocks Undervalued | 69.26% |

| Stocks Overvalued | 30.74% |

| Stocks Undervalued by 20% | 32.34% |

| Stocks Overvalued by 20% | 10.96% |

ValuEngine Sector Overview

| Sector | Change | MTD | YTD | Valuation | Last 12-MReturn | P/E Ratio |

| Utilities | 0.18% | 6.06% | 6.06% | 2.80% overvalued | 1.79% | 20.49 |

| Business Services | 0.11% | 9.09% | 9.09% | 0.80% overvalued | -5.48% | 22.32 |

| Computer and Technology | 1.89% | 8.59% | 8.72% | 0.04% overvalued | 1.77% | 27.96 |

| Aerospace | 1.49% | 9.61% | 9.61% | 3.27% undervalued | -1.71% | 24.43 |

| Consumer Staples | -0.37% | 6.49% | 6.49% | 4.91% undervalued | -8.13% | 22.35 |

| Medical | 0.07% | 10.87% | 10.87% | 5.84% undervalued | 5.83% | 27.53 |

| Consumer Discretionary | 0.42% | 8.76% | 8.76% | 6.00% undervalued | -7.68% | 24.25 |

| Retail-Wholesale | 0.30% | 8.86% | 8.86% | 6.09% undervalued | -5.69% | 21.13 |

| Multi-Sector Conglomerates | 0.49% | 7.82% | 7.82% | 6.19% undervalued | -16.10% | 16.68 |

| Finance | 0.24% | 6.98% | 6.98% | 8.04% undervalued | -9.24% | 15.68 |

| Transportation | 0.28% | 9.95% | 9.95% | 9.78% undervalued | -14.42% | 18.05 |

| Auto-Tires-Trucks | 0.92% | 7.92% | 7.92% | 11.94% undervalued | -24.95% | 10.73 |

| Industrial Products | 0.49% | 7.16% | 7.16% | 13.19% undervalued | -10.58% | 19.20 |

| Basic Materials | 0.75% | 6.22% | 6.20% | 15.36% undervalued | -21.79% | 18.81 |

| Construction | 0.97% | 8.64% | 8.64% | 18.39% undervalued | -21.92% | 16.83 |

| Oils-Energy | 0.68% | 12.61% | 12.61% | 29.14% undervalued | -20.78% | 17.26 |

Want to learn more about ValuEngine? Our methods? Our history?

Check out our video presentation HERE

Sector Talk–Oils/Energy

Below, we present the latest data on Oils/Energy stocks from our Professional Stock Analysis Service. Top- five lists are provided for each category. We applied some basic liquidity criteria–share price greater than $3 and average daily volume in excess of 100k shares.

Top-Five Oils/Energy Stocks–Short-Term Forecast Returns

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| MTRX | MATRIX SERVICE | 20.28 | 13.20% | 8.45% |

| RUN | SUNRUN INC | 12.01 | 37.56% | 87.95% |

| DO | DIAMOND OFFSHOR | 11.22 | 104.49% | -40.95% |

| VNOM | VIPER ENERGY | 28.97 | 6.73% | 12.42% |

| SEMG | SEMGROUP CORP-A | 16.3 | 78.16% | -44.75% |

Top-Five Oils/Energy Stocks–Momentum

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| ENPH | ENPHASE ENERGY | 6.66 | -17.64% | 229.70% |

| NOA | NORTH AMER CNST | 10.19 | -11.06% | 99.80% |

| RUN | SUNRUN INC | 12.01 | 37.56% | 87.95% |

| CQP | CHENIERE ENERGY | 38.25 | -0.04% | 19.64% |

| PBR | PETROBRAS-ADR C | 15.52 | 6.00% | 18.56% |

Top-Five Oils/Energy Stocks–Composite Score

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| PBR | PETROBRAS-ADR C | 15.52 | 6.00% | 18.56% |

| COP | CONOCOPHILLIPS | 66.12 | 0.60% | 9.31% |

| CQP | CHENIERE ENERGY | 38.25 | -0.04% | 19.64% |

| HFC | HOLLYFRONTIER | 53.85 | -8.51% | 9.32% |

| PAA | PLAINS ALL AMER | 23.3 | -43.01% | 2.01% |

Top-Five Oils/Energy Stocks–Most Overvalued

| Ticker | Name | Mkt Price | Valuation (%) | Last 12-M Return (%) |

| DO | DIAMOND OFFSHOR | 11.22 | 104.49% | -40.95% |

| SEMG | SEMGROUP CORP-A | 16.3 | 78.16% | -44.75% |

| RUN | SUNRUN INC | 12.01 | 37.56% | 87.95% |

| MTRX | MATRIX SERVICE | 20.28 | 13.20% | 8.45% |

| VLO | VALERO ENERGY | 78.95 | 10.28% | -19.16% |

Free Download for Readers

As a bonus to our Free Weekly Newsletter subscribers,

we are offering a FREE DOWNLOAD of one of our Stock Reports

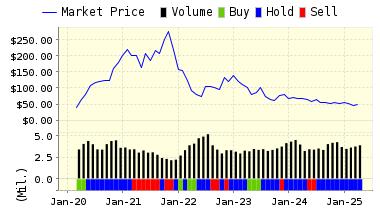

Etsy, Inc. (ETSY) offers e-commerce services. It provides online and offline marketplaces to buy and sell goods. The company’s product include art, home and living, mobile accessories, jewelry, wedding, and others. It operates primarily in Berlin, Germany, Dublin, Ireland, Hudson, New York, London, United Kingdom, Melbourne, Australia, Paris, France, San Francisco, California and Toronto, Canada. Etsy, Inc. is headquartered in Brooklyn, New York.

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on ETSY INC for 2019-01-24. Based on the information we have gathered and our resulting research, we feel that ETSY INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Sharpe Ratio.

You can download a free copy of detailed report on Etsy, Inc. (ETSY) from the link below.

Read our Complete Rating and Forecast Report HERE.

| ValuEngine Forecast | ||

| Target Price* |

Expected Return |

|

|---|---|---|

| 1-Month | 54.93 | 1.09% |

| 3-Month | 55.35 | 1.87% |

| 6-Month | 57.27 | 5.38% |

| 1-Year | 61.45 | 13.09% |

| 2-Year | 59.37 | 9.26% |

| 3-Year | 61.14 | 12.52% |

| Valuation & Rankings | |||

| Valuation | 25.87% overvalued | Valuation Rank(?) | 9 |

| 1-M Forecast Return | 1.09% | 1-M Forecast Return Rank | 99 |

| 12-M Return | 185.25% | Momentum Rank(?) | 100 |

| Sharpe Ratio | 0.38 | Sharpe Ratio Rank(?) | 85 |

| 5-Y Avg Annual Return | 20.74% | 5-Y Avg Annual Rtn Rank | 95 |

| Volatility | 55.22% | Volatility Rank(?) | 30 |

| Expected EPS Growth | 37.04% | EPS Growth Rank(?) | 71 |

| Market Cap (billions) | 6.07 | Size Rank | 84 |

| Trailing P/E Ratio | 100.63 | Trailing P/E Rank(?) | 33 |

| Forward P/E Ratio | 73.43 | Forward P/E Ratio Rank | 4 |

| PEG Ratio | 2.72 | PEG Ratio Rank | 16 |

| Price/Sales | 11.25 | Price/Sales Rank(?) | 10 |

| Market/Book | 18.96 | Market/Book Rank(?) | 8 |

| Beta | 0.98 | Beta Rank | 40 |

| Alpha | 0.91 | Alpha Rank | 99 |

ValuEngine.com is an Independent Research Provider (IRP), producing buy/hold/sell recommendations, target price, and valuations on over 5,000 US and Canadian equities every trading day.

Contact ValuEngine at (321) 325-0519 or support@valuengine.com

Visit www.ValuEngine.com for more information

ValuEngine Capital Management LLC is a Registered Investment Advisory (RIA) firm that trades client accounts using ValuEngine’s award-winning stock research.

Contact ValuEngine Capital at info@valuenginecapital.com

Visit www.ValuEngineCapital.com for more information

Steve Hach

Senior Editor

ValuEngine.com